Could be accurate depending on how many kids he has. Say he has 5 kids, that's $10k in tax credits. The child tax credit was greatly expanded this year, not only going from $1000 to $2000, but also to qualify for it, instead of phasing out at $75k (single filer) it starts at $200k. This new tax law would have made me pay more this year if not for the child tax credit.Something doesn't add up. I read this 3 times but may still be missing something. Did you ONLY pay a total of $444 on $81,000?! That's like 0.5% tax rate. That's "go to jail" taxes. Unless you pre-paid last year, this can not be accurate. You should have paid about $10k and then played tax roulette. I am going to assume that there is a typo in there.

How's that tax cut working out?

Page 12 - Seeking answers? Join the AnandTech community: where nearly half-a-million members share solutions and discuss the latest tech.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

local

Golden Member

- Jun 28, 2011

- 1,852

- 517

- 136

Something doesn't add up. I read this 3 times but may still be missing something. Did you ONLY pay a total of $444 on $81,000?! That's like 0.5% tax rate. That's "go to jail" taxes. Unless you pre-paid last year, this can not be accurate. You should have paid about $10k and then played tax roulette. I am going to assume that there is a typo in there.

Is exactly as stated from what I can tell. Taxes would have taken about 5 minutes to complete if I hadn't spent the time to fill out all the mileage stuff that does not matter anymore. $81k total income, $24k standard deduction, $6k in child tax credits. If it is wrong then if falls under the calculations are screwed up thing and HRB will eat it. And the documents it spit out said my final tax rate was 1%, down from 2% last year.

fleshconsumed

Diamond Member

- Feb 21, 2002

- 6,486

- 2,363

- 136

And here (along with his other posts) we see the end result of GOP policy of agitating "the real Americans" against anybody in the high cost of living areas as liberal cucks, making them the "enemy of the people", all in an effort to distract them from the real crimes of the ultra wealthy that write laws to cut social safety nets for these very same "real Americans" only to give 0.1%'ers yet another tax cut.Again, don't do research or anything you fucking moron.

You are the ultimate defintion of an afluenza cuck.

Don't let facts hurt your feelings.

@s0me0nesmind1 I hope that one day you're going to wake up from your propaganda induced slumber and realize that you've been played for a fool.

- Mar 20, 2000

- 102,402

- 8,572

- 126

page 11 may of this thread may be the single worst page in the history of AT P&N. bravo, @Indus and @s0me0nesmind1 , bravo.

Indus

Lifer

- May 11, 2002

- 15,968

- 11,112

- 136

page 11 may of this thread may be the single worst page in the history of AT P&N. bravo, @Indus and @s0me0nesmind1 , bravo.

God I had trouble sleeping last night after that discussion..

My head is still spinning.. Don't remind me! And they said taxes were boring..

Maybe I shoulda waited till April 14th.

Last edited:

Victorian Gray

Lifer

- Nov 25, 2013

- 32,083

- 11,718

- 136

sportage

Lifer

- Feb 1, 2008

- 11,492

- 3,163

- 136

Finally got mine done this weekend. Various deduction removals and the cap on SALT meant we have $9k less in deductions this year than last.

Thats what I've been saying all along i.e. Trump's tax hit to the middle class.

And "some" around here dare ask, "what caps? what deduction eliminations?" as if everything Donald Trump told Americans about his tax reform was to be believed.

Believed? Donald Trump?

The same guy that made a living out of lying, swindling, conning, and cheating people?

Well, now you know....

I meant, people in general now know.

s0me0nesmind1

Lifer

- Nov 8, 2012

- 20,842

- 4,785

- 146

Thats what I've been saying all along i.e. Trump's tax hit to the middle class.

And "some" around here dare ask, "what caps? what deduction eliminations?" as if everything Donald Trump told Americans about his tax reform was to be believed.

Believed? Donald Trump?

The same guy that made a living out of lying, swindling, conning, and cheating people?

