A third of renters didn't pay in April. While the REIT (real estate insurance trust) index is down about 20% the break-down is interesting, residential REITs are actually down less than the index, which is somewhat curious, but I suspect this has to do with market cap bias because the residential REIT sector is overweighted by a few large players like EQR, MAA, and ESS.

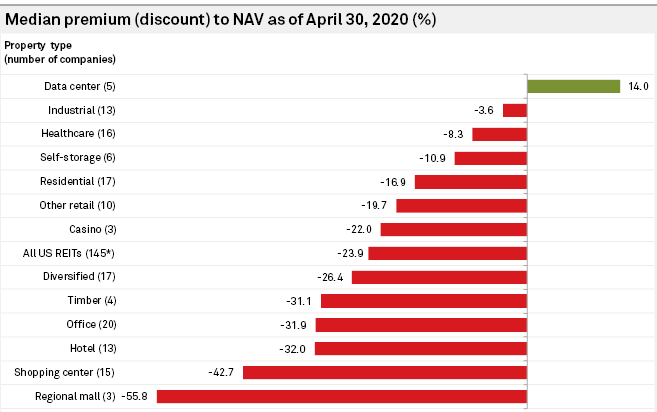

Datacenter REITs are heavily being overbid, industrial REITs are probably the best sector to be in right now, major industrial REITS like STAG collected 98-99% of rent in April because they mostly own e-commerce warehouses (Amazon is their largest tenant). Other sectors are trading at a pretty big discount.

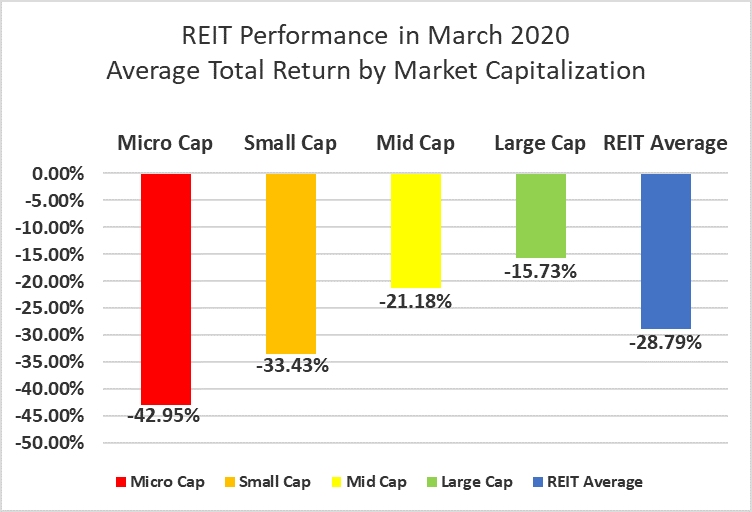

Here's the large cap vs small cap bias going on. Small apartment REITs like BRG and BRT are down about 40-50% while mega caps like MAA and EQR are basically doing as well as the index or even better.

Right now markets are pricing in liquidity risk, which is low for large caps, even if they are income impaired. They aren't quite at the point of pricing in

solvency risk with large caps, so we will see what happens.