That's the opposite of how a capitalist system works - you need real competition to have price pressures and similar pace of innovation. Lack of serious competitive price pressures generally results in terrible price competition - telecomm companies in US and Canada are the perfect example. If AMD is out, even if Intel is split into 2 "competing" companies, all it would do is create an illusion of competition. Even now Intel is already ripping us off. Instead of raising prices, they are selling us less die space (but that's directly related to CPU performance and core count).

Intel's first quad core came out in 2006 and by 2007, you were able to buy one for around $300-330 in the form of Q6600. Next year Intel is launching Haswell and it will still be $300 for a quad-core i7. If you don't see anything wrong with this picture, I don't know what to tell you. When AMD actually had competitive Athlon 64 CPUs, Intel wouldn't even dare charge extra for hyper-threading. Now they are tacking on an $80-100 price premium for this 1 feature in the i7 2600/2700/3770K. That's ridiculous and the only reason they are getting away with it is because Bulldozer has failed.

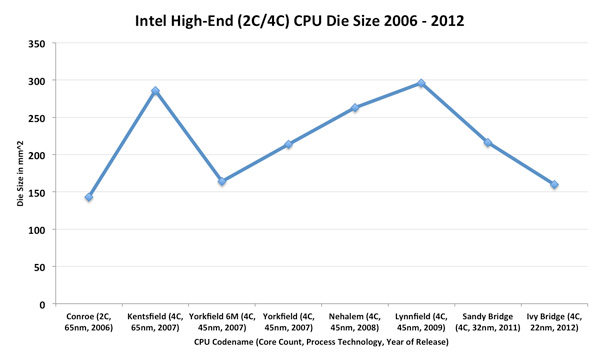

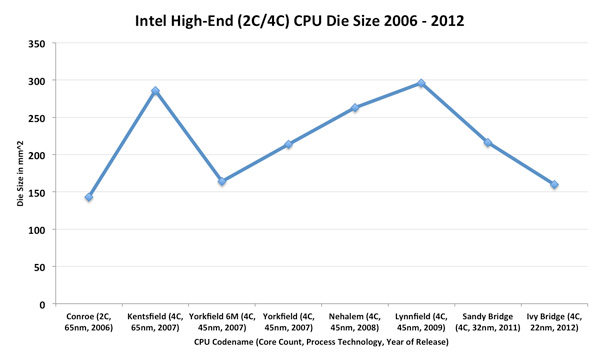

Also, when AMD CPUs had no competition from Intel, we had this:

Intel may lower prices if another competitor emerges, but your theory that in the long-run Intel will magically lower prices on their CPUs because they have less competition is an odd one.