Alpha One Seven

Golden Member

- Sep 11, 2017

- 1,098

- 124

- 66

Nah, I get around $15,000 / yr in SSDI. Maybe a little more now with the 2018 2% COLA.

Yeah, pretty small budget for hardware purchases, huh? The last year or two, I was borrowing from good old Mom.Now that I'm doing mining, and have a number of decent Ryzen rigs, and as many GPUs as my PCs will hold, I'm going to be paying her back this year, hopefully substantially.

I've pared back my cell phone ($160/yr), Internet ($9.95/mo, $112/mo for the gigabit FIOS connection, debating on keeping that), the things that are expensive are my car ins. ($200+/mo), and rent (~$400/mo). But thank the Lord Above that I can manage on that income. Mining is a nice little bonus, even though it rolls in really slowly. Even if I have to pay taxes on it. Which, given my low income otherwise, I wonder if I maybe don't have to?

Edit: I eat a lot of Ramen and McD's dollar value menu stuff.

Canadian power company(ies) are actively working on attracting bitcoin miners and large datacenters to use their extra unused power & recycling the heat produced so it's put to good use in greenhouses cause is cold AF a lot of the year.

https://bitcoinmagazine.com/articles/energy-company-hydro-quebec-looks-attract-bitcoin-miners/

It's a race & competition to attract the most big miners.

Holy cr@p!

Somebody moved $400+ million dollars worth of Bitcoin's for $1 transaction fee in one shot.

https://blockchain.info/tx/92785a57f6e9e9eb9d37a00e6e8be7f888376f65fa2b8f868db261cbf6cca7b0

Segwit transactions are really fast & cheap, but WOW that's a lot of money

They're doing better, but $1 is still a bit much - remember, people are going to be paying that much for any transaction, regardless of its size. Sure is better than $5-$25 transaction fees though.

Let's see if Bitcoin can get its act together well enough to catch up to Ethereums tx/day count and get tx fees down in the ballpark of $.20 or less. Then there is hope.

Still, with all the reliance on off-chain solutions like LN that may be required to get there, it becomes questionable as to why anyone would pick Bitcoin's blockchain as the basis for those transactions. Most off-chain solutions can be applied to multiple blockchains.

I do not see having free or near-free onchain transactions as the goal. A second layer solution like LN seems to be working out much better than I originally thought. Those are essentially free and instant with the benefit of working through the TOR network and are offchain. So the blockchain remains relatively light on resources for full node operators, wth really needs to fix that fits their node operators.

Oh god LOL.

Look up coin called PONZI. It's a literal joke. Their whitepaper is a dictionary definition of the word ponzi scheme (I'm not being figurative!).

And their website is a tongue in cheek.

http://ponzicoin.co/home.html

From their Q&A

Q: Is this site secure?

A: We use Equifax-grade security.

From their website:

Well it started $0.003 last March. Shot upto $0.05 in December... now it's $0.13.

What the fack.

Onchain or offchain won't really matter for the end-user so long as the money gets where it needs to go. All Lightning transfers will incur some cost since you have to pay to open and close channels . . . it's just a matter of how many transactions you can resolve in the interim. In the long run, I think most crypto-based payment networks will use a combination of on-chain and off-chain solutions until we migrate to something more sophisticated than existing blockchain tech (tangles possibly, not sure what will win out in the end). You will want higher onchain throughput and lower latency to make offchain transactions less onerous (slow onchain transactions could make the opening and closing of Lightning channels problematic, for example; ditto for Raiden).

Another problem is that the LN developers are practically begging people to stop using the alpha version on the main net. It is working for some, but not for others:

https://www.ethnews.com/lightning-network-users-report-losing-bitcoin-due-to-bugs

On the one hand you have rabid pro LN/RSK pushing for rapid adoption and lecturing everyone that "it's ready today", but on the other hand you have developers cautioning people to slow down and let them work on the code some more. Given the buggy nature of LN right now, I'd say caution is warranted.

Canada is on a roll, first the government is inviting all miners with cheap renewable power & space, now they're going to introduce their first regulated crypto fund consisting of BTC, ETH, & LTC. That should be good for tax purposes for both individuals and governments, curious to see how it will develop. Some provinces have reached over 5% of the population having bought or own cryptos. Adoption is accelerating there at almost Asian-like speed it looks like.

I've tinkered a bit with LN and it works well. A channel can basically stay open until either of the 2 participants decides to close it. It just works really fast and even the phone app is much easier to use than I'd imagine at this stage of development.

