Im willing to bet they already covered. If not they probably had a bunch of cheap out of the money call options that are now worth enough to offset big losses in their short stock position (hedged short position).

Besides, the real money was made in shorting pot stocks. While I never did short any pot stock, I do remember looking at put options for Tilray around November 2018. At the time the stock was $110 and one put option, good for 100 shares short at $80 by June 2019, would have cost $2000 per contract or $20 each. Obviously this made no sense since it was already 30 dollars below the current stock price (out of the money), and you culdnt short the shares either since they were hard to borrow. Way too risky.

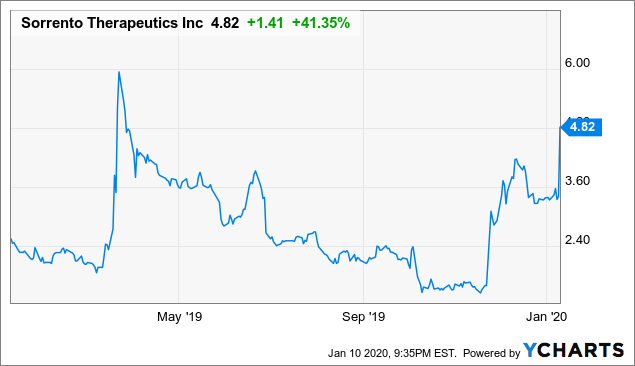

As luck would have it, TLRY fell from $110 in November 2018 to $35 by June 2019, so the put contract would have been worth $4500 or $45 each. Today, Tilray trades for $15 and change and there are plenty of people who think Tilray will go to ZERO. So much for the pot revolution!