FelixDeCat

Lifer

- Aug 4, 2000

- 31,262

- 2,786

- 126

^This is suspect. Back in the day, it was not uncommon to pay $200+ per trade to buy or sell stocks. Later "discount" brokers got it down to $49 and less in the early 1990s. When the WWW came along, online brokers had it around $19 then eventually $9.99 per buy AND sell ($20 round trip). Starting in 2020, the commissions went to zero.

So unless you waited until you had an amount high enough in paid dividends to overcome the absurd commissions from the 1930s until the late 1990s, its unlikely your returns would have been that high.

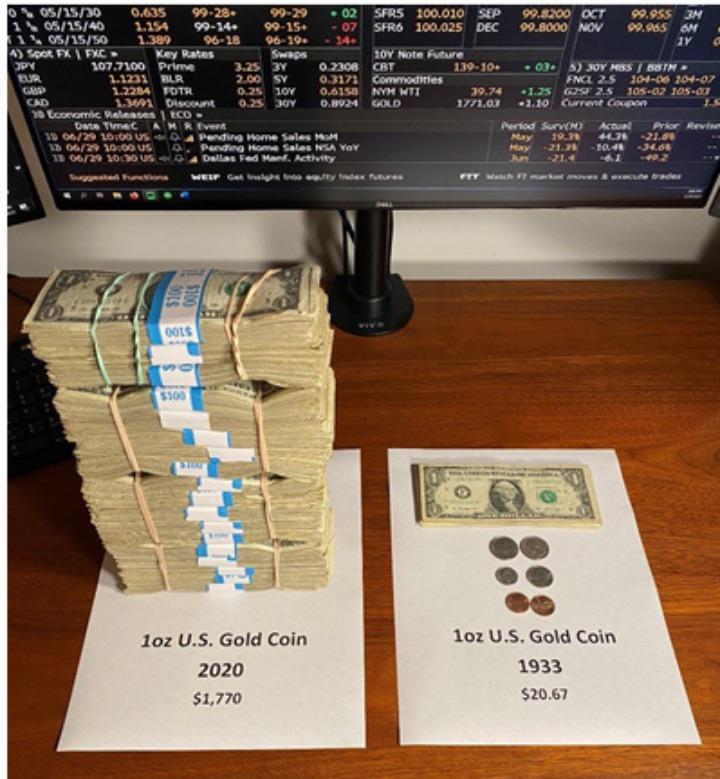

Also, I created an Excel spreadsheet using a more realistic rate of return of 10% annually. That averages out bull markets and bear markets from 1933 to 2022. Assuming no dividends (AND CERTAINLY NO COMMISSIONS) were reinvested, I get an ending balance of $111,573:

Starting around the year 2000 or so, commissions were $10-$20 to buy, so you can throw in a 2% kicker, which is the typical big cap stock dividend.

Giving the kicker might leave you a balance of $150,000. However you have to live 89 YEARS to get there, and start investing the day you are born!

So unless you waited until you had an amount high enough in paid dividends to overcome the absurd commissions from the 1930s until the late 1990s, its unlikely your returns would have been that high.

Also, I created an Excel spreadsheet using a more realistic rate of return of 10% annually. That averages out bull markets and bear markets from 1933 to 2022. Assuming no dividends (AND CERTAINLY NO COMMISSIONS) were reinvested, I get an ending balance of $111,573:

Starting around the year 2000 or so, commissions were $10-$20 to buy, so you can throw in a 2% kicker, which is the typical big cap stock dividend.

Giving the kicker might leave you a balance of $150,000. However you have to live 89 YEARS to get there, and start investing the day you are born!