Charles Kozierok

Elite Member

- May 14, 2012

- 6,762

- 1

- 0

But yet people are entitled to all sorts of things are they not?

Not in my opinion.

But yet people are entitled to all sorts of things are they not?

Try getting a loan or buying a house when the money market was paying 16%.Many of these seniors are off loading their houses. If interest rates were higher the housing crash would have been far worse. In fact, it's pretty obvious that housing is still on life support and that life support is low interest rates. If they went higher housing would crash fantastically and these seniors downgrading house sizes or moving into other homes would be even more fvcked.

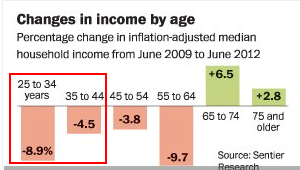

Honestly, I frankly have a lot more sympathy for young people today, who are: SCREWED. Crap tons of debt facing a much worse employment situation.

It's not all about you. People need a fair return on their cash and they aen't getting it.

The hights rate I see is 1.65% APY. Are you kidding me? If you like low interst then you must like Obama's deficit too.

There's a borrower for every lender; low returns on their cash means lower interest rates on my mortgage and credit cards.

Neither does your desire to help one subset of people over another.There's a borrower for every lender; low returns on their cash means lower interest rates on my mortgage and credit cards. Your desire to help one subset of people in the economy (boomers/savers) doesn't mean it's OK to screw over another (younger people/consumers).

emc and cisco have not seen $100 a share in years.

How many people lost their retirement when enron crashed? The investors had been told the company was solid and a good investment.

Then there was the tech bubble a few years ago. When I bought cisco and emc stock both were over $100 a share and had a solid track record.

(snip)

Then there was the housing bubble.

So what are the people supposed to do?

You're right - in fact Cisco has NEVER hit $100 a share. Perhaps you would like to amend your statement with a correct one?

Neither does your desire to help one subset of people over another.

So cut the "free market" BS and explain to me how it's OK for the government to loan out (print) so much money as to screw over the folks who bothered to save money.

In other words, you save for decades to have a nice retirement, then the banks strangle the return through low interest rates.

Nope, because my post reflects the heart of the statement.

A lot of people lost a lot of money from the tech crash a decade ago.

exactly why its hard for young guys like me to give a crap anymore about retirement. ive seen and heard of so many cases now where people saved their whole lives only to have inflation, low interest or total loss mitigating all of their efforts.

You're right - in fact Cisco has NEVER hit $100 a share. Perhaps you would like to amend your statement with a correct one?

According to the majority of people on ATOT, they never pay interest on their credit cards and get a free cruise every year with their rewards points.

The thing is, the younger generation should be able to afford higher interest rates then the older generation can do without

A lot of people lost a lot of money from the tech crash a decade ago.

No, you're wrong. It's gone over 100 on more than one occasion in fact (link below shows most recent time in March 2000). You're simply not accounting for the multiple stock splits that CSCO has undergone that are normally adjusted on charts.

CSCO historical prices

Good point. My mistake

Not in my opinion.

I don't think it's OK. I oppose the unprecedented and completely wrong-headed wide open fiscal and monetary policies being run by both the Fed and government. I oppose quantitative easing, the massive deficit spending stimulus, the massive bailouts of favored industries (financial services, automotive, etc), short-term market fixes (e.g. prohibiting short sales, etc), and the regulatory environment of "make it up as you go along" that's prevailed for the last few years. Every one of them has helped foster a Japanese style zombie economy that won't end until the feds and government stop trying to artificially prop up asset values, save people from recognizing their losses, and allow major players to be shielded from their own bad decisions.

Politicians on both sides do it. They just spend the money on different things. Funny how so many people are again worried about the deficit now that the money isn't being spent on war, defense like it was. Coincidence? I think not.

If I was in my 20s, and was watching all of this stuff about the housing market crashing, price of student loans, job market, bank bailouts,,, I would probably lose faith in the system.

No wonder the number of boomerang kids is at an all time high.

On the other end of the spectrum we have the retirees barely scrapping by.

True, and it's equally frustrating. If spent on infrastructure or direct debt relief for citizens we would have at least had something to show for it.

While the Iraq war certainly appears like a debacle in hindsight, it was certainly a closer decision in the moment (and before we knew the truth about WMD in Iraq). Even now, I see a small sliver of redeeming grace in it - invading Iraq on suspicion of WMDs will mean future invasions on the same premise are probably off the table (sorta like how the decision to nuke Hiroshima might have prevented a full-blown nuclear war later). Think of how much worse it would have been if we'd passed on Iraq and invaded Iran instead on the same reasoning.

If I was in my 20s, and was watching all of this stuff about the housing market crashing, price of student loans, job market, bank bailouts,,, I would probably lose faith in the system.

No wonder the number of boomerang kids is at an all time high.

On the other end of the spectrum we have the retirees barely scrapping by.

True, and it's equally frustrating. If spent on infrastructure or direct debt relief for citizens we would have at least had something to show for it.

While the Iraq war certainly appears like a debacle in hindsight, it was certainly a closer decision in the moment (and before we knew the truth about WMD in Iraq). Even now, I see a small sliver of redeeming grace in it - invading Iraq on suspicion of WMDs will mean future invasions on the same premise are probably off the table (sorta like how the decision to nuke Hiroshima might have prevented a full-blown nuclear war later). Think of how much worse it would have been if we'd passed on Iraq and invaded Iran instead on the same reasoning.

Your apologisms make me wanna puke.

A close decision? GWB told his cabinet to find him a way to invade Iraq at their first meeting, per O'Neill, and 9/11 was the way, and an utterly dishonest one at that.

Go ahead and puke then; your mind is obviously made up and has revised history to suit your position. You're ignoring that at the time Congress passed an authorization of force, UN resolutions were in place allowing the strike, huge public majorities supported action, and there was widespread agreement among most politicians of both sides that a WMD program of some sort was being undertaken. Your side put all its chips on stopping the invasion and lost big, same as the GOP did for Obamacare.