It's a bit trickery when it comes to deployment. Since BTC itself is a completely open development (main developers have only limited say at best which is a good thing) anybody is free to do whay they want. I wouldn't deploy LN commercially for myself yet until there's a lot more peer review, but good luck to those that do like TORguard, it does works quite well as-is, just not bullet proof yet.

Onchain for major transactions and a 2nd layer offchain for everyday transactions with separate wallet funding seems the best & safest setup for the foreseeable future. Cold storage, Layer 1 wallet, Layer 2 wallet.

This is still a thing? I mean, come on, let the gpu's drop.

Now would be a good time for a competitor to Nvidia and ATI to come in the game. Nvidia and ATI don't want to produce more since they are scared this is a bubble that will soon burst and are counting on that. If another came into play and was more aggressive and mass produced enough GPUs to fill in the market, ATI and Nvidia would feel pressured to produce more as well.

Hello everybody! I'm not sure how to approach this subject here since it could come across as shilling/doomsaying for personal profit, so some personal disclosure is in order.

Whatever crypto holdings I had of any substance, I dumped in Dec 2017. The IRS is getting their money, all fed/state laws were obeyed, etc. I have no skin in the game outside of a few piddly tokens I've mined since then.

One of the things that had me spooked back then were rumblings about Tether (USDT) and its influence on the crypto world. I had set a baseline profit goal and a maximum profit goal as well, and prices pushed past the maximum so I said, "why not? Let's sell this crypto", and so it was.

If you think I have a warchest sitting to the sidelines awaiting investment somewhere else . . . well yes, actually, I do, though all I will say about that, is that it is %5300 larger than it was when I started in 2016. So yeah theoretically I could FOMO back in after a crash and increase my stack, or I could just walk away.

The fact is that what I'm about to tell you is already circulating in the crypto invesetor world, so . . . I didn't start this talk, and whatever any of us do here will likely be irrelevant to whatever price shifts we see over the next month or so. The market is bigger than just us.

Tether is coming apart at the seams:

https://mktstk.com/2018/01/28/tether-is-breaking-its-peg-to-the-dollar/

Others are saying stuff like this, though I can't confirm/deny their claims:

https://www.reddit.com/r/ethtrader/comments/7tmkol/tether_is_breaking_its_peg_to_the_dollar/dtedce5/

Personally I think the above poster has not gone far enough in describing the risk levels posed by the USDT situation assuming his assessment of crypto capitalization is correct. USDT printing goes further back than Nov. 2017; in fact, you could probably trace it back to H1 2017. The last time that BTC appeared to have anything resembling an "organic" price level was late July when it was around $2k, though others have estimated that USDT pumping started $1k earlier, in Feb. 2017.

The simplest way I was able to wrap my mind around the probable effects of a USDT-based fallout was to come to the following conclusions:

1). Any exchange that accepts USDT will fall apart, potentially stranding assets Mt. Gox-style

2). AT BEST crypto values will retrace to Feb-July 2017 levels.

For BTC that would mean a drop to the $1k-$2k range. For ETH things could get much worse, since the Feb 2017 price was under $16, while the July price was averaged around $200 (there was a big dip back then, following stabilization in the $300 range, but I do not expect a USDT collapse scenario to bring ETH down to a floor as high as $300).

And that assumes a straight-up historical rewind of prices. Things might not shake out like that. Also consider that tokens like BCH didn't even exist back then . . . some of those could have value 100% backed by USDT. Take USDT out of the equation, and they evaporate. Poof! Gone. Or they might survive the crash, and other tokens that had value as far back as Feb 2017 might take a disproportionate hit in market cap. ETH could get pushed to Dec 2016 levels (~$7).

Outside of the fact that a lot of people would be wiped out by a market cataclysm of this scale, it also sucks that a lot of excellent tech projects would be rapidly defunded in a heartbeat. Crypto moves FAST. Stuff like OMG and RDN could lose capitalization overnight.

Not good.

So what should you make of this? All I can really ask you to do is watch the market carefully, and be wary of automated trading tools protecting you in the event of a crash. Get any crypto assets you're holding on Poloniex or Bitfinex off those exchanges ASAP since they may go Mt. Gox on us within the next year. Have a plan to liquidate or move to a crypto that you think will be safe BEFORE things go tits-up. Once the panic selling starts, it's already too late.

