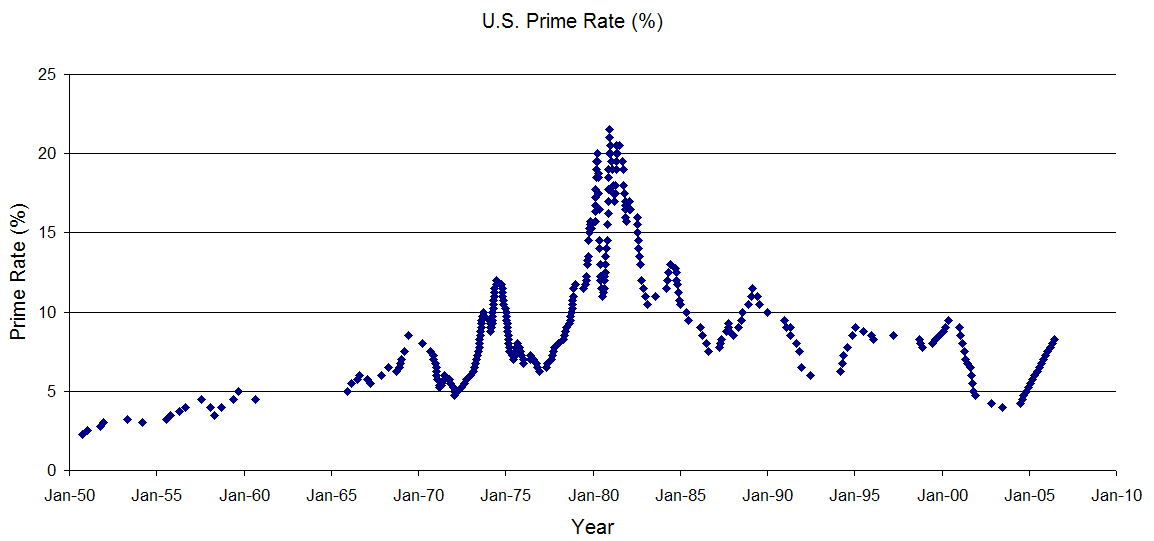

Maybe it's different in your part of the world, but in Washington it works the way I said. My parents bought their house around 1981 for about $60,000 at an interest rate of something like 12%. Let's convert that to today's dollars using this

CPI calculator. $60,000 in 1981 is $149,224 in 2012. One could say that was one hell of a good deal because it's currently worth about $330,000. When you factor in interest rates, you'll find that the two are a lot closer than they appear.

$149,224 at 12% over 30 years = $1,534.94/mo in today's dollars

BoA's posted fixed rate is 4.278%

$330,000 at 4.278% over 30 years = $1,628.82/mo in today's dollars

Do you see how that works? The cost of goods is based on how much money people have. If people in 1981 had the same budget as people today with the same job, they end up paying the same monthly rate for their mortgage. The difference is that high interest rates are much easier to pay off because the principal is significantly lower. My dad's single income was able to support a family of 4 and pay off the entire mortgage in less than 10 years. Today? Good luck with that.

When the interest rate is up around 12% and the principal of the loan in today's dollars is $149,224, what percentage of the principal are you paying off when you live as cheap as possible and pay an extra $10,000? 10000/149224 = 6.7%

Now let's try that at a lower interest rate. You're in the same house, still living as cheap as possible, you still saved an extra $10,000 to pay off the mortgage, but now you're looking at $330,000 of principal. 10000/330000 = 3.0%

This simple math demonstrates how low interest rates have destroyed the middle class. My parents got a killer deal. Every dollar they saved and paid toward the mortgage actually made a huge difference because the principal was so low. Now that interest rates are super low and people can borrow 10x their yearly income, it takes forever to pay anything off.

I know that a lot of people don't understand this very simple concept, and I really don't know why. People go to a poor place like Mexico and they see that everything is way cheaper. Did they ever ask why? A lot of charities work this angle to guilt people into giving donations. They'll say something like "did you know half the world lives on less than $1 per day?" and they never explain what the cost of living is in those areas. When people make $1 per day, the cost of food might only be $0.50. It's not like people need to work 3 days to buy 1 meal. That's not how the free market works.