You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

brianmanahan

Lifer

- Sep 2, 2006

- 24,613

- 6,003

- 136

i bonds from treasury direct is all i've got. you can only buy 10$k a year, but i've been moving some of my savings account to them over the years so i have a decent amount.

other than that i just use intermediate term bonds and know they'll probably take a slight hit. but if there's a crash, at least they won't drop %30-50 like stocks.

oh, and a little bit of gold.

other than that i just use intermediate term bonds and know they'll probably take a slight hit. but if there's a crash, at least they won't drop %30-50 like stocks.

oh, and a little bit of gold.

[DHT]Osiris

Lifer

- Dec 15, 2015

- 17,341

- 16,589

- 146

UsandThem

Elite Member

- May 4, 2000

- 16,068

- 7,383

- 146

I just keep all of my savings/retirement funds in my Metamask Wallet.

ultimatebob

Lifer

- Jul 1, 2001

- 25,134

- 2,450

- 126

I've given up investing in treasury bonds. With the yields as low as they are, you're basically losing money to inflation by holding onto them.

I'm still holding onto some higher yield corporate bonds, though. S&P 500 Index funds have become my default investment when I can't figure out where to put it otherwise, though. It seems that most mutual funds struggle to beat the S&P 500, so you might as well just own the benchmark instead of try to beat it.

I'm still holding onto some higher yield corporate bonds, though. S&P 500 Index funds have become my default investment when I can't figure out where to put it otherwise, though. It seems that most mutual funds struggle to beat the S&P 500, so you might as well just own the benchmark instead of try to beat it.

Last edited:

Red Squirrel

No Lifer

Long term goal to live off grid which will eliminate pretty much all costs of living which keep going up each year, leaving me with less and less disposable income each year. The tricky bit is finding a source of income though but whatever that source is, it won't have to be as much as my current job, so the money is going to go much further. Then I can actually do proper investing.

My current investments are fairly paltry as I don't have much money left over to put towards it.

My current investments are fairly paltry as I don't have much money left over to put towards it.

Ibonds could potentially be problematic in the OPs situation since liquid was mentioned and they have interest penalties until several (3?) years of holding.i bonds from treasury direct is all i've got. you can only buy 10$k a year, but i've been moving some of my savings account to them over the years so i have a decent amount.

other than that i just use intermediate term bonds and know they'll probably take a slight hit. but if there's a crash, at least they won't drop %30-50 like stocks.

oh, and a little bit of gold.

Depending on the dollar amount I'd probably just move it around for some bank account opening bonuses. Those will pay more than a CD or savings account unless you have a lot of cash sitting around

Longer term nothing is going to have a better chance of out pacing inflation like the stock market. VTSAX was up 25.71% for 2021 and 25.77% year over year for the past 3 years so a tad more than inflation

ultimatebob

Lifer

- Jul 1, 2001

- 25,134

- 2,450

- 126

Long term goal to live off grid which will eliminate pretty much all costs of living which keep going up each year, leaving me with less and less disposable income each year. The tricky bit is finding a source of income though but whatever that source is, it won't have to be as much as my current job, so the money is going to go much further. Then I can actually do proper investing.

My current investments are fairly paltry as I don't have much money left over to put towards it.

Sounds like the Cheez investment strategy, although he might have taken it a bit too far

herm0016

Diamond Member

- Feb 26, 2005

- 8,516

- 1,128

- 126

ponyo

Lifer

- Feb 14, 2002

- 19,688

- 2,811

- 126

repoman0

Diamond Member

- Jun 17, 2010

- 5,191

- 4,572

- 136

With inflation at 6+% and 15 year mortgage rates at below 3%, it seems the best way to protect your wealth is to go into debt up to your eyeballs 👀 and buy real estate or gold. No holding taxes for gold.

30 year was below 3% for a while too … I got a no fees refi in six months ago at 2.875 and paying ~20% less monthly than I was when I bought this place two years ago. My fiancee and I are going to buy our country / “retirement” home in the mountains up north soon as well. Most people wait until they’re 50-60 but we want to enjoy it for the rest of our 20s and 30s too.

Other than that we’re keeping it simple with around $50k in no/bullshit interest bank accounts and the rest in stock market index funds. No real need to over-optimize beyond that. At some point, we started to be lucky enough to have “enough” and it doesn’t add anything to our lives to try to get bigger numbers in a fidelity account somewhere. Strategy will have to shift of course as we get older but it works for now.

zinfamous

No Lifer

- Jul 12, 2006

- 111,817

- 31,283

- 146

Ibonds could potentially be problematic in the OPs situation since liquid was mentioned and they have interest penalties until several (3?) years of holding.

Depending on the dollar amount I'd probably just move it around for some bank account opening bonuses. Those will pay more than a CD or savings account unless you have a lot of cash sitting around

Longer term nothing is going to have a better chance of out pacing inflation like the stock market. VTSAX was up 25.71% for 2021 and 25.77% year over year for the past 3 years so a tad more than inflation

yeah, OP, just open a brokerage account and put it in VTSAX. It will always beat those laughable savings accounts and it's as liquid as you need it to be (well, what is it, maybe 2-3 days from selling shares and transferring funds between banks?), very similar to a savings account.

The value will move a lot of course, but it's still very stable compared to individual stocks, and if you ignore the wildish swings with the market, up 30%, down15%, up 3%, it will still always be worth more than your ~0.1% savings account.

brianmanahan

Lifer

- Sep 2, 2006

- 24,613

- 6,003

- 136

Hermes and gold.

buy hermes and gold, and get a blanket covered in leg hair for free

ponyo

Lifer

- Feb 14, 2002

- 19,688

- 2,811

- 126

buy hermes and gold, and get a blanket covered in leg hair for free

ponyo

Lifer

- Feb 14, 2002

- 19,688

- 2,811

- 126

I hear Turkish banks are paying 20%+ interest.

https://www.reuters.com/markets/eur...-rates-race-lira-deposits-sources-2021-12-24/

https://www.reuters.com/markets/eur...-rates-race-lira-deposits-sources-2021-12-24/

Heh - I'm assuming joking but just in case anyone is considering that - more than decent chance Erdogan does some sketchy shit with their economy which can tank your investmentI hear Turkish banks are paying 20%+ interest.

https://www.reuters.com/markets/eur...-rates-race-lira-deposits-sources-2021-12-24/

ponyo

Lifer

- Feb 14, 2002

- 19,688

- 2,811

- 126

Currency risk is huge and can wipe out any interest rate gains. Unless you live in Turkey, you have to convert the lira back to dollar, Euro, or whatever your native currency. That's the huge risk on top of Erdogan doing something stupid. We are truly blessed here in the United States that the world uses the dollar as the reserve currency.Heh - I'm assuming joking but just in case anyone is considering that - more than decent chance Erdogan does some sketchy shit with their economy which can tank your investment

Red Squirrel

No Lifer

Sounds like the Cheez investment strategy, although he might have taken it a bit too far

Pretty much, except I will actually own the land and probably build something bigger, and actually insulated.

Charmonium

Lifer

- May 15, 2015

- 10,449

- 3,483

- 136

There's no need to make changes for some transient inflation. If you hold mostly equities, remember that companies can raise prices faster than you can meet them. Sure, if you're in a sector with a very elastic demand curve (very sensitive to changes in price) then you might have to make a judgement call about doing it at all and if so, where's the sweet spot such that you can increase prices but only so much that it doesn't hurt your profitability.

If you mainly own debt instruments, then at the very least try to set up a bond ladder. You'll still have capital losses but as each bond gets very close to redemption, it will (should) approach it's face value and since those capital losses were all paper rather than real, you should be OK. Bottom line though, if you think interest rates are going to go up in the longer term, you should really try to avoid bonds.

The one exception I can think of is junk bonds. These are valued mainly in relation to their stock price. So they trade more like equities than debt.

