- Jan 23, 2007

- 1,406

- 389

- 136

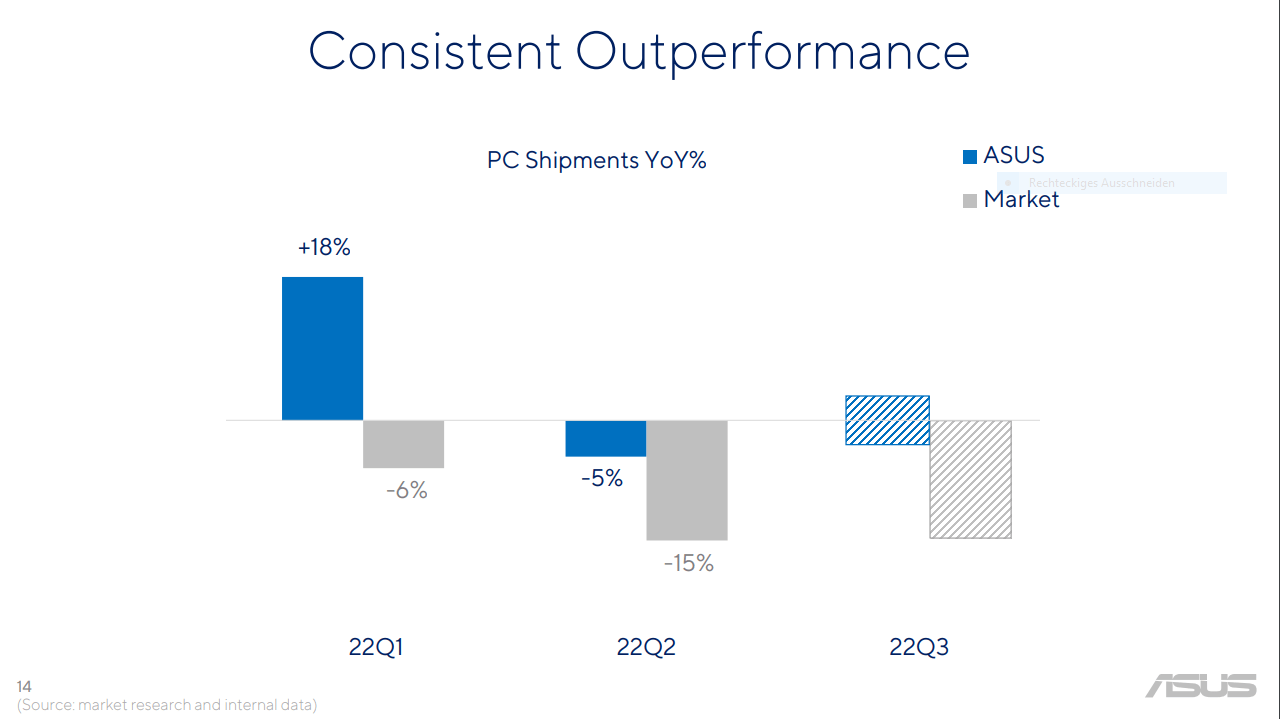

AMD warns of third-quarter revenue shortfall on weaker PC demand, supply chain issues

Semiconductor company AMD issued preliminary third-quarter results Thursday that were well below its initial guidance.

I'm assuming that Intel and other system manufacturers are also seeing a similar slowdown of around 16% to 20% compared to what was expected.

Do you think this will lead to price drops?