Svnla

Lifer

- Nov 10, 2003

- 17,999

- 1,396

- 126

Yeah no data tends to not be good, but it's easy enough to get some by getting a basic credit card. I got my first CC at 18, limit was like $500 if I recall. It was enough to pay for web hosting and domain registration and other online stuff. I always used credit from that point and always paid on time so probably why my score is so high now days. I use credit regularly but also pay it off. Though I always wondered if paying it off too soon (that I never pay interest) was bad or not. Probably not given where I'm at. At the end of the day it's just a number though, I don't think anything over 750 matters much as far as being able to get good rates etc.

Pay all your balances before they are due so you would not have to pay any interest = ok, never bad.

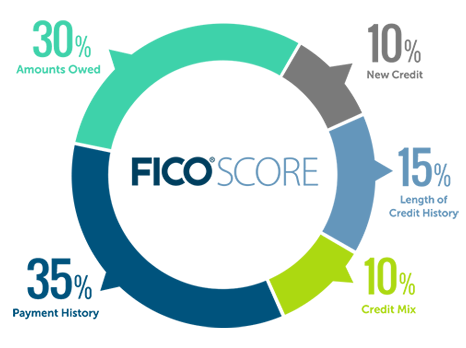

Again, want to have good credit score (750-760 of FICO and higher)? Do these things - ALWAYS, again, ALWAYS pay on time, never late + Use only 30% of your credit line or less + The longer you have credit = better + Have different types of credit (student loan, credit cards, home loan, etc.) + Don't open a bunch of credit cards or loans or credit lines within a short period of time.

Below is how your credit score is calculated by FICO (5 major factors).

Last edited: