Finally got all my forms and got my taxes done. Let's take a look at the results using a few different levels of analysis:

Trumpian Analysis: In 2017 I owed $798. In 2018 I got a refund of $750. I'M SO MUCH BETTER OFF!! Thank you Heaven-sent Prophet Trump for the gift from God!

News Media Analysis: In 2017 I paid $3,488 in total tax. In 2018 I paid $3,335 in total tax. I'm slightly better off under the Trump tax plan than I was before.

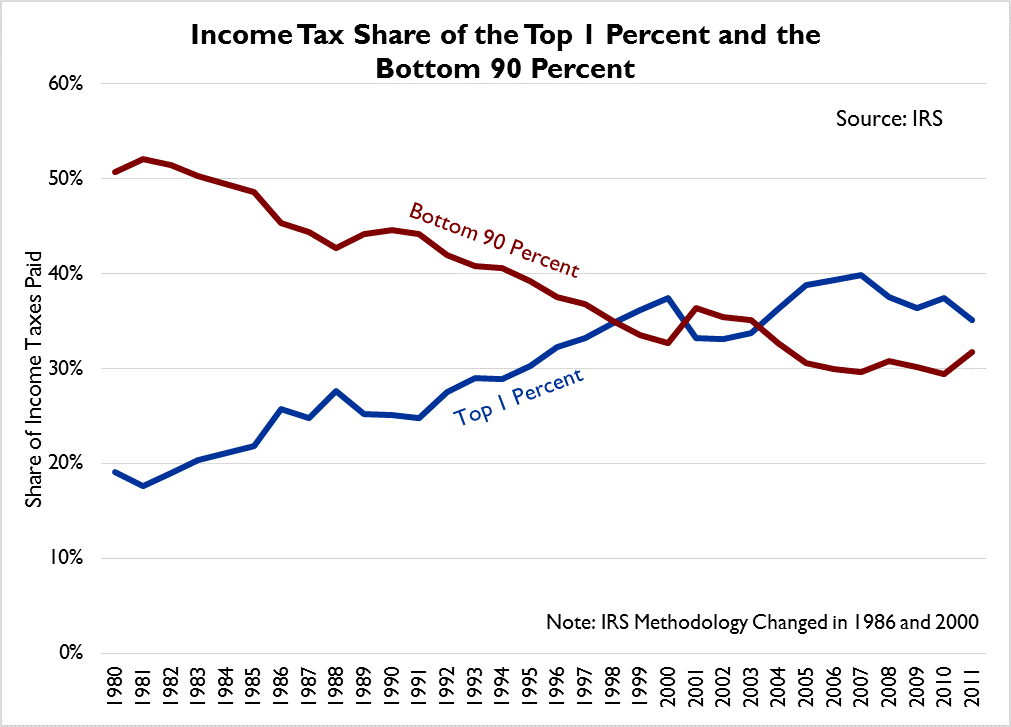

Basic Economist Analysis: In 2017 I had an effective tax rate of 1.41%. In 2018 I had an effective tax rate of 2.66%. Screw you Trump for hurting the middle class at the benefit of the 1%!

Experienced Economist Analysis: In 2017 I had an AGI of $79,121,and a taxable income of $41,690. In 2018 I had an AGI of 106,513 and a taxable income of $82,513. Given the total tax due in the News Media Analysis those effective tax rates cannot be right. Turns out that I had a substantial change in income type in 2018 that is not properly accounted for in the effective tax rate calculation. My wife changed her business tax election from LLS as Partnership to LLC as S-Corp. Then she started paying herself wages. That shifted a not insubstantial amount of tax (~$1,900) from self-employment tax to tax on wages. Since self-employment tax isn't technically part of the effective tax rate calculation (Line 13 divided by Line 7 on a 2018 form) it skews the calculation and cannot be relied upon. Additionally, I had several other changes including, but not limited to: a substantial increase in wage income, a loss of personal exemptions, a loss of itemized deductions, an increase in standard deduction, an increase in child tax credit amounts, and an increase in student loan payment deductions. By redoing my 2018 taxes using the 2017 methodology I estimate my 2018 tax bill would have been about $6,680. So, the end (correct) result is that the tax law changes cut my tax burden in half.

It is worth noting that the changes to general personal income taxes (adjusted tax tables, increased standard deduction, increased child credits, etc.) resulted in a minor decrease in my tax burden, a few hundred dollars. The bulk of the benefit came from the change in how pass-through income is handled and our conscious decision to take advantage of that by shifting to S-Corp taxation. Had my wife's income been taxed as self-employment income we would have been walloped with several thousand more dollars in taxes. That's not a move the average taxpayer can take advantage of.