On Intel's IDM 2.0 business plan and their fab options, this article from Scotten Jones at SemiWiki is a great read:

In January I presented at the ISS conference a comparison of Intel’s, Samsung’s and TSMC’s leading edge offerings. You can read a write-up of my presentation here. With the problems going on at Intel, that article generated a lot of interest in the investment community, and I have been holding a...

semiwiki.com

Scotten Jones obviously has tremendous industry experience and insight, and he highlights many of the issues and the pros and cons for Intel's options.

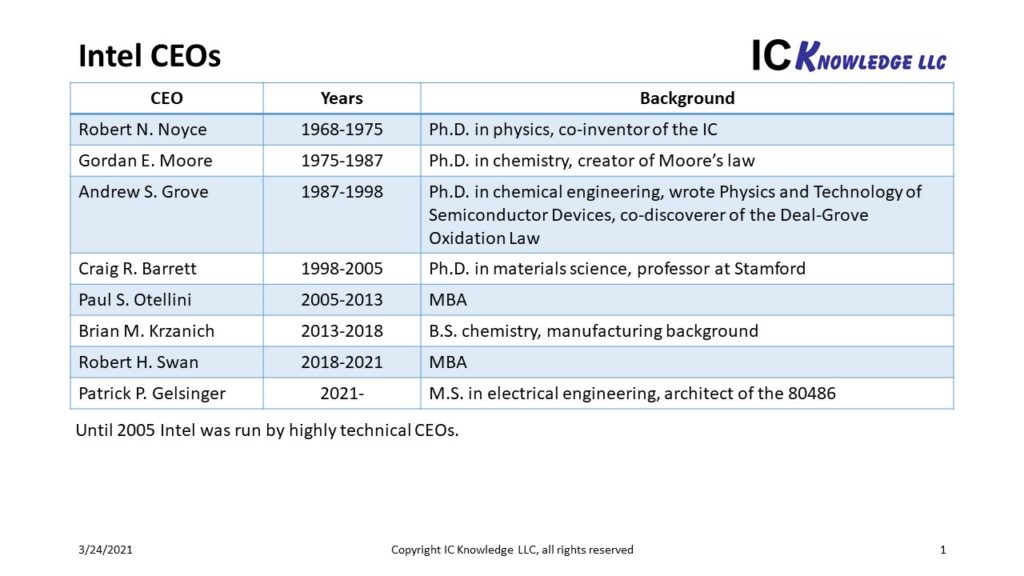

That said, he sounds a bit like an Intel sentimentalist, as he concludes that Intel's best course of action is to not be distracted by their new foundry business, but instead double down on getting back to glory (2 year process development cadence), which implies that Intel maintains the market domination needed to be able to fill their fabs with Intel product, i.e. maintain "critical mass", as he calls it.

On this latter point is where I think he goes wrong. Without maintaining critical mass, Intel will not generate the revenue and profit needed to keep scaling up R&D and capex to stay at the increasingly expensive leading-edge of process development and fab investment forever.

Like I pointed out in my earlier post, if AMD achieves and continues 37% growth this year and for the next two years, they will be at over 2.5 the size today in terms of revenue, and possibly at over 50% unit share, by the end of 2023. Meanwhile, Intel will have transitioned to chiplet design at that point, and much of the silicon in their "disaggregated" chips may come from outside to stay competitive, as the chance of them regaining process leadership by then is slim. And like I pointed out before, without process leadership Intel will increasingly face fierce product competition from other directions as well, such as RISC-V, ARM, GPU, FPGA, AI/ML — all threatening their ability to maintain critical mass.

I'm starting to think that Intel Foundry Services will become the IDM exit strategy at Intel. As the prospect of getting back to leadership in all areas continues to fade, while fab expense and process R&D continue to increase relentlessly, they will look to spin off the fabs into IFS and likely partner with a foundry to get back to critical mass.