Right now I have about 3/4 of my money in stock with the rest in debt mutual funds or ETFs. But my stocks are mix between mutual funds (<1% in TOTAL admin fees). and I've been gradually dumping the individual shares.

If you mainly own debt instruments, then at the very least try to set up a bond ladder. You'll still have capital losses but as each bond gets very close to redemption, it will (should) approach it's face value and since those capital losses were all paper rather than real, you should be OK. Bottom line though, if you think interest rates are going to go up in the longer term, you should really try to avoid bonds.

The one exception I can think of is junk bonds. These are valued mainly in relation to their stock price. So they trade more like equities than debt.

Right now I have about 3/4 of my money in stock with the rest in debt mutual funds or ETFs. But my stocks are mix between mutual funds (<1% in TOTAL admin fees). and I've been gradually dumping the individual shares.

Red Squirrel

No Lifer

Dr. Detroit

Diamond Member

- Sep 25, 2004

- 8,514

- 912

- 126

Red Squirrel

No Lifer

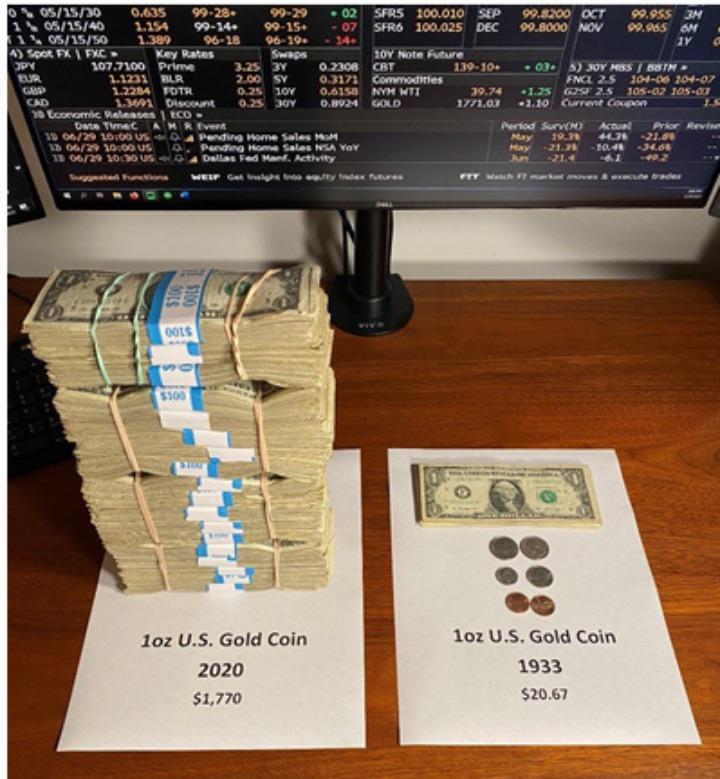

Stock market is in a huge bubble right now though. There's no knowing how long it will stay like that. Stock market can indeed be high return but it's also high risk. I mean, sure the price of silver/gold could maybe tank too but I think the odds of that are smaller as there is a real cost to mine/process it.

Not linking to image directly since there's swearing and don't think that's allowed, but thread here:

Ok, so that still shows the image anyway... oh well lol.

Not linking to image directly since there's swearing and don't think that's allowed, but thread here:

Ok, so that still shows the image anyway... oh well lol.

TRENDING THREADS

-

News NVIDIA and Intel to Develop AI Infrastructure and Personal Computing Products

- Started by poke01

- Replies: 217

-

Discussion Zen 5 Speculation (EPYC Turin and Strix Point/Granite Ridge - Ryzen 9000)

- Started by DisEnchantment

- Replies: 25K

-

Discussion Intel Meteor, Arrow, Lunar & Panther Lakes + WCL Discussion Threads

- Started by Tigerick

- Replies: 22K

-

Discussion Intel current and future Lakes & Rapids thread

- Started by TheF34RChannel

- Replies: 23K

AnandTech is part of Future plc, an international media group and leading digital publisher. Visit our corporate site.

© Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.