- Nov 14, 2011

- 10,522

- 6,041

- 136

Exclusive: Hedge fund Third Point urges Intel to explore deal options

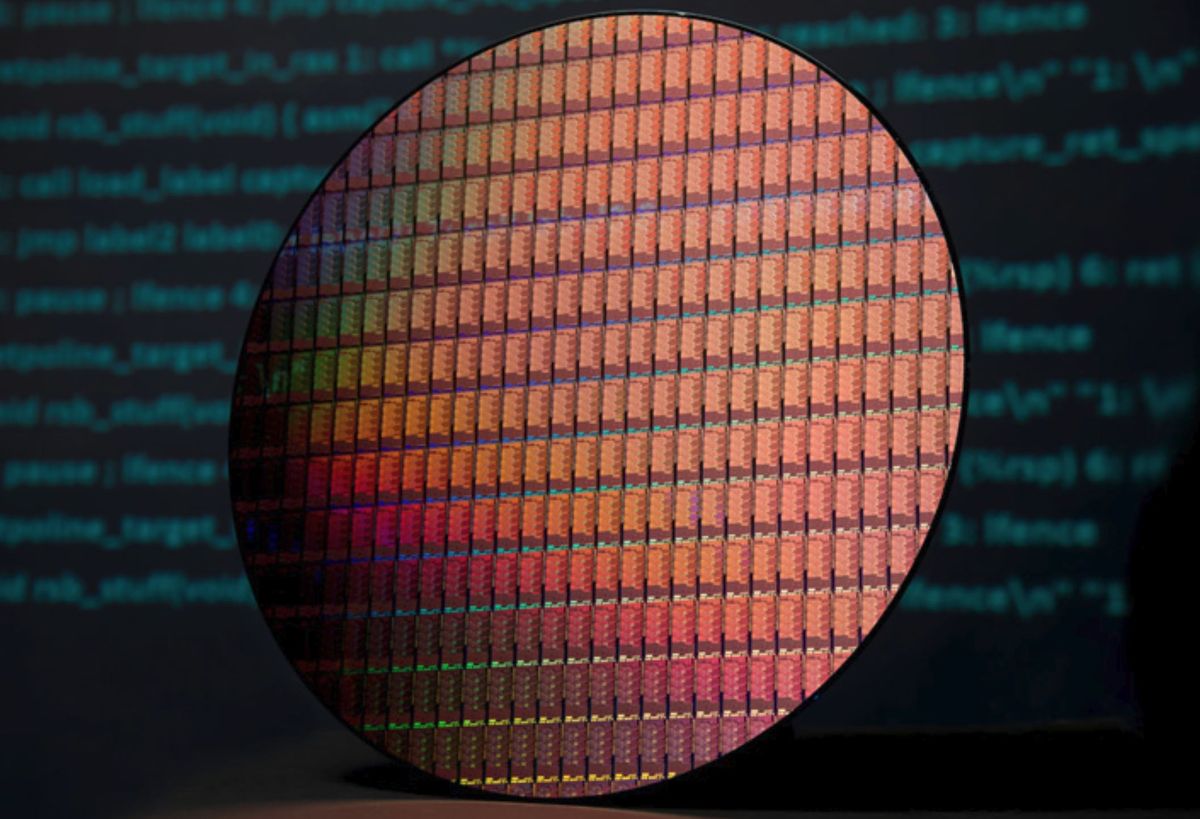

Activist hedge fund Third Point LLC is pushing Intel Corp to explore strategic alternatives, including whether it should keep chip design and production under one roof, according to a letter it sent to the company's chairman on Tuesday that was reviewed by Reuters.

(Reuters) - Activist hedge fund Third Point LLC is pushing Intel Corp to explore strategic alternatives, including whether it should keep chip design and production under one roof, according to a letter it sent to the company’s chairman on Tuesday that was reviewed by Reuters.

Were it to gain traction, Third Point’s push for changes could lead to a major shakeup at Intel, which has been slow to respond to investor calls to outsource more of its manufacturing capacity. It could also lead to the unwinding of some of its acquisitions, such as the $16.7 billion purchase of programmable chip maker Altera in 2015.

I wonder if Intel will take heed? They certainly need to change something.