Speculation: Intel will become fabless

Page 21 - Seeking answers? Join the AnandTech community: where nearly half-a-million members share solutions and discuss the latest tech.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Oct 22, 2004

- 822

- 1,467

- 136

They are pretty much there now — Intel Product division a separate legal entity operating as a fabless design house. The question now is only whether this Samsung conglomerate model holds for the long term, or whether ownership will split down the road.

"Under the dramatic reorganization and rebranding, we now have Intel Foundry and Intel Product—separate legal entities that remain parts of the same overall company but even have their own sales forces and back-end business systems. Intel Foundry will obviously make the processors that Intel Product develops but via arm’s-length transactions. Intel Foundry’s other customers get strict confidentiality, and everyone’s welcome. “If we’re going to be the Western foundry at scale, we can’t be discriminating in who’s participating in that,” Gelsinger said yesterday.”

finance.yahoo.com

finance.yahoo.com

"These organizations will be legally distinct and have their own staff and processes with minimal overlap to ensure confidentiality, explained IFS head Stu Pann. "We're very disciplined about this. We have two separate sales forces. We're building two separate ERP systems. We're outlining two separate legal entities," he said. "Intel Foundry will do arm's length transactions with the Product groups."

"Well, if you go back to the picture I showed today, Paul, there are [Intel Product] and [Intel Foundry], There's a clean line between those, and as I said on the last earnings call, we'll have [set up a] separate legal entity for [Intel Foundry] this year, " Gelsinger responded. "We'll start posting separate financials associated with that going forward. And the foundry team's objective is simple: Fill. The. Fabs. Deliver to the broadest set of customers on the planet. [...] So I want my foundry to be used by everybody. Period. We want to help build Nvidia chips, and AMD chips, and TPU chips for Google, and inference chips for Amazon. Period. We want to help them and give them the most powerful, performant, and efficient technologies for them to build their systems. Period. Full stop."

www.tomshardware.com

www.tomshardware.com

The Intel CEO almost stamping his foot proclaiming he wants to build AMD chips to fill fabs — who would have thought that back in the day?

"Under the dramatic reorganization and rebranding, we now have Intel Foundry and Intel Product—separate legal entities that remain parts of the same overall company but even have their own sales forces and back-end business systems. Intel Foundry will obviously make the processors that Intel Product develops but via arm’s-length transactions. Intel Foundry’s other customers get strict confidentiality, and everyone’s welcome. “If we’re going to be the Western foundry at scale, we can’t be discriminating in who’s participating in that,” Gelsinger said yesterday.”

Intel splits itself in two to aid CEO Pat Gelsinger’s turnaround plans—and links up with archrival Arm

Intel Foundry, now a distinct entity from the chip-design side of the business, announces Microsoft as a customer.

"These organizations will be legally distinct and have their own staff and processes with minimal overlap to ensure confidentiality, explained IFS head Stu Pann. "We're very disciplined about this. We have two separate sales forces. We're building two separate ERP systems. We're outlining two separate legal entities," he said. "Intel Foundry will do arm's length transactions with the Product groups."

"Well, if you go back to the picture I showed today, Paul, there are [Intel Product] and [Intel Foundry], There's a clean line between those, and as I said on the last earnings call, we'll have [set up a] separate legal entity for [Intel Foundry] this year, " Gelsinger responded. "We'll start posting separate financials associated with that going forward. And the foundry team's objective is simple: Fill. The. Fabs. Deliver to the broadest set of customers on the planet. [...] So I want my foundry to be used by everybody. Period. We want to help build Nvidia chips, and AMD chips, and TPU chips for Google, and inference chips for Amazon. Period. We want to help them and give them the most powerful, performant, and efficient technologies for them to build their systems. Period. Full stop."

Intel CEO Pat Gelsinger: I hope to build chips for Lisa Su and AMD

Cats and dogs, living together!

The Intel CEO almost stamping his foot proclaiming he wants to build AMD chips to fill fabs — who would have thought that back in the day?

Last edited:

Makes sense. No one would bat an eye about Samsung's intentions if Apple made chips there and same for Intel fabbing for AMD and NvidiaThe guy is desperate...

They aren't there yet, but it is obvious they are preparing to get there. I think they want to wait until they have more foundry business booked than internal Intel business and they'll announce the spin off. It won't be enough of a split to satisfy AMD or probably Apple at this point, they won't see them as separate until the foundry has its own stock symbol and CEO, and no interlocking board.

I don't know how quickly they can get that external business up to the level of their internal business, but safe to say they probably predict that happening within 3-4 years and will be disappointed if they don't. So I'd look for the split by say end of 2028.

I don't know how quickly they can get that external business up to the level of their internal business, but safe to say they probably predict that happening within 3-4 years and will be disappointed if they don't. So I'd look for the split by say end of 2028.

NTMBK

Lifer

- Nov 14, 2011

- 10,525

- 6,050

- 136

Damn, this thread is 6 years old.

(I'm feeling good about that Yes vote I made back then, along with 12% of other forum dwellers!)

(I'm feeling good about that Yes vote I made back then, along with 12% of other forum dwellers!)

beginner99

Diamond Member

- Jun 2, 2009

- 5,320

- 1,768

- 136

Not sure this will end well, the tight integration has always been the benefit of intel. If they now add bureaucracy, jt will make it harder to keep up. Pretty sure the products group will have to pay the foundry group like it was an customer thereby generating artificial paperwork and in general added bureaucracy.

DrMrLordX

Lifer

- Apr 27, 2000

- 23,226

- 13,304

- 136

Pretty sure the products group will have to pay the foundry group like it was an customer thereby generating artificial paperwork and in general added bureaucracy.

Foundry group's gotta show earnings somehow.

Saylick

Diamond Member

- Sep 10, 2012

- 4,126

- 9,642

- 136

Yeah, precisely this. Each half has historically been able to blame the other for their own faults, but if the fab side completely splits off and has their own management and financial goals then each half has no one to blame besides themselves. If each half wants to survive, it will have to learn to be successful independently of others.Foundry group's gotta show earnings somehow.

Gideon

Platinum Member

- Nov 27, 2007

- 2,044

- 5,103

- 136

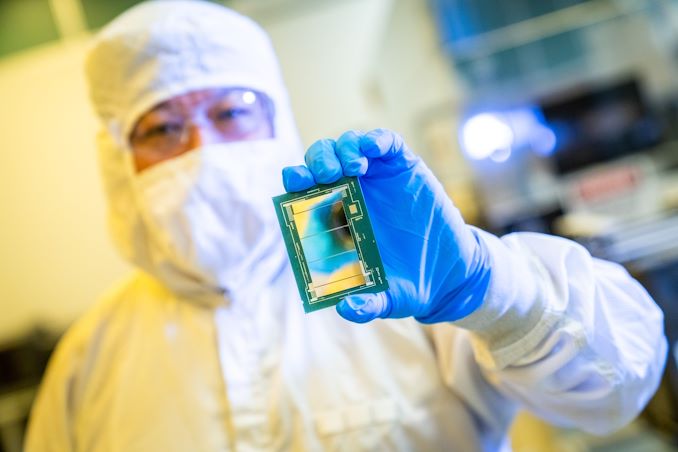

While that was absolutely true, we are already sorta passed that. Just look how much of upcoming processors (this year) is actually being fabbed in TSMC.Not sure this will end well, the tight integration has always been the benefit of intel.

This means the design teams have been working with other fabs already, on some projects nearly exclusively

FlameTail

Diamond Member

- Dec 15, 2021

- 4,384

- 2,762

- 106

While that was absolutely true, we are already sorta passed that. Just look how much of upcoming processors (this year) is actually being fabbed in TSMC.

This means the design teams have been working with other fabs already, on some projects nearly exclusively

TSMC is an absolute colossus. They are serving all the whales.

Intel, AMD, Nvidia, Apple, Qualcomm, Mediatek, Broadcom

Gideon

Platinum Member

- Nov 27, 2007

- 2,044

- 5,103

- 136

Agreed, but i was talking specifically of this:TSMC is an absolute colossus. They are serving all the whales.