Well, now you know....

I meant, people in general now know.

People that itemize aren't the middle class. How many times do I have to repeat this for you ignorant fools to understand that?

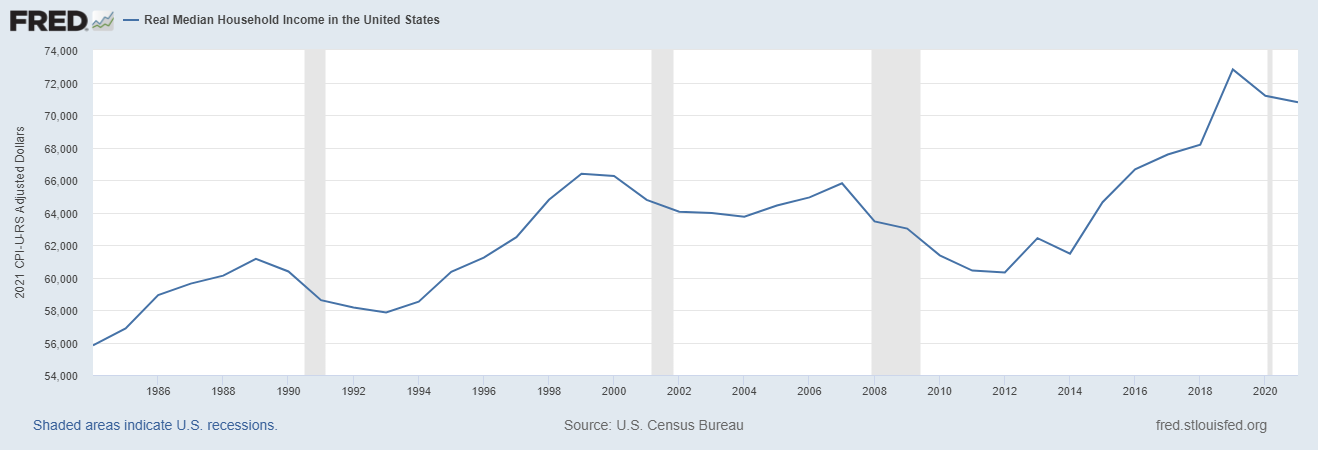

I mentioned it above but I need to mention it again here - Do you even know what the average income is in the US?

Thats what I've been saying all along i.e. Trump's tax hit to the middle class.

And "some" around here dare ask, "what caps? what deduction eliminations?" as if everything Donald Trump told Americans about his tax reform was to be believed.

Believed? Donald Trump?

The same guy that made a living out of lying, swindling, conning, and cheating people?

Well, now you know....

I meant, people in general now know.

My income is well above the median income for my area - although I am still far from an income 1%er

sactoking

Diamond Member

- Sep 24, 2007

- 7,647

- 2,921

- 136

I itemized in 2017. Total household income of 81,413. AGI of 79,121. Itemized deductions of 17,181.

According to this Investopedia report citing this US Census Bureau story of September 2018 and using this Pew definition of "middle class", it should fall between $40,500 and 122,000 (nationally). Or you can adjust your data regionally using this Pew calculator. In either case my family is firmly middle class. And we itemize. Or at least we used to. Now my wife and I will get about $7,000 more in standard deduction and lose about $8,000 in exemptions. Not sure how 2018 will look yet, still waiting on one form,

According to this Investopedia report citing this US Census Bureau story of September 2018 and using this Pew definition of "middle class", it should fall between $40,500 and 122,000 (nationally). Or you can adjust your data regionally using this Pew calculator. In either case my family is firmly middle class. And we itemize. Or at least we used to. Now my wife and I will get about $7,000 more in standard deduction and lose about $8,000 in exemptions. Not sure how 2018 will look yet, still waiting on one form,

People that itemize aren't the middle class. How many times do I have to repeat this for you ignorant fools to understand that?

I mentioned it above but I need to mention it again here - Do you even know what the average income is in the US?

My income the first year I itemized on my taxes was around $80k, which is definitely middle class.

s0me0nesmind1

Lifer

- Nov 8, 2012

- 20,842

- 4,785

- 146

My income the first year I itemized on my taxes was around $80k, which is definitely middle class.

Not really, I'd place you in Upper-Middle based on income.

All it takes to be in the TOP 10% is ~$118k. With $80k, you're in the top 20%.

I mean, you're not rich, but you're significantly above that 50% threshold. Hence Upper-middle.

The personal exemption loss kind of ruled out the standard deduction for me and left me with not much of any change at all in tax returns. I will say that my paychecks were slightly higher , so I think my tax rate was over all decreased. Not enough to really notice. Us workers don't get shit. Economy flops, bail out the corps and banks. Economy doing well, give them more tax breaks. Makes no damn sense..

Not really, I'd place you in Upper-Middle based on income.

All it takes to be in the TOP 10% is ~$118k. With $80k, you're in the top 20%.

I mean, you're not rich, but you're significantly above that 50% threshold. Hence Upper-middle.

I mean doesn't 'upper-middle' mean 'the upper part of the middle class'? Haha.

I firmly agree with you that people often drastically overestimate the median household income in America and people who have much higher income than average think they are just an average Joe. That being said, I'm not aware of any definition for middle class in the US where $80k would not apply, especially considering it's generally calculated by household and not individual.

The personal exemption loss kind of ruled out the standard deduction for me and left me with not much of any change at all in tax returns. I will say that my paychecks were slightly higher , so I think my tax rate was over all decreased. Not enough to really notice. Us workers don't get shit. Economy flops, bail out the corps and banks. Economy doing well, give them more tax breaks. Makes no damn sense..

I think it makes sense if you accept that the goal was simply to give rich people more money and the rest of it didn't really matter.

I think it makes sense if you accept that the goal was simply to give rich people more money and the rest of it didn't really matter.

The rest of it was to get some people to buy in to the con of rich people looting the Treasury, target unfriendly political groups & spread the FUD.

Indus

Lifer

- May 11, 2002

- 15,968

- 11,112

- 136

People that itemize aren't the middle class. How many times do I have to repeat this for you ignorant fools to understand that?

I mentioned it above but I need to mention it again here - Do you even know what the average income is in the US?

Keep repeating it a billion times.. no make it 11ty billion times.. and 11ty billion times it will be lies and complete utter bullshit!

Indus

Lifer

- May 11, 2002

- 15,968

- 11,112

- 136

Not really, I'd place you in Upper-Middle based on income.

All it takes to be in the TOP 10% is ~$118k. With $80k, you're in the top 20%.

I mean, you're not rich, but you're significantly above that 50% threshold. Hence Upper-middle.

Quoting for hypocrisy.

Seems most of the time you don't even know the shit you're spewing.

ArchAngel777

Diamond Member

- Dec 24, 2000

- 5,223

- 61

- 91

Prior to this year, I itemized and always came out better than the standard deduction. Of course, the only reason is that charity was roughly 6K per year (+mortgage interest and a few other things). This is with roughly 90K combined income. This year, because the standard deductions were raised higher (with the offset loss of the 4400 per dependent), it turns out that I did better taking the standard deduction this year.

If I remember correctly, last year it was 4400 per dependent + mortgage interest + charity that it worked out better to itemize. This is filing joint. My wife works as a part time substitute teacher.

Anyhow, all things considered, I probably received a refund about $1200 higher than last year. This was probably due to the increase in the child tax credit (I have two children) Do I think it was necessary to spend all that time restructuring? Probably not... But I am all for making taxes much easier and closing loopholes. That said, I don't see how this was any easier. It is pretty much the same for me when I filed this year.

If I remember correctly, last year it was 4400 per dependent + mortgage interest + charity that it worked out better to itemize. This is filing joint. My wife works as a part time substitute teacher.

Anyhow, all things considered, I probably received a refund about $1200 higher than last year. This was probably due to the increase in the child tax credit (I have two children) Do I think it was necessary to spend all that time restructuring? Probably not... But I am all for making taxes much easier and closing loopholes. That said, I don't see how this was any easier. It is pretty much the same for me when I filed this year.

Bitek

Lifer

- Aug 2, 2001

- 10,676

- 5,239

- 136

AGI and taxable over 200.

Lost tons of deductions. Took std.

All withholdings are at 0, but still owe 5 fing grand.

Thank goodness we save lots of our money and bought a cheaper house for the area or that would have been a really painful hit.

Overall rate went down 3%, but 2/3 of that is due to child credit which won't last forever.

After that it will be 1% cut. :roll:

I know a number of people who are getting fucked in either higher rates or just owing where they used to get refunds and are freaking out.

A lot of bullshit and national debt for little benefit IMO. God knows what this will do to property values and taxes (school funding) long term.

Repeal this piece of crap and replace with real tax reform and/or do something useful, like fix roads or HC.

Lost tons of deductions. Took std.

All withholdings are at 0, but still owe 5 fing grand.

Thank goodness we save lots of our money and bought a cheaper house for the area or that would have been a really painful hit.

Overall rate went down 3%, but 2/3 of that is due to child credit which won't last forever.

After that it will be 1% cut. :roll:

I know a number of people who are getting fucked in either higher rates or just owing where they used to get refunds and are freaking out.

A lot of bullshit and national debt for little benefit IMO. God knows what this will do to property values and taxes (school funding) long term.

Repeal this piece of crap and replace with real tax reform and/or do something useful, like fix roads or HC.

Last edited:

umbrella39

Lifer

- Jun 11, 2004

- 13,816

- 1,126

- 126

Quoting for hypocrisy.

Seems most of the time you don't even know the shit you're spewing.

This is a common problem for Russians called michal1980...

sao123

Lifer

- May 27, 2002

- 12,653

- 205

- 106

AGI and taxable over 200.

Lost tons of deductions. Took std.

All withholdings are at 0, but still owe 5 fing grand.

Thank goodness we save lots of our money and bought a cheaper house for the area or that would have been a really painful hit.

Overall rate went down 3%, but 2/3 of that is due to child credit which won't last forever.

After that it will be 1% cut. :roll:

I know a number of people who are getting fucked in either higher rates or just owing where they used to get refunds and are freaking out.

A lot of bullshit and national debt for little benefit IMO. God knows what this will do to property values and taxes (school funding) long term.

Repeal this piece of crap and replace with real tax reform and/or do something useful, like fix roads or HC.

Seems everyone's in favor of higher taxes and higher spending until they have to pay for it...

Go ask s0me0nesmind1, he will tell you how your 200k puts you in the top 1% and you should be paying more... Happily.

s0me0nesmind1

Lifer

- Nov 8, 2012

- 20,842

- 4,785

- 146

Seems everyone's in favor of higher taxes and higher spending until they have to pay for it...

Go ask s0me0nesmind1, he will tell you how your 200k puts you in the top 1% and you should be paying more... Happily.

Wut? You don't read much, do you?

TRENDING THREADS

-

Discussion Zen 5 Speculation (EPYC Turin and Strix Point/Granite Ridge - Ryzen 9000)

- Started by DisEnchantment

- Replies: 25K

-

Discussion Intel Meteor, Arrow, Lunar & Panther Lakes + WCL Discussion Threads

- Started by Tigerick

- Replies: 22K

-

News NVIDIA and Intel to Develop AI Infrastructure and Personal Computing Products

- Started by poke01

- Replies: 384

-

Discussion Intel current and future Lakes & Rapids thread

- Started by TheF34RChannel

- Replies: 23K

AnandTech is part of Future plc, an international media group and leading digital publisher. Visit our corporate site.

© Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.