Those of us who have already moved to fiat in bulk could be well-positioned to buy at the floors once they emerge, but outside of ETH PoS I'm not sure why I would. Once the USDT fiasco runs its course, there will be a major loss of confidence in crypto assets, and possible regulations following up afterwards. I think some projects - like ETH - will do well under regulatory supervision, but others may not fare so well. Outside of a dead-cat bounce, I don't see crypto rising very far above the post-USDT floors for awhile. The only good thing I can say about the potential crisis is that a lot of weak hands that never belonged in the cryptoverse will be pushed out, and that a lot of bad projects will die on the vine. The scammier they are, the quicker they'll fall.

I don't know how long it will take for all this to play out. As I said above, noise about USDT goes back to at least last Nov/Dec, so this kind of information isn't necessarily new. But dumping your auditor like that? That just makes no sense.

If you think I have a warchest sitting to the sidelines awaiting investment somewhere else . . . well yes, actually, I do, though all I will say about that, is that it is %5300 larger than it was when I started in 2016. So yeah theoretically I could FOMO back in after a crash and increase my stack, or I could just walk away.

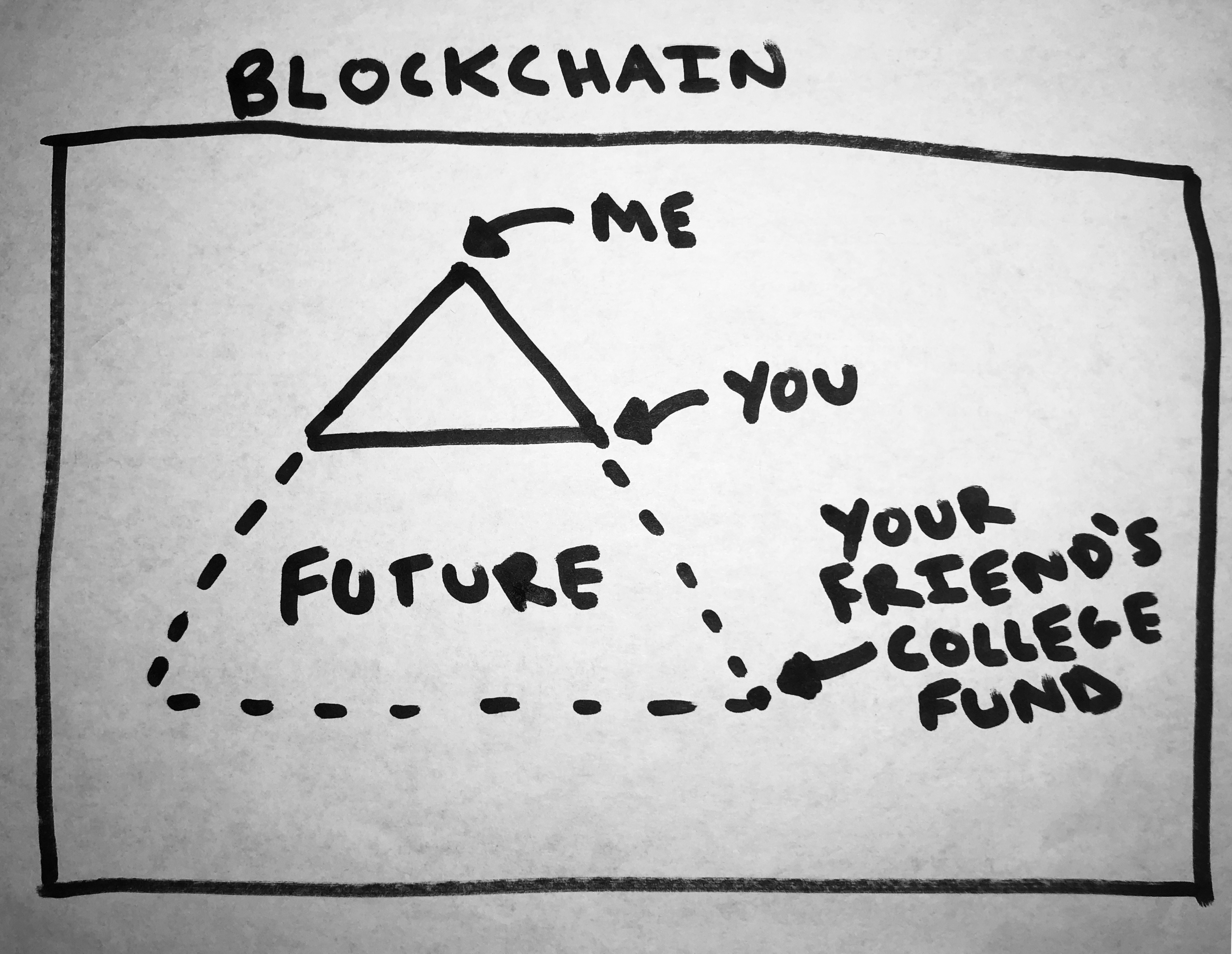

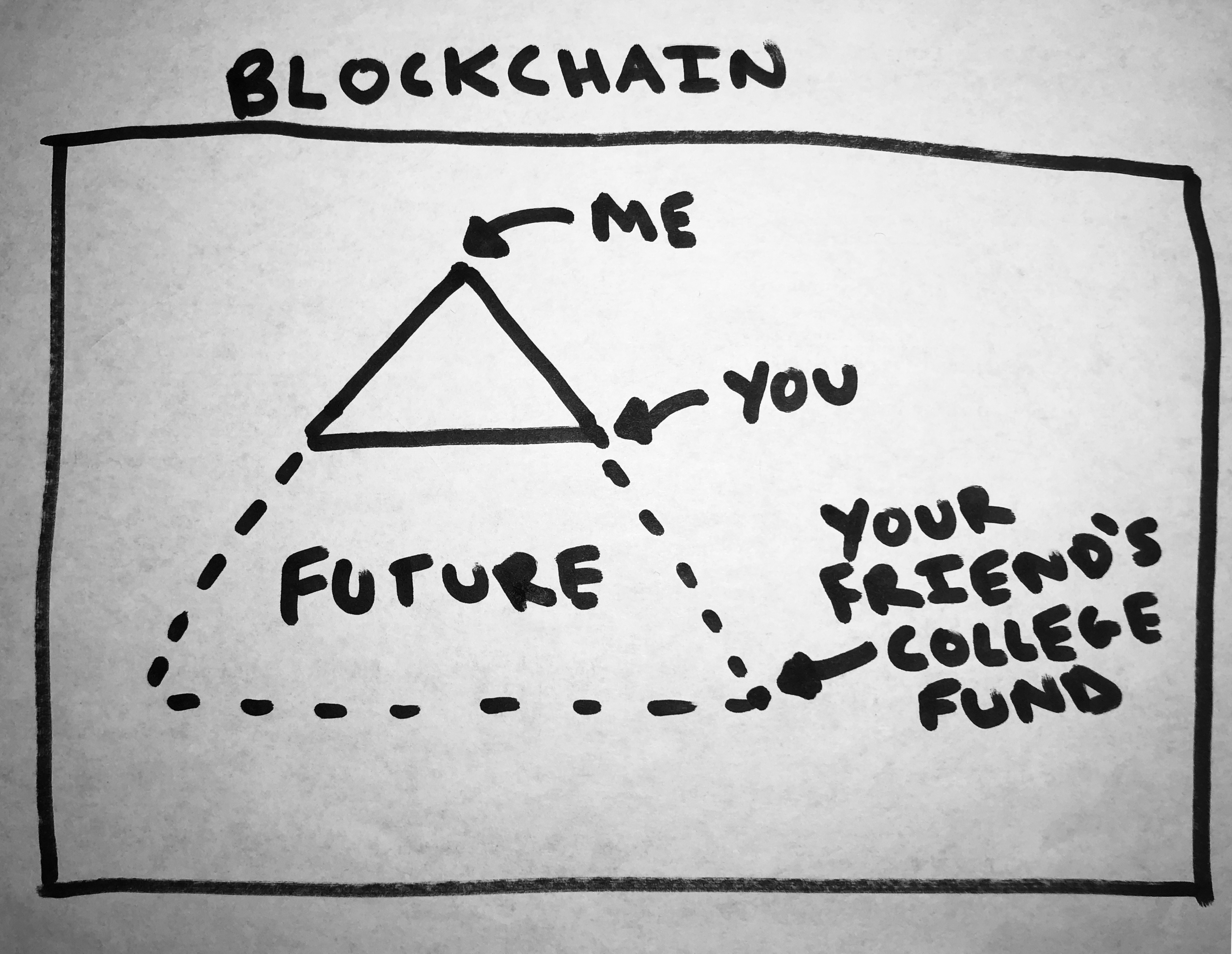

The Bitfinex/Tether scam goes pretty deep (read up on BFX tokens, that's a laugh a minute there), but it's just the tip of the iceberg.

The irony is strong with this one....We have $2.2 billion in potentially "fake" assets being used to buy up crypto