As Hot Chips 34 starting this week, Intel will unveil technical information of upcoming Meteor Lake (MTL) and Arrow Lake (ARL), new generation platform after Raptor Lake. Both MTL and ARL represent new direction which Intel will move to multiple chiplets and combine as one SoC platform.

MTL also represents new compute tile that based on Intel 4 process which is based on EUV lithography, a first from Intel. Intel expects to ship MTL mobile SoC in 2023.

ARL will come after MTL so Intel should be shipping it in 2024, that is what Intel roadmap is telling us. ARL compute tile will be manufactured by Intel 20A process, a first from Intel to use GAA transistors called RibbonFET.

Comparison of upcoming Intel's U-series CPU: Core Ultra 100U, Lunar Lake and Panther Lake

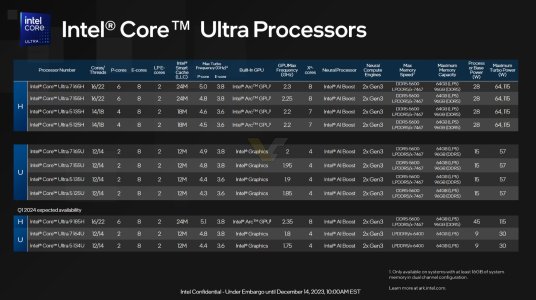

| Model | Code-Name | Date | TDP | Node | Tiles | Main Tile | CPU | LP E-Core | LLC | GPU | Xe-cores |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Core Ultra 100U | Meteor Lake | Q4 2023 | 15 - 57 W | Intel 4 + N5 + N6 | 4 | tCPU | 2P + 8E | 2 | 12 MB | Intel Graphics | 4 |

| ? | Lunar Lake | Q4 2024 | 17 - 30 W | N3B + N6 | 2 | CPU + GPU & IMC | 4P + 4E | 0 | 8 MB | Arc | 8 |

| ? | Panther Lake | Q1 2026 ? | ? | Intel 18A + N3E | 3 | CPU + MC | 4P + 8E | 4 | ? | Arc | 12 |

Comparison of die size of Each Tile of Meteor Lake, Arrow Lake, Lunar Lake and Panther Lake

| Meteor Lake | Arrow Lake (20A) | Arrow Lake (N3B) | Arrow Lake Refresh (N3B) | Lunar Lake | Panther Lake | |

|---|---|---|---|---|---|---|

| Platform | Mobile H/U Only | Desktop Only | Desktop & Mobile H&HX | Desktop Only | Mobile U Only | Mobile H |

| Process Node | Intel 4 | Intel 20A | TSMC N3B | TSMC N3B | TSMC N3B | Intel 18A |

| Date | Q4 2023 | Q1 2025 ? | Desktop-Q4-2024 H&HX-Q1-2025 | Q4 2025 ? | Q4 2024 | Q1 2026 ? |

| Full Die | 6P + 8P | 6P + 8E ? | 8P + 16E | 8P + 32E | 4P + 4E | 4P + 8E |

| LLC | 24 MB | 24 MB ? | 36 MB ? | ? | 8 MB | ? |

| tCPU | 66.48 | |||||

| tGPU | 44.45 | |||||

| SoC | 96.77 | |||||

| IOE | 44.45 | |||||

| Total | 252.15 |

Intel Core Ultra 100 - Meteor Lake

As mentioned by Tomshardware, TSMC will manufacture the I/O, SoC, and GPU tiles. That means Intel will manufacture only the CPU and Foveros tiles. (Notably, Intel calls the I/O tile an 'I/O Expander,' hence the IOE moniker.)

Attachments

Last edited: