- Oct 30, 2000

- 42,589

- 5

- 0

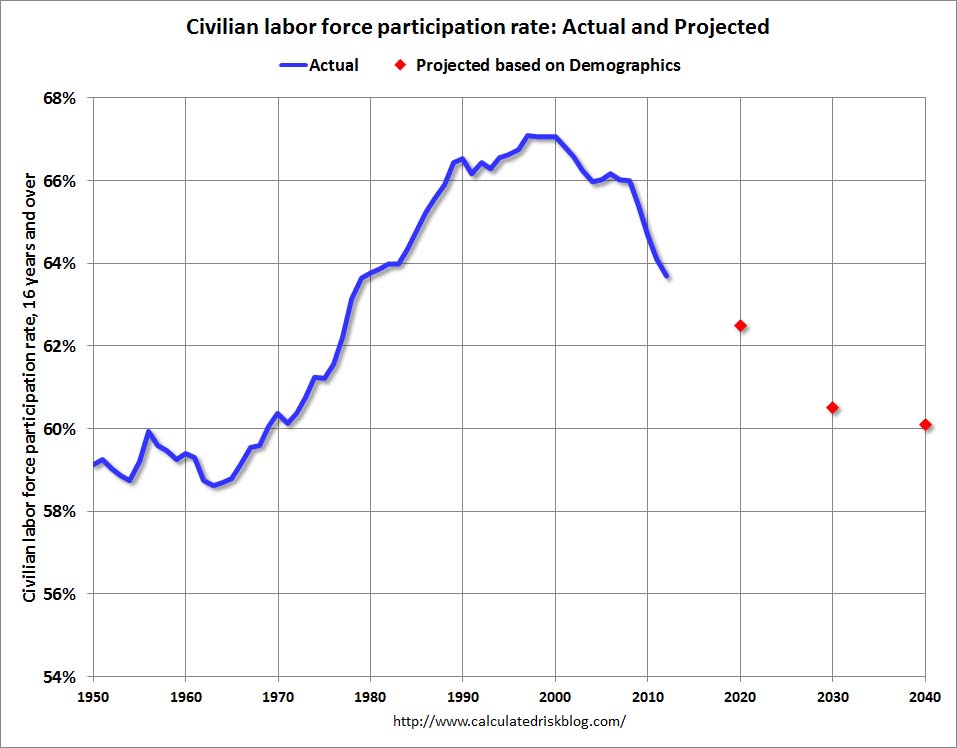

Due to people dropping out of the market, not due to jobs being generated.

Business still is distrustful of economic direction and the administration policies.

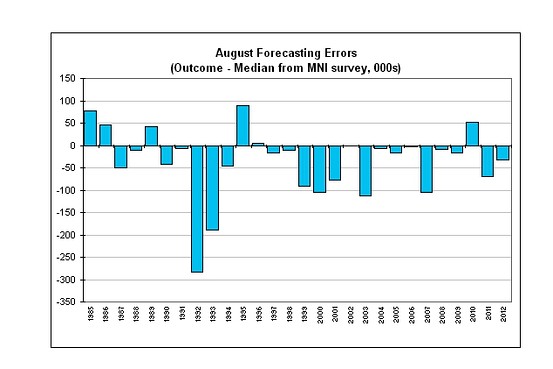

government forecasts we know are rosy and over inflated, but by 40%. That sound like manipulation of numbers.

Business still is distrustful of economic direction and the administration policies.

government forecasts we know are rosy and over inflated, but by 40%. That sound like manipulation of numbers.

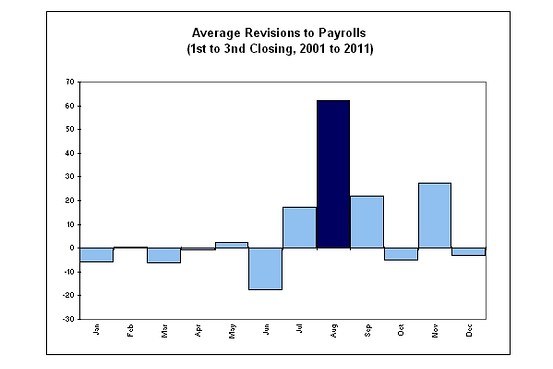

LinkWASHINGTON (AP) U.S. employers added 169,000 jobs in August and many fewer in July than previously thought. Hiring has slowed from the start of the year and could complicate the Federal Reserve's decision later this month on whether to reduce its bond purchases.

The Labor Department said Friday that the unemployment rate dropped to 7.3 percent, the lowest in nearly five years. But it fell because more Americans stopped looking for work and were no longer counted as unemployed. The proportion of Americans working or looking for work fell to its lowest level in 35 years.

July's job gains were just 104,000, the fewest in more than a year and down from the previous estimate of 162,000. June's figure was revised to 172,000, from 188,000. The revisions lowered total job gains over those two months by 74,000.