DrMrLordX

Lifer

- Apr 27, 2000

- 23,117

- 13,219

- 136

Leading Edge is not over at GlobalFoundries.

GF just said that's it's over. Sorry, not buying it.

Leading Edge is not over at GlobalFoundries.

You can tell he is try to convince himself by the massive increase in his posting, before he could continue on in the delusion, but now with irrefutable evidence he needs to convince himself it never happened.GF just said that's it's over. Sorry, not buying it.

Leading-Edge involvesGF just said that's it's over. Sorry, not buying it.

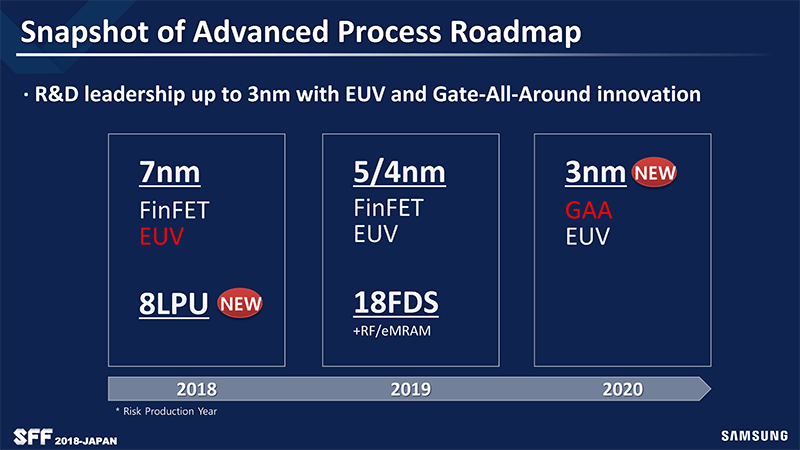

Which is PDK version 0.5 if they follow GlobalFoundries' risk production measures.*Risk production in 2020

Leading Edge is not over at GlobalFoundries.

Only FinFETs, IBM is aware of this decision and so was AMD. This list includes Qualcomm, MediaTek, HiSilicon, and Unisoc.

Everyone knew about GlobalFoundries cancelling FinFETs to improve upon FDSOI. The reasoning was simple, it had a higher return of investment for everyone. All of them wanted 12FDX over 7LP.

Once the restructuring from FinFETs and FDSOI to just FDSOI. GlobalFoundries will do some interesting things in Q1 2019.

---

"The only meaningful benefit of SOI for 14nm FF was to add eDRAM. Ironically that node is the first and last FF on SOI node of entire world. For the next nodes there is no choice for them other than using a foundry process (say 7nm at SS or TSMC) and drop eDRAM."

- Ali Khakifirooz, NVM engineer @ Intel, and one of the creators of UTBB FDSOI

and

3nm by 2020.

Do you think GlobalFoundries could have done this? (imho, no.)

IBM POWER roadmap doesn't not declare POWER10's node either.

https://pbs.twimg.com/media/DlKexFpX4AALa6B.jpg:large

eDRAM always fell way to eMRAM anyway:

https://pc.watch.impress.co.jp/img/pcw/docs/471/308/photo027.jpg

Quit warping reality to suit your preferences of a brighter FDSOI & CMT future. I'm sorry, but it ain't gonna happen. At least not until GF finds a new investor.Leading-Edge involves

1. FDSOI <== the future of this was accelerated.

2. FinFETs <== the future of this was canned.

Gary Patton said:Now that we’re relieved from burden of having to fund this bleeding edge stuff, we’re able to redirect dollars and resources toward these other areas….

Nope, doesn't consider this leading edge either ...Tom Caulfield 28. Aug 2018 said:Lifting the burden of investing at the leading edge will allow GF to make more targeted investments in technologies that really matter to the majority of chip designers in fast-growing markets such as RF, IoT, 5G, industrial and automotive

#248 is 2018(repeated Semicon West 2017), Semicon Europa 2016, CEA-Leti 2018(regurgitating GlobalFoundries).You're linking slides and images without attribution. What are the dates on these presentations? I'm rather curious if this information predates GloFo's announcement last week. I mean, look at that one up there, it lists 7nm FinFET for 2018. That was known as early as last year to be a tough call.

