- Oct 22, 2004

- 822

- 1,467

- 136

After Intel released their dire earnings and forecast this week, AMD again passed Intel in market capitalisation (currently $122B vs $116B). It will be interesting to see if AMD can retain their higher valuation this time around, which very much depends on their own financial results in the current market turmoil. AMD will report quarterly earnings after market close on Tuesday 2023-01-31.

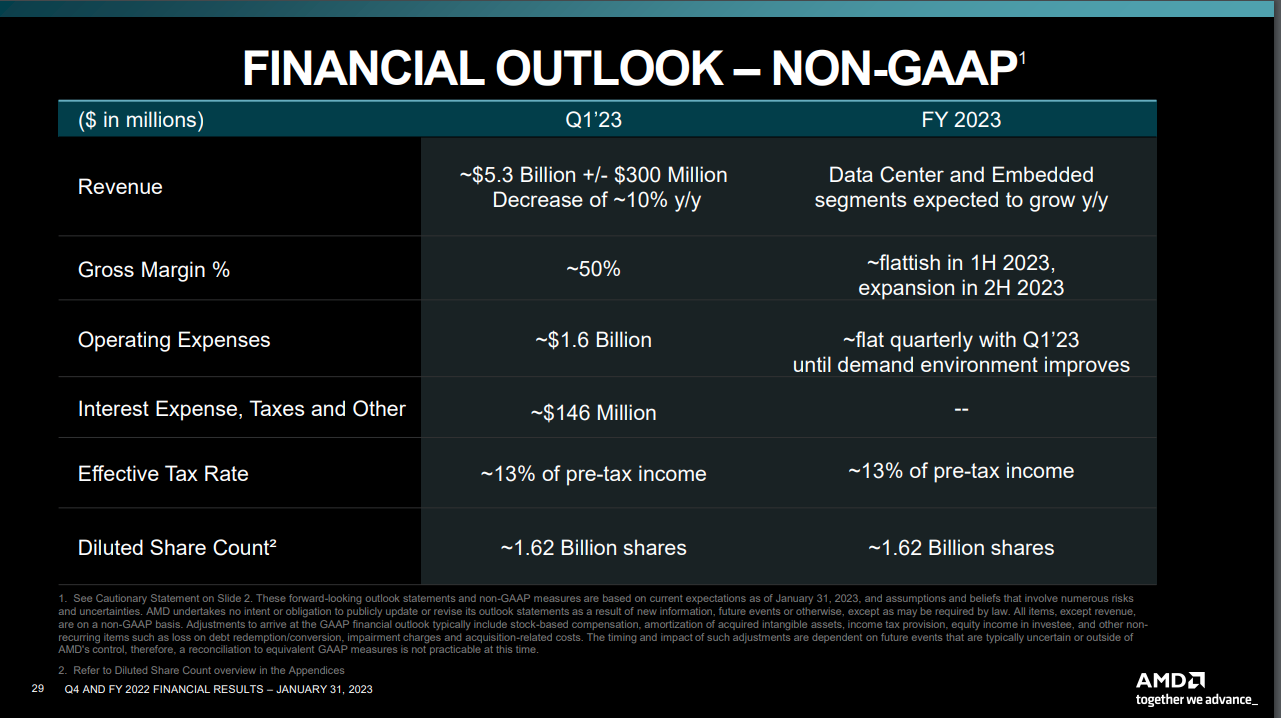

AMD has forcasted revenue to hit $5.50B ± 0.30B. Zacks Estimates on average expects $5.51B, with $0.66 EPS, with a revenue forecast for next quarter slightly up at $5.57B, presumably based on AMD's competitive position and strong growth in the data centre segment, in particular, outweighing the weakness in the client segments.

Do you think AMD will miss, hit or beat their revenue target? Will they forecast revenue up, flat or down for the current quarter?

PS. While we all wait for AMD's results, here is a nice video by CNBC on AMD's history and comeback:

AMD has forcasted revenue to hit $5.50B ± 0.30B. Zacks Estimates on average expects $5.51B, with $0.66 EPS, with a revenue forecast for next quarter slightly up at $5.57B, presumably based on AMD's competitive position and strong growth in the data centre segment, in particular, outweighing the weakness in the client segments.

Do you think AMD will miss, hit or beat their revenue target? Will they forecast revenue up, flat or down for the current quarter?

PS. While we all wait for AMD's results, here is a nice video by CNBC on AMD's history and comeback:

Last edited: