Homerboy

Lifer

- Mar 1, 2000

- 30,890

- 5,001

- 126

This will be blamed on the Democrats taking majority...

I was right!

Last edited:

This will be blamed on the Democrats taking majority...

Wage growth for the most part has nothing to do with Trump, as most of the wage growth is due to 24 states raising minimum wage. Example, washing states minimum wage went up 12.5%. ($12 to $13.50).

I believe it's 2025.Is my memory right that the very little benefit that was in the trump tax cut for the middle class expires next year?

I thought the middle class stuff was right after the election. I will have to go check.I believe it's 2025.

I thought the middle class stuff was right after the election. I will have to go check.

Nope I was just wrong. I had thought the expiration was sooner than 2027.You might be referring to the payroll tax deferral that Trump signed a few months ago--basically "elect me or you will have to pay all those taxes back! If you do elect me...you might not?"

It is currently in effect, and some employees--notably all federal employees, and of course employers that are Chud Donnie acolytes--have subjected their employees to this blackmail from POTUS (fed has no choice).

You might be referring to the payroll tax deferral that Trump signed a few months ago--basically "elect me or you will have to pay all those taxes back! If you do elect me...you might not?"

It is currently in effect, and some employees--notably all federal employees, and of course employers that are Chud Donnie acolytes--have subjected their employees to this blackmail from POTUS (fed has no choice).

I thought the middle class stuff was right after the election. I will have to go check.

You might be referring to the payroll tax deferral that Trump signed a few months ago--basically "elect me or you will have to pay all those taxes back! If you do elect me...you might not?"

It is currently in effect, and some employees--notably all federal employees, and of course employers that are Chud Donnie acolytes--have subjected their employees to this blackmail from POTUS (fed has no choice).

No, meaning the part of the TCJA where the middle class tax cuts expire but the corp tax cuts were made permanent.

They had a 10-year sunset for costing because they passed it under reconciliation, and it can't have a negative impact on the budget after 10 yrs under reconciliation rules.

You mean for people whose taxes actually take a noticeable difference out of their earnings aren't going to keep those crumbs?oh right, the 10 year thing. Already forgot about it (which is the entire point and exactly what we were all saying.)

Very true, highly driven by state actions.

Wut? You can't be serious?

You honestly think that wage growth is simply based on minimum wage laws?

Christ - some of you really need to take a business 101 course or something...

Nobody said it was simply based on minimum wage laws. That is your reading comprehension failing you. The facts show that lower class bracket received the highest wage growth, with the top bracket (the rich) receiving the next highest, and the actual middle class receiving the least. But when the minimum wage goes up in 24 states out of 50, it sure as hell is going to have an effect on wage growth for a number of reasons.Wut? You can't be serious?

You honestly think that wage growth is simply based on minimum wage laws?

Christ - some of you really need to take a business 101 course or something...

Is my memory right that the very little benefit that was in the trump tax cut for the middle class expires next year?

No, meaning the part of the TCJA where the middle class tax cuts expire but the corp tax cuts were made permanent.

They had a 10-year sunset for costing because they passed it under reconciliation, and it can't have a negative impact on the budget after 10 yrs under reconciliation rules.

Actually, you where partially correct about 2021. I came across an article this morning that the tax breaks that expire in 2027, actually do it incrementally between 2021 and 2027. It's an opinion based in the fact that they are claiming that it is it's Republican's who are raising taxes on the middle class, but the facts about the incremental increases based on income level, are not opinion.Nope I was just wrong. I had thought the expiration was sooner than 2027.

Actually, you where partially correct about 2021. I came across an article this morning that the tax breaks that expire in 2027, actually do it incrementally between 2021 and 2027. It's an opinion based in the fact that they are claiming that it is it's Republican's who are raising taxes on the middle class, but the facts about the incremental increases based on income level, are not opinion.

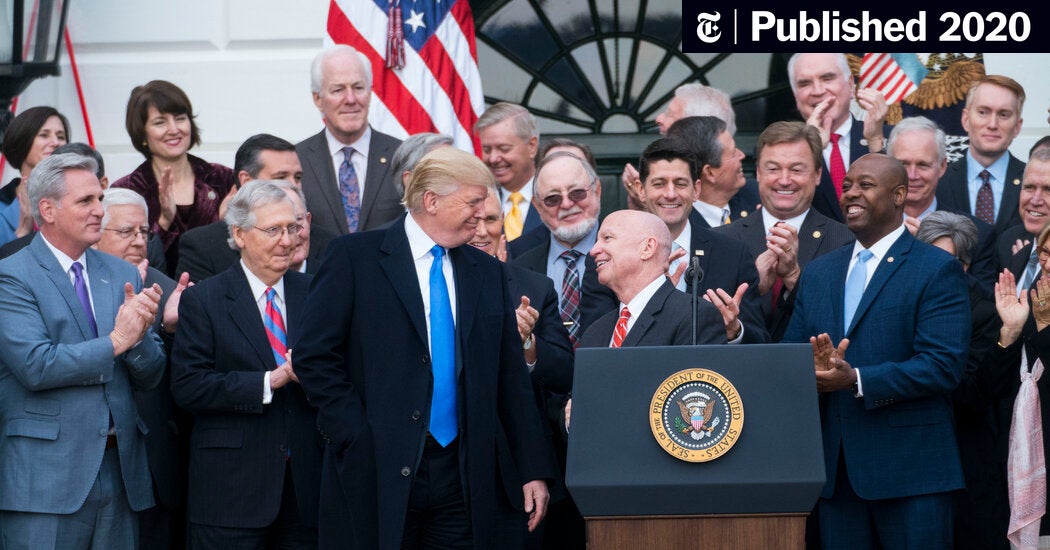

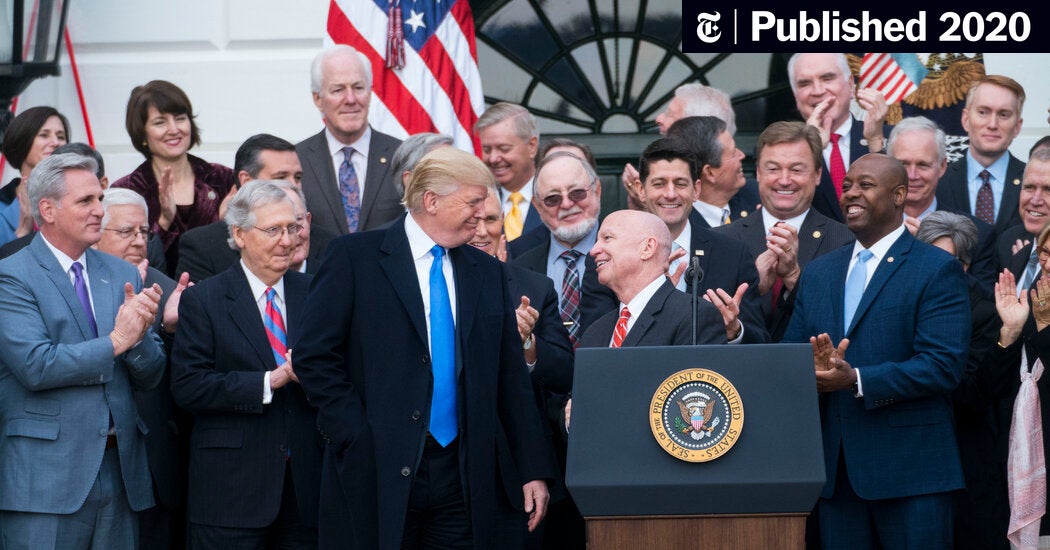

Opinion | Republicans, Not Biden, Are About to Raise Your Taxes (Published 2020)

President Trump built in tax increases beginning in 2021, for nearly everyone but those at the very top.www.nytimes.com

While I don’t care about the specific year you do agree that long term the Trump ‘tax cuts’ mean higher taxes for most people, right? I mean if nothing else the changed inflation estimate to chained CPI for tax brackets is a lifelong tax increase for people who make their money through wages.I'm searching all over this article for what mystical change is going to happen in 2021 concerning the TCJA. I'm not finding where they are citing some kind of change - care to enlighten me?

The Tax brackets are going up yearly (as they always do for inflation)

The tax rates are staying the same for the tax brackets

The standard deduction is going up yearly (as they always do for inflation)

None of the standard lower to middle class tax credits/deductions (such as the child tax credit) is being altered.

There is literally nothing that is increasing taxes for lower to middle income people in 2021.

2021 Tax Brackets

What are the 2021 tax brackets? Explore 2021 federal income tax brackets and federal income tax rates. Also: child tax credit and earned income tax credittaxfoundation.org

While I don’t care about the specific year you do agree that long term the Trump ‘tax cuts’ mean higher taxes for most people, right? I mean if nothing else the changed inflation estimate to chained CPI for tax brackets is a lifelong tax increase for people who make their money through wages.

It is hard to think of a bigger failure of tax policy than the TCJA. It was just a smash and grab for rich people.

Our business taxes VASTLY needed reformation to keep up with and be competitive with other countries. Was this the right choice? I don't know - I'm not a business tax expert. But just take a look at any western country and the general trend is the lowering of business taxation and an increase in consumer taxes such as a VAT.

This isn't questionable - it's a fact and general trend across the globe of developed nations.

View attachment 32729

View attachment 32730

On the subject of Individual taxes - Part of me likes and part of me doesn't like the expiration. I mean, part of it isn't so much a "tax increase" but simply a return to what was there previously. Almost like a "temporary discount". Regardless, I don't like this way of lowering taxes by holding individual americans feet to the fire every 10 years. I DO however agree with it in the sense that we SHOULD be reforming taxes on a regular basis - and every 10 years seems reasonable. Which we all know is what will happen when they are near expiration. Another tax reform will be passed. Prior to the TCJA (in 2017) I think the last major tax reform was in... 1986 with Reagan?

I don't want to steer too off-topic from my original question of demanding WHAT that article is saying is changing in 2021 that affects the average taxpayer. Because that just looks like a delicious cup of bullshit fake news.

Forget the expiration, it is a long term tax INCREASE on wage earners. In the end it is a tax increase in probably 80-90% of Americans so that we can cut taxes for rich people.Our business taxes VASTLY needed reformation to keep up with and be competitive with other countries. Was this the right choice? I don't know - I'm not a business tax expert. But just take a look at any western country and the general trend is the lowering of business taxation and an increase in consumer taxes such as a VAT.

This isn't questionable - it's a fact and general trend across the globe of developed nations.

View attachment 32729

View attachment 32730

On the subject of Individual taxes - Part of me likes and part of me doesn't like the expiration. I mean, part of it isn't so much a "tax increase" but simply a return to what was there previously. Almost like a "temporary discount". Regardless, I don't like this way of lowering taxes by holding individual americans feet to the fire every 10 years. I DO however agree with it in the sense that we SHOULD be reforming taxes on a regular basis - and every 10 years seems reasonable. Which we all know is what will happen when they are near expiration. Another tax reform will be passed. Prior to the TCJA (in 2017) I think the last major tax reform was in... 1986 with Reagan?

I don't want to steer too off-topic from my original question of demanding WHAT that article is saying is changing in 2021 that affects the average taxpayer. Because that just looks like a delicious cup of bullshit fake news.