- Aug 4, 2000

- 31,262

- 2,785

- 126

lol.It is absolutely nuts (IMO) to think that Tesla is worth more than Ford + GM combined. Fucking. Nuts.

Seriously, I like Tesla. I like Elon Musk... but if you think they have some kind of lockdown on the electric car market you're just fucking nuts.

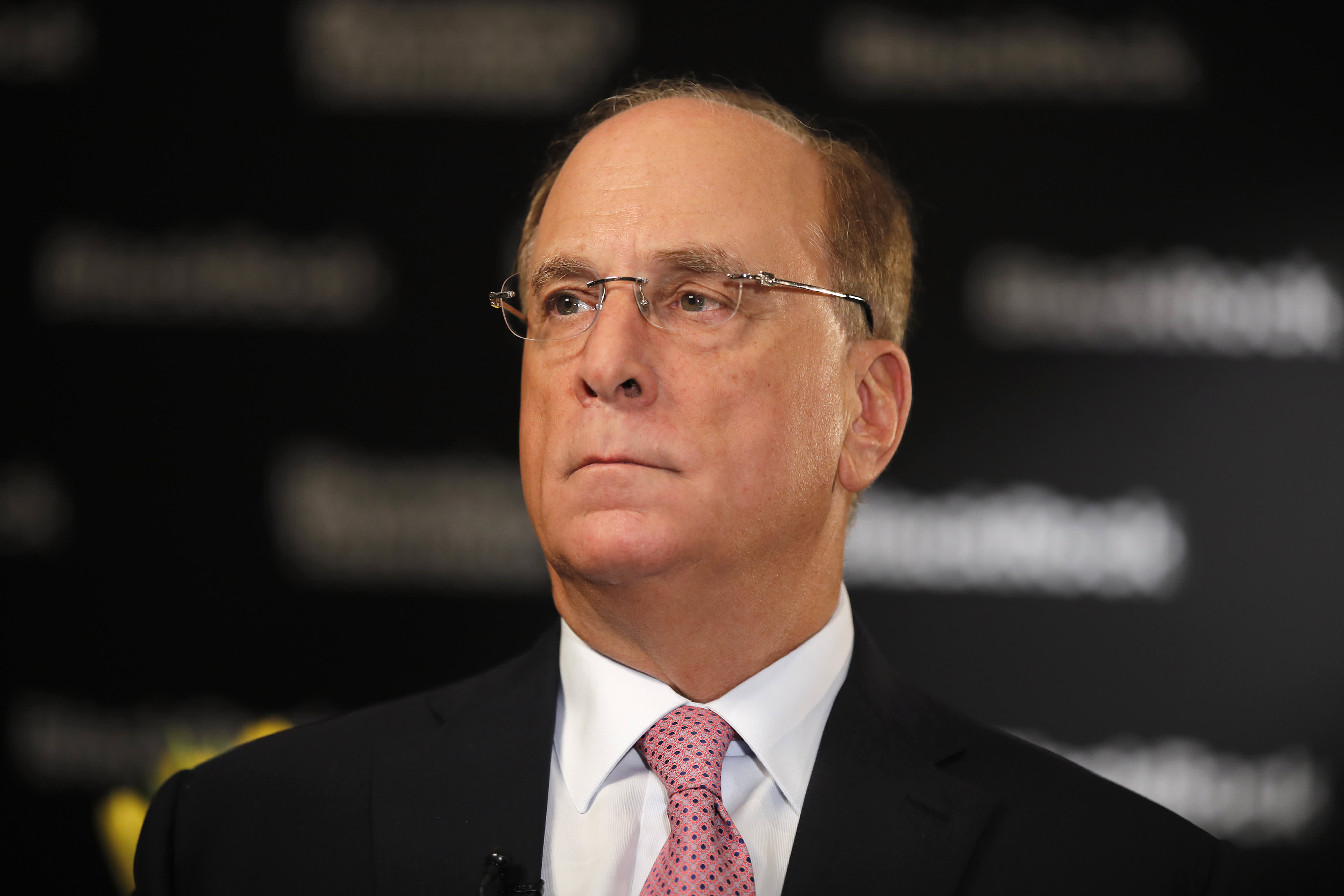

CNBC interview with Larry Fink, the CEO of BlackRock. This is eyeopening interview and shows you how the big institutional investors are now thinking about climate change and world sustainability. When someone who manages $7 trillion dollars of investment money talks about how they want to invest in clean energy companies going forward, you need to pay close attention to what they're saying. You can tell from the interview Larry Fink is not just bullshitting and talking for television PR points. He really believes in this and is going to act accordingly. When you're investing, you need to see where the big whales are going and try to get in front of them or ride along with them. We just started 2020. At the end of this decade, people will look back and say this is when the big change occurred. We're at the tipping point. This is why TSLA is must own stock for this decade and not expensive. FAANG stocks led us higher from 2010-2020. New breed of companies like Tesla will lead us from 2020 to 2030. You don't want to miss the next gorilla.

Based on what I've seen so far, competition is years behind. And because the talent and the pace of innovation at Tesla is so fast and so great, the technology gap between Tesla and the legecy automakers is actually increasing rather than decreasing. It's my opinion most of the legacy automakers will die. They'll start merging as they're dying to try to combine their remaining strength to take on Tesla but I'm afraid even that won't be enough. So yes, I expect most of them will die. Not in 5 years but within 10-20 years. Countries will probably try to bail them out but they will be wasting their money in doing so.Do you really think other established car companies won't have a competing product? So what - they are all just going to fall over and die in the next 5 years?

Why EV over ICE car? Because once you drive EV, especially Tesla, regular cars will feel stupid. That's why EV will take over. Because EVs are so much better and so superior to ICE cars. And once battery prices drop some more in couple of years, EV will be cheaper to build than ICE cars. It's like when the iPhone first came out. The first couple gen iPhones were good but the iPhone didn't become great until the iPhone 4S. We're in the beginning innings of the EV revolution. Future EVs are going to be even more amazing. And the computer and software in these cars are going to be so much better than today. And of course, the holy grail is autonomous driving. And I'm in the camp Tesla will solve it first which will change everything.I remember the following things over the last 20 years that have changed that I did not like, but I have been forced to adapt to:

* The change from 16:10 aspect ratio as the norm to being forced to adapt to 16:9 on all devices, even work monitors. Because everyone wants to watch widescreen movies 24x7 on all devices. Who works anymore?

* The insistence that desktop computers are obsolete and everyone only wants a tablet or phone to get through life - first the devices then they made most websites tablet friendly (for finger use) vs desktop friendly (mouse use).

* Automakers phasing out cars because they sell SUVs at higher profits and in greater numbers. I bought a new car last year, not an SUV, and because cars are harder to sell I got mine well equipped for cheap!

* Making bigger and bigger cell phones. I had my first smart phone in 2005, the HP iPaq using Windows Mobile. If it does not fit in my pocket, I dont want it. And I dont want to pay $1,000 - $2,000 for it either! Only $250 and it has to fit in my pocket. The end.

Now the argument is for cars that run on rechargeable batteries. Whats the practical need? My car has an efficient gas engine that gets 28-40MPG. I might consider a hybrid engine for the same power and price, in about 10-15 years. But 100% rechargeable? I sometimes forgot to charge my phone. What happens if I forget to charge my car?

Now the argument is for cars that run on rechargeable batteries. Whats the practical need? My car has an efficient gas engine that gets 28-40MPG. I might consider a hybrid engine for the same power and price, in about 10-15 years. But 100% rechargeable? I sometimes forgot to charge my phone. What happens if I forget to charge my car?

I would like to get an EV for the sole reason of not having to ever do an oil change again. I don't think I would buy a Tesla though. Maybe the Ford Mustang EV.

Dude with synthetic these days you really don't have to change your oil often in the slightest. If you do average driving I would say about once a year is completely acceptable.

Definitely not an "every 3000 miles" or "every 3 months" thing anymore.

Why EV over ICE car? Because once you drive EV, especially Tesla, regular cars will feel stupid. That's why EV will take over. Because EVs are so much better and so superior to ICE cars. And once battery prices drop some more in couple of years, EV will be cheaper to build than ICE cars. It's like when the iPhone first came out. The first couple gen iPhones were good but the iPhone didn't become great until the iPhone 4S. We're in the beginning innings of the EV revolution. Future EVs are going to be even more amazing. And the computer and software in these cars are going to be so much better than today. And of course, the holy grail is autonomous driving. And I'm in the camp Tesla will solve it first which will change everything.

I have my Tesla on order. Cybertruck Tri-Motor. All paid for in full and free, thanks to Tesla shorts.It's going to replace my Toyota Tundra truck. I can't wait.

Bye bye, WDC.

I'm glad I was patient with it. I bought it when it was in the 40's. It almost got called away once; after that I decided to go longer and higher with the calls.

SmileDirect's exciting business

No doubt, on the surface, SmileDirect has exciting prospects. The company has developed a direct-to-consumer approach to tooth realignment. Customers can either stop into one of over 300 SmileShops to get a 3D scan, or use an at-home impression kit and mail it into SmileDirect.

After the customer mails in the results, a licensed orthodontist in SmileDirect's doctor network approves a plan, then sends clear aligners directly to the customer's home. The whole offering, which takes place without the need for X-rays or regular visits to an orthodontist, costs about $1,895, compared to traditional solutions that go for $5,000 to $8,000.