- Jan 15, 2000

- 7,052

- 0

- 0

http://graphics8.nytimes.com/news/business/0915taxesandeconomy.pdf

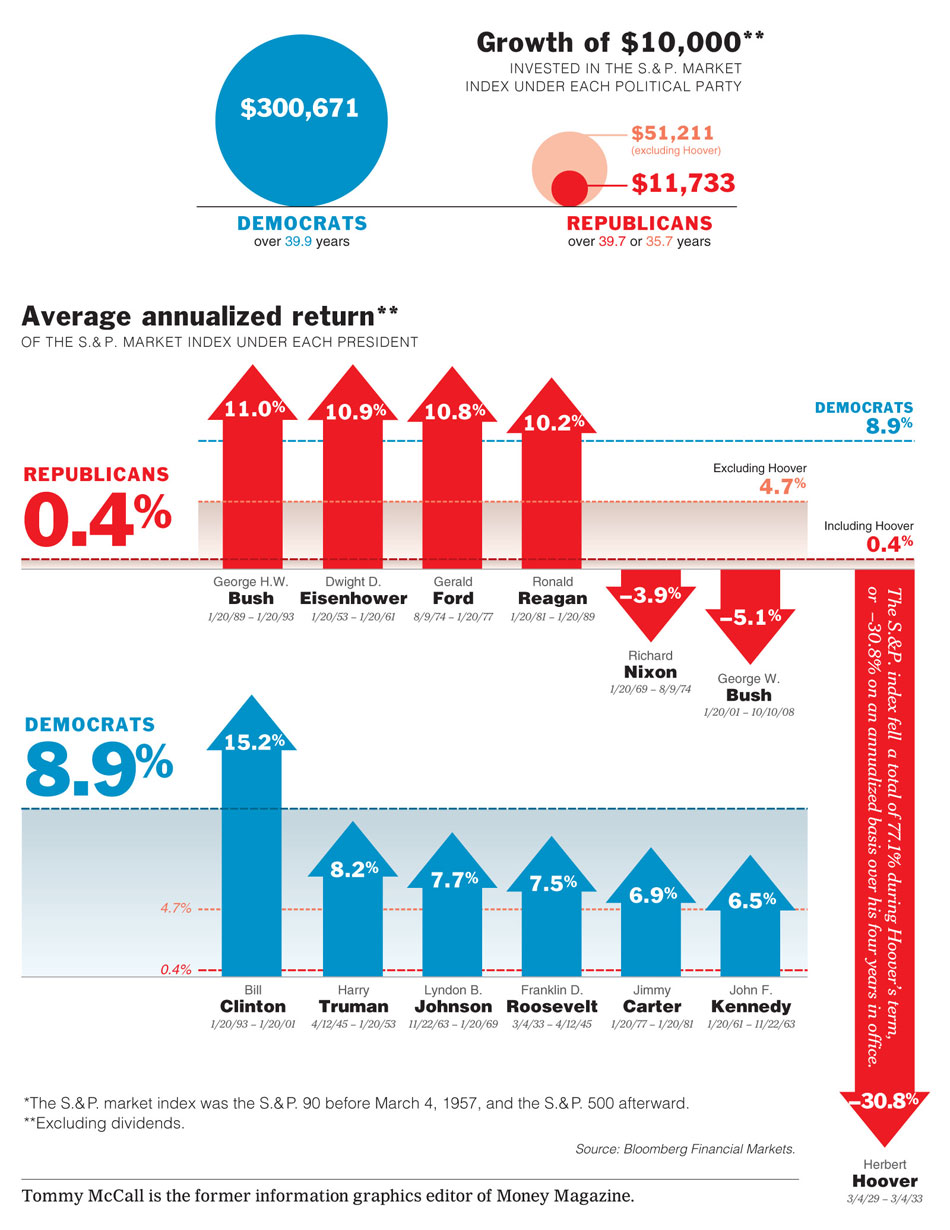

An excellent study put out by the Congressional Research Service which analyzes tax rates since 1945 in the US. Their conclusions verify what most of us on the left already know, lowering tax rates on the top marginal earners does not stimulate the economy and promote economic growth. All it has consistently done over the last 50 years is increase concentration of wealth at the top end.

It boggles my mind how anyone with a rational thinking brain can continue to support a party that espouses this economic philosophy despite overwhelming evidence to the contrary.

An excellent study put out by the Congressional Research Service which analyzes tax rates since 1945 in the US. Their conclusions verify what most of us on the left already know, lowering tax rates on the top marginal earners does not stimulate the economy and promote economic growth. All it has consistently done over the last 50 years is increase concentration of wealth at the top end.

It boggles my mind how anyone with a rational thinking brain can continue to support a party that espouses this economic philosophy despite overwhelming evidence to the contrary.