JEDI

Lifer

- Sep 25, 2001

- 29,391

- 2,738

- 126

not many small shops paying rent right now...What’s everyone think of REITs as part of a “own total market” strategy?

Last edited:

not many small shops paying rent right now...What’s everyone think of REITs as part of a “own total market” strategy?

not many small shops paying rent right now...

i guess you're not buying at $1 then?

SRNE fighting to stay under $5.

Wish they'd hurry up and consolidate back into the $3s so I could open a position.

Ive told the story a few times already about my brother buying some shares back in 2008 when HTZ went under a buck on bankruptcy fears. He then held the shares until they hit $18 dollars each, and it happened fairly quickly.

The difference between now and 2008 is that this time Hertz filed for protection from creditors.

They do have a billion in cash and billions in debt and there is chance the equity (existing shares) could survive. It all depends on how quickly they can get people into cars and paying them rent. If that doesnt happen soon, I suspect the shares go to zero.

If business picks up soon, there might be leverage with creditors. This is all very speculative however and I would not risk any more than you are ok with losing completely, because thats a real possibility.

Isn't there only like... 3 big name car rental companies in the game? Hertz, Enterprise Group (National, Alamo, and Enterprise?), and Avis/Budget ?

Like I said, with how massive these bankruptcies are, at what point are things "too big to fail"?

Because honestly, only having 2 options for car rentals when you go to airports (in some cases 1) will be lame.

from your link:The most likely outcome is that Hertz WILL survive, but in a smaller form. Creditors will most likely take control of the company and get 100% of the equity in a newly formed company.

Speculators in the existing shares may try to buy now hoping against hope to be included in a .005% stake in the new company, but thats the long shot bet. Have to see what happens and how close to zero the shares go.

How Are Stock Prices Determined? | The Motley Fool

Learn how stock prices are determined for a company in the U.S. stock market, and check out a few examples of share price valuations.www.fool.com

from your link:

Stockholders are the last in line, and generally only get anything if the rest of the creditors are repaid in full. And since the reason most companies use Chapter 11 protection in the first place is an inability to pay their debts, you can probably imagine that this doesn't happen too often.

so .005% chance sounds about right..lol

Been seeing a lot of discussion around the ARK funds (there are a few others) and their high MER, but also their proven outperformance.

What’s everyone think of REITs as part of a “own total market” strategy?

not many small shops paying rent right now...

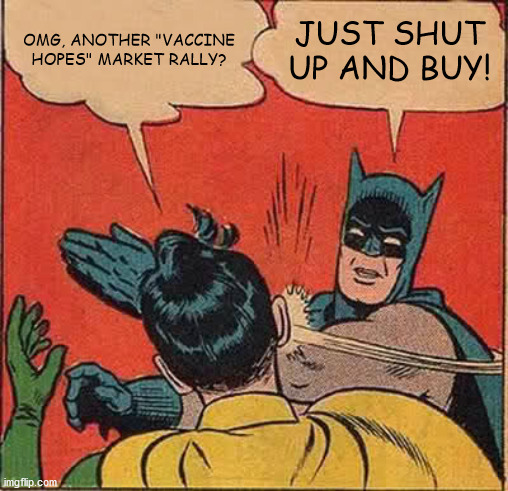

s&p breaking thru 3000 resistance levelSo we are already up nearly 40% from the bottom and the market is scheduled for another 2% gain in the morning on "Vaccine Hopes!".

Again.

So we are already up nearly 40% from the bottom and the market is scheduled for another 2% gain in the morning on "Vaccine Hopes!". Again.

So we are already up nearly 40% from the bottom and the market is scheduled for another 2% gain in the morning on "Vaccine Hopes!". Again.

s&p's resistance lvl at 3000 has been pierced.Overpriced? I mean how far are we from record highs at this point?

I'm hoping for a serious come to Jesus moment type of correction.