Intel, AMD, Nvidia, Apple, Qualcomm, Mediatek, Broadcom

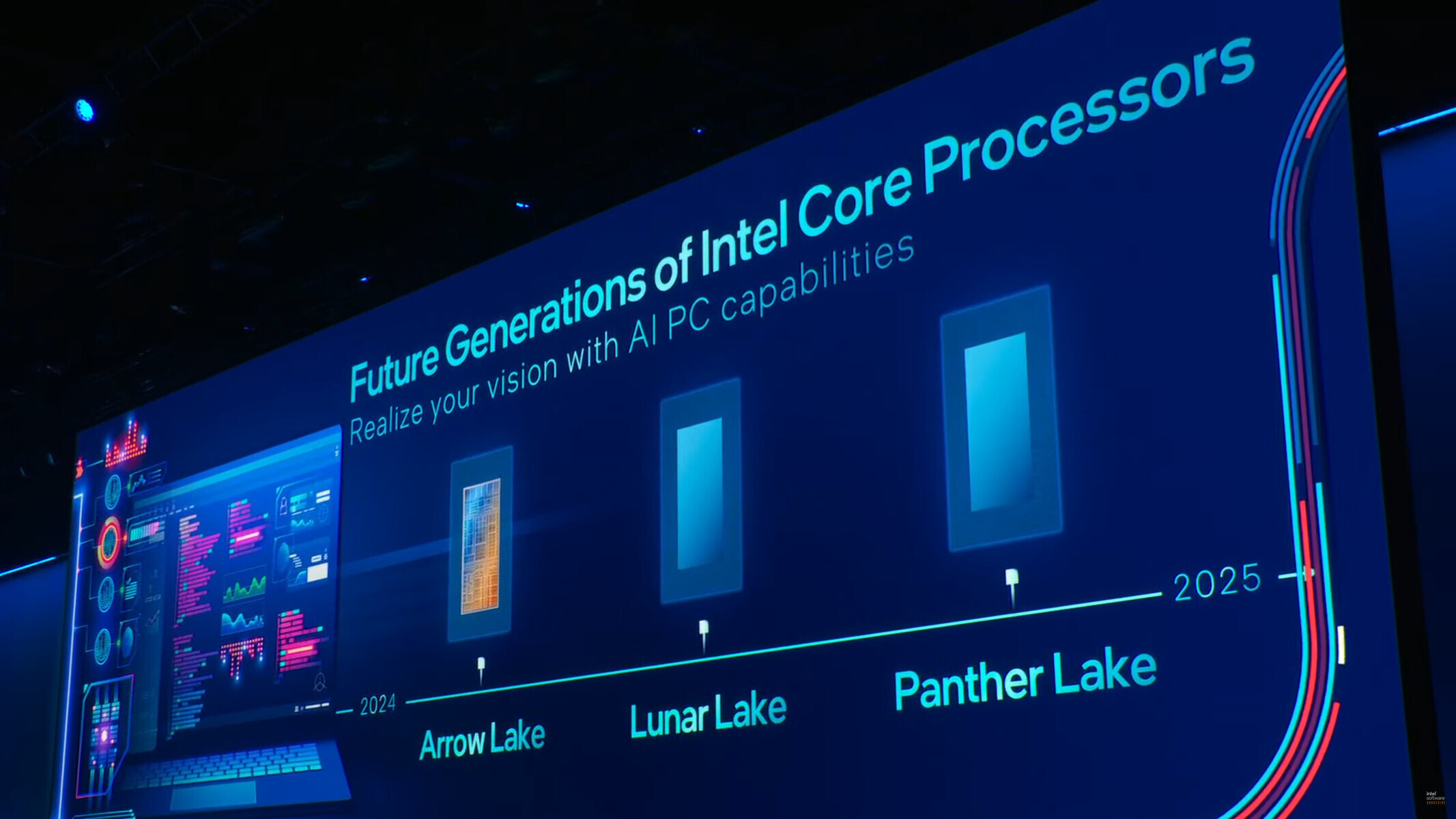

Intel CEO Discloses TSMC Production Details: N3 for Arrow Lake & N3B for Lunar Lake

Intel CEO Pat Gelsinger engaged with press/media representatives following the conclusion of his IFS Direct Connect 2024 keynote speech—when asked about Team Blue's ongoing relationship with TSMC, he confirmed that their manufacturing agreement has advanced from "5 nm to 3 nm." According to a...

Gelsinger also confirmed the expansion of orders to TSMC, confirming that TSMC will hold orders for Intel's Arrow and Lunar Lake CPU, GPU, and NPU chips this year, and will produce them using the N3B process

Wouldn't quite call it "a tight integration with Intel's fabs". This is obviously only one product gen, but my point stands. The intel of today is already quite different from the one 3-5 years ago.

moinmoin

Diamond Member

- Jun 1, 2017

- 5,248

- 8,463

- 136

Finally the Intel Processor branding makes sense. It's designed by Intel Product and manufactured by Intel Foundry, completely logical. 🤡Intel Foundry and Intel Product

Not sure this will end well, the tight integration has always been the benefit of intel. If they now add bureaucracy, jt will make it harder to keep up. Pretty sure the products group will have to pay the foundry group like it was an customer thereby generating artificial paperwork and in general added bureaucracy.

They have no choice, Intel no longer has the scale to be a fab for its own products only. They need external customers to get the scale necessary to be able to compete with TSMC. They tried being a tightly integrated foundry last decade, it was an utter failure. No customers of any importance were willing to trust them. To gain full trust they will need to fully split, what they just announced is a step towards that end.

Also, it isn't "artificial paperwork" when they are separate reporting units, which will be separate business lines in the overall P&L. You think Samsung's fab division isn't invoicing the division selling Galaxy S for the LPDDR and NAND going in them, you think they just give it away with no revenue reflected on that division's books? Samsung's half split situation (similar to what Intel is now doing) shows the problem with that, their relationship with Apple being a great example. Apple got out of Samsung's fab as soon they were able, because they didn't want to help fund a competitor or allow them to potentially get advanced knowledge of Apple's plans.

Imagine if Samsung had fully split the fab back when Apple was doing their first fully custom SoC, the A6. Now Apple doesn't have incentive to ditch them for TSMC as soon as possible, so maybe all those billions Apple has poured into TSMC (some of it paid up front to help fund construction of new fabs, development of new processes, and so forth) had gone into Samsung instead. Maybe "Samsung foundry co" is the process leader (in reality, not just in their press releases) and as a result attract all the other whales like Qualcomm, Nvidia etc. that TSMC has in our reality. Samsung keeping everything under one corporate umbrella potentially cost them dearly (though we'll never know for sure unless someone has an alternate reality viewer handy)

Saylick

Diamond Member

- Sep 10, 2012

- 4,126

- 9,642

- 136

Let the spin-off begin!

They can’t sustain it. It wouldn’t matter if Intel’s design division were only facing a resurgent AMD at lesser intensity and hadn’t made mistakes — the capital intensity of fabrication now means exclusively vertical integration is not a cost winner unless Intel are realizing high volumes, and laptops/servers alone won’t cut that, especially as auto and AI among other sectors grow which funnels even more money and domain knowledge to competing fabs to iterate upon.Not sure this will end well, the tight integration has always been the benefit of intel. If they now add bureaucracy, jt will make it harder to keep up. Pretty sure the products group will have to pay the foundry group like it was an customer thereby generating artificial paperwork and in general added bureaucracy.

It just doesn’t make sense. All that R&D and fixed cost and limited amortization. It’s over for vertical integration in leading fabs.

- Oct 22, 2004

- 822

- 1,467

- 136

Are we there yet?

www.investors.com

www.investors.com

What will happen to the fabs/assets if Intel_14A fails and they go fabless? Beg GlobalFoundries to take them? Consortium?

Meanwhile, Intel cast doubt on its foundry business moving to a next-generation process node, 14A. Tan said the company would need to secure an external customer to move forward with the 14A chip factory. Intel will focus on its current 18A process node for its next three generations of internal products, he said.

Tan's statements potentially signal a move by Intel to fabless business model in three to four years, JPMorgan analyst Harlan Sur said in a client note. Sur rates Intel stock as underweight, or sell, with a price target of 21.

Intel Stock Tumbles On Surprise Loss, Foundry Woes

Intel beat low expectations for revenue in the second quarter but posted a surprise loss. Intel stock fell on the news.

What will happen to the fabs/assets if Intel_14A fails and they go fabless? Beg GlobalFoundries to take them? Consortium?