It's going to be hard to pay any attention to your posts unless you place time stamps on all of this evidence that you have accumulated.

GF is going to dissapear slowly. 10 years and they are gone or completely irrelevant. Not only for highend but all over. Bought out for nothing doing fab work for others.

There i no such thing as a niche market for them with their us based cost structure doing cheap processes. They will learn that. History shows niche is a thing of the 80ties.

Their RF competence is surely miniscule and easily out competed. Its way way to late to start scaling that now. If they started scaling 6 years ago and skipped all usual highend process dev they might have had a chance.

They have nothing to bring to the market others cant do cheaper or better. 14nm is dirt cheap and fully depreciated, and we are well into 7nm, before they get anything 22xxx whatever to the market. Its a dead end. They cant recover their fixed cost.

Its just imagination with no technical or organizational backbone.

They can just purshade Mubadala to continue and give them oil money because the alternative is using money on western whores and more racing cars for the political elite.

They think gf is a better investment. Or they try to delay the obvious because of sunk cost fallacy. Especially dangerous in a political controlled organization.

Obviously Mubadala is wrong and should take the entertainment.

GF is going to dissapear slowly. 10 years and they are gone or completely irrelevant. Not only for highend but all over. Bought out for nothing doing fab work for others.

There i no such thing as a niche market for them with their us based cost structure doing cheap processes. They will learn that. History shows niche is a thing of the 80ties.

Their RF competence is surely miniscule and easily out competed. Its way way to late to start scaling that now. If they started scaling 6 years ago and skipped all usual highend process dev they might have had a chance.

They have nothing to bring to the market others cant do cheaper or better. 14nm is dirt cheap and fully depreciated, and we are well into 7nm, before they get anything 22xxx whatever to the market. Its a dead end. They cant recover their fixed cost.

Its just imagination with no technical or organizational backbone.

They can just purshade Mubadala to continue and give them oil money because the alternative is using money on western whores and more racing cars for the political elite.

They think gf is a better investment. Or they try to delay the obvious because of sunk cost fallacy. Especially dangerous in a political controlled organization.

Obviously Mubadala is wrong and should take the entertainment.

Yep.I suspect that GloFo will find a second life producing specialised parts for the US military. Lots of work making radar and communications chips, in a secure fab based in the US.

Wow, the previous two

Maybe you and Nosta could just cancel each other out, with your polar opposite viewpoints.

This is not doom and gloom for GF. Leadership made a rational decision here, they now have a chance to make money,since they aren't sinking so much into leading/bleeding edge process development.

GF will exit the spotlight of PC enthusiasts, as new leading edge CPU/GPU/SoC parts will be using other fab options, but there are plenty of industry uses for fabs outside of leading edge GPU/CPU/SoC parts.

How on earth is 400M usd going to fund new nodes?

Whens the last time you saw a fab announce that they are putting future nodes on hold indefinitely and halting R&D and then start it all back up again?It won't. GF isn't going to develop new nodes. Or, at least, that's what all their announcements indicate.

Whens the last time you saw a fab announce that they are putting future nodes on hold indefinitely and halting R&D and then start it all back up again?

The only way I can see GF survive is by buying 3 year old process tech from someone like Samsung and implementing it. It's the only way they can survive as a long term (n-1, n-2) fab. Otherwise, they will end as you have said.They are eating into prior years capital investment from mubadala.

Its not going to last.

How on earth is 400M usd going to fund new nodes? Its a drop in the ocean in fab world. I guess it just barely covers variable cost. So its good business now but its lipstick on a pig. Fab technology and -knowledge- wears down quickly.

I am right. So no middle way.

.

Their RF competence is surely miniscule and easily out competed. Its way way to late to start scaling that now.

Well, a sentence of yours in a previous post :

Even if FDSOI is the best process for RF applications..?.

Actually they should be quite competitive in this department, firms that adopted FDSOI did so for the RF performance, basically lower input capacitances wich allow for higher frequencies when devices are used within their linear region.

Well, a sentence of yours in a previous post :

Even if FDSOI is the best process for RF applications..?.

Actually they should be quite competitive in this department, firms that adopted FDSOI did so for the RF performance, basically lower input capacitances wich allow for higher frequencies when devices are used within their linear region.