AVX10 sounds a bit like ARM's ARGON/SVE instruction set.

It's not like that at all. SVE's point is that it is designed in such a way that you can run the exact same codepath on CPUs with wildly different vector lengths, and other than running a different amount of iterations, get the same result.

AVX10 256/512 are not like that at all, the only convenience is that you can easily query for vector length, everything else is the job of the developer (or, more likely, the compiler). They are deranged if they think most devs are going to emit code that does anything other than supports some minimal common subset.

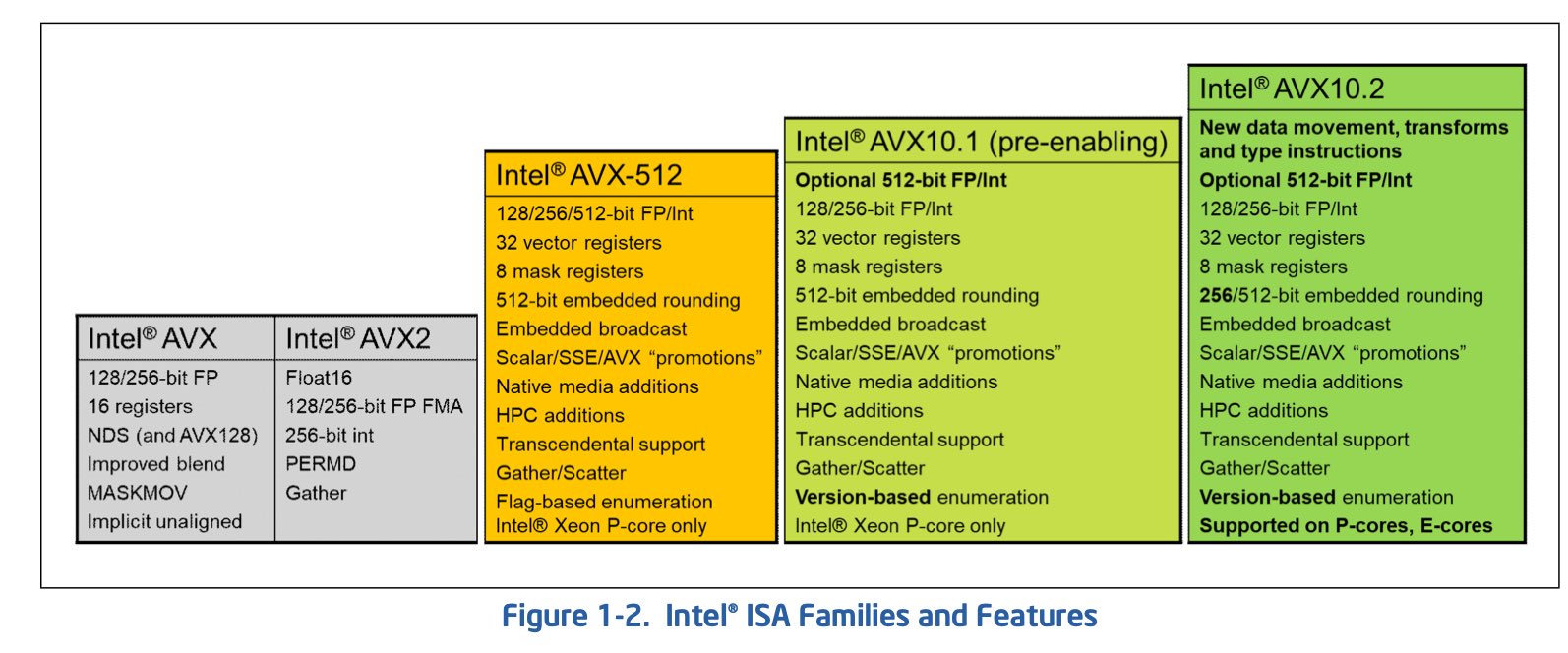

This is effectively giving up on the 64-byte vector length for client CPUs, while retaining the predication and other useful features of AVX-512. I am mildly disappointed, but really, the wide vectors were the least interesting and important part of AVX-512 anyway. A world with AVX10.2 256-bit is still much, much better than AVX2, and if they now start supporting it across the product line and do so consistently, then after about a decade, consumer stuff can finally start targeting it.

Worst struggle in history=second highest amount of money they had in the last 12 years...(and highest total assets EVER)

Maybe you should explain what you consider struggle for a capitalistic company that is trying to make money.

Intel cash on hand from 2012 to 2025. Cash on hand can be defined as cash deposits at financial institutions that can immediately be withdrawn at any time, and investments maturing in one year or less that are highly liquid and therefore regarded as cash equivalents and reported with or near...

www.macrotrends.net

Also look at the liabilities column. They have the most cash on hand and highest assets ever, because they took $11B of long-term debt last quarter, and are sitting on most of the cash. (This is not a criticism of this action, it was actually quite shrewd of them, as their ability to loan money at decent terms might be worse in the future, so might as well take out all the debt now and park it in treasuries until it's needed.)

Also total assets is not a good measure of a healthy company, because a lot of assets are very illiquid and might not be worth nearly as much as their book value if they had to be sold, and in the meantime they are just burning capital through depreciation.

I'm not an Intel doomer. I think there are a lot of smart people there, including people I know personally, and many of them are working really hard to turn the ship around and fix their problems. But it's really deluded to look at Intel's current financials and think that they are a healthy company. They really, really aren't. They have tens of billions of dollars invested in old, depreciating assets, their current product line is nowhere near good enough to regain their old position, and their manufacturing, the old crown jewel of the company, is still either lagging or at least hasn't proven it has caught up to the competition.