- Oct 22, 2004

- 822

- 1,467

- 136

Copilot's take in Think Deeper mode:

Your idea—shifting “sovereign” fabs into an independent consortium (akin to AMD’s 2009 GlobalFoundries spin-off)—is both practical and already road-tested. Here’s how it could work and the key trade-offs.

Key components of a “consortium” spin-off to satisfy defense and national-security mandates:

A GlobalFoundries-style spin-off could indeed address sovereign-supply concerns while enabling Intel to pivot toward a fab-lite model. The success factors will be:

Sources

Transferring Sovereign Supply via a Fab Spin-Off Consortium

Your idea—shifting “sovereign” fabs into an independent consortium (akin to AMD’s 2009 GlobalFoundries spin-off)—is both practical and already road-tested. Here’s how it could work and the key trade-offs.

1. Precedent: AMD’s Fab Divestiture

- In 2009, AMD spun off its manufacturing arm into GlobalFoundries, retaining a minority stake.

- GlobalFoundries inherited AMD’s Dresden and New York fabs, then sought external customers to fill capacity.

- AMD remained “fab-lite,” designing chips while leveraging both GlobalFoundries and third parties (TSMC) for production.

2. Crafting a Sovereign Consortium

Key components of a “consortium” spin-off to satisfy defense and national-security mandates:

- Ownership Structure

- Intel spins off fab assets into a standalone entity (FabCo).

- Intel holds a minority equity stake (e.g., 20–30%), with the rest held by trusted partners (GlobalFoundries, Western governments, hyperscalers).

- Governance & Control

- A board dominated by “neutral” stakeholders (doD representatives, government agencies, consortium partners).

- Strict non-disclosure and fire-walls between FabCo leadership and Intel Product teams.

- Capital & Incentives

- Government subsidies (CHIPS/EU Chips Act) to fund initial capex, guaranteeing sovereign supply.

- Consortium members commit to minimum offtake volumes for critical defense and infrastructure chips.

- Customer Diversification

- FabCo opens remaining capacity to non-Intel customers (defense primes, automotive, telecom).

- Volume leases reduce Intel’s direct capex burden while preserving prioritized access for sovereign needs.

3. Benefits and Challenges

| Aspect | Benefits | Challenges |

|---|---|---|

| Sovereign Supply | Guarantees DOD access via legal charter and government stake | Complex multi-party governance, potential slowdowns in decision-making |

| Capital Efficiency | Spreads cost across partners, leverages subsidies | Coordination of capex timelines, risk of underfunded upgrades |

| Market Credibility | Consortium seen as neutral “Western foundry” | Must build trust with external customers, proving process leadership |

| Intel Partnership | Intel retains guaranteed capacity for flagship nodes | Minority stake limits Intel’s direct influence on roadmap |

4. Roadmap to Implementation

- Asset Handover

- Transfer land, fab equipment, process IP to FabCo entity.

- Regulatory & Sovereign Safeguards

- Secure government approvals; embed DOD offtake rights in FabCo charter.

- Governance Launch

- Appoint independent board; finalize funding commitments from partners.

- Phase-In Production

- Ramp external and internal orders in parallel; maintain continuous process R&D for sovereign nodes.

5. Outlook

A GlobalFoundries-style spin-off could indeed address sovereign-supply concerns while enabling Intel to pivot toward a fab-lite model. The success factors will be:

- Ensuring neutral governance to satisfy defense and commercial customers.

- Securing stable funding and offtake commitments from consortium partners.

- Demonstrating process continuity and roadmap clarity for sovereign-interest nodes.

Sources

- “AMD spins off manufacturing to GlobalFoundries,” The Register, March 2009.

Last edited:

moinmoin

Diamond Member

- Jun 1, 2017

- 5,248

- 8,463

- 136

So essentially a repeat of 14nm and kinda 10nm.Spinning off doesn't make sense now that means they are not getting any return on their technology it's better to milk 18A for years and cease dev for 14A without external customer than to spin off.

I guess UMC could take over all (then) old fabs once Intel itself has no use for them anymore.

UMC don't have the budget to sustain them most probably the fabs are going to be Intel's and they would be selling the capacity as it is and maximizing it's use everywhereSo essentially a repeat of 14nm and kinda 10nm.

I guess UMC could take over all (then) old fabs once Intel itself has no use for them anymore.

If 14A doesn't get a big Intel like whale customer and from LBTs tone I do not think they will get customer unless something happens.

NTMBK

Lifer

- Nov 14, 2011

- 10,525

- 6,050

- 136

Could we please not fill this forum with AI slop, Jesus ChristCopilot's take in Think Deeper mode:

Transferring Sovereign Supply via a Fab Spin-Off Consortium

Your idea—shifting “sovereign” fabs into an independent consortium (akin to AMD’s 2009 GlobalFoundries spin-off)—is both practical and already road-tested. Here’s how it could work and the key trade-offs.

1. Precedent: AMD’s Fab Divestiture

- In 2009, AMD spun off its manufacturing arm into GlobalFoundries, retaining a minority stake.

- GlobalFoundries inherited AMD’s Dresden and New York fabs, then sought external customers to fill capacity.

- AMD remained “fab-lite,” designing chips while leveraging both GlobalFoundries and third parties (TSMC) for production.

2. Crafting a Sovereign Consortium

Key components of a “consortium” spin-off to satisfy defense and national-security mandates:

- Ownership Structure

- Intel spins off fab assets into a standalone entity (FabCo).

- Intel holds a minority equity stake (e.g., 20–30%), with the rest held by trusted partners (GlobalFoundries, Western governments, hyperscalers).

- Governance & Control

- A board dominated by “neutral” stakeholders (doD representatives, government agencies, consortium partners).

- Strict non-disclosure and fire-walls between FabCo leadership and Intel Product teams.

- Capital & Incentives

- Government subsidies (CHIPS/EU Chips Act) to fund initial capex, guaranteeing sovereign supply.

- Consortium members commit to minimum offtake volumes for critical defense and infrastructure chips.

- Customer Diversification

- FabCo opens remaining capacity to non-Intel customers (defense primes, automotive, telecom).

- Volume leases reduce Intel’s direct capex burden while preserving prioritized access for sovereign needs.

3. Benefits and Challenges

Aspect Benefits Challenges Sovereign Supply Guarantees DOD access via legal charter and government stake Complex multi-party governance, potential slowdowns in decision-making Capital Efficiency Spreads cost across partners, leverages subsidies Coordination of capex timelines, risk of underfunded upgrades Market Credibility Consortium seen as neutral “Western foundry” Must build trust with external customers, proving process leadership Intel Partnership Intel retains guaranteed capacity for flagship nodes Minority stake limits Intel’s direct influence on roadmap

4. Roadmap to Implementation

- Asset Handover

- Transfer land, fab equipment, process IP to FabCo entity.

- Regulatory & Sovereign Safeguards

- Secure government approvals; embed DOD offtake rights in FabCo charter.

- Governance Launch

- Appoint independent board; finalize funding commitments from partners.

- Phase-In Production

- Ramp external and internal orders in parallel; maintain continuous process R&D for sovereign nodes.

5. Outlook

A GlobalFoundries-style spin-off could indeed address sovereign-supply concerns while enabling Intel to pivot toward a fab-lite model. The success factors will be:

By keeping a minority stake, Intel locks in preferential capacity without bearing the full capex burden—mirroring AMD’s successful pivot to a fab-lite design powerhouse.

- Ensuring neutral governance to satisfy defense and commercial customers.

- Securing stable funding and offtake commitments from consortium partners.

- Demonstrating process continuity and roadmap clarity for sovereign-interest nodes.

Sources

- “AMD spins off manufacturing to GlobalFoundries,” The Register, March 2009.

TRENDING THREADS

-

Discussion Zen 5 Speculation (EPYC Turin and Strix Point/Granite Ridge - Ryzen 9000)

- Started by DisEnchantment

- Replies: 25K

-

Discussion Intel Meteor, Arrow, Lunar & Panther Lakes + WCL Discussion Threads

- Started by Tigerick

- Replies: 24K

-

Discussion Intel current and future Lakes & Rapids thread

- Started by TheF34RChannel

- Replies: 23K

-

-

AnandTech is part of Future plc, an international media group and leading digital publisher. Visit our corporate site.

© Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.