with china making all mining and associated business/hardware/accessories illegal, where else are the top 3 asic miner manufacturers (all chinese) going to go to fab their products? do any of the taiwan fabs have the extra capacity?

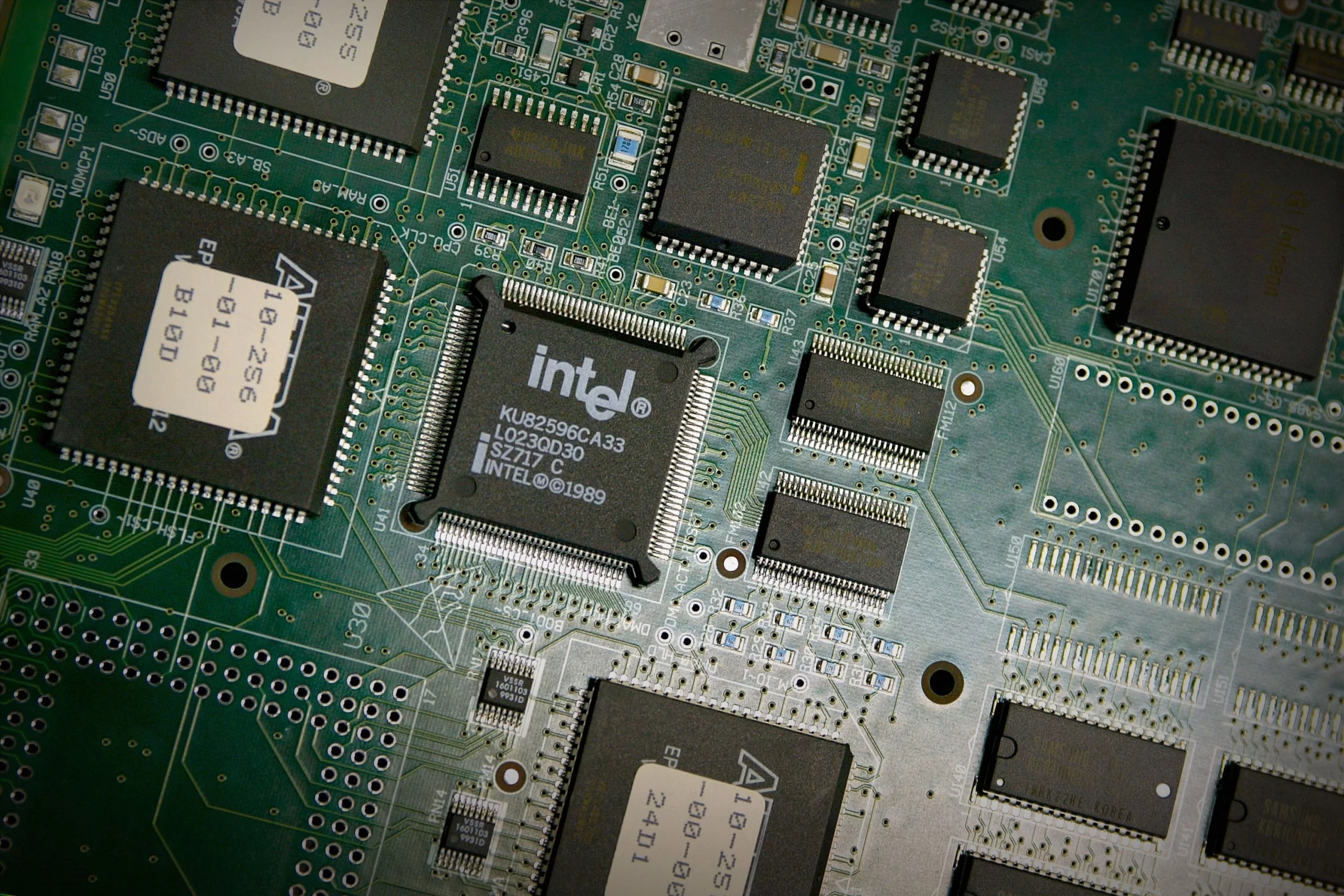

intel must seem like a safe port in a storm, probably plenty of capacity on older nodes and even newer nodes are an option if only to use as a pipecleaner. the real question is how soon they could possibly get new silicon out, though with the china shutdown it isnt like some new startup will suddenly swoop in to beat the old names to market with a next gen asic miner.

sidenote: one of the larger chinese mining farms moved to texas for the cheap wind power, gov abbot wants to make texas the "crypto leader".

Beijing's crackdown on cryptocurrency sends bitcoin entrepreneurs moving to the wild wild west.

www.bbc.com

other farms went to the pacific northwest for the cheap hydro power.

the eth move to pos will be very entertaining to watch this summer. i wonder what innosilicon will do with their eth miner line.

www.techspot.com

www.techspot.com