Pretty eh, Notebook volume was up 54% (!) but server sales are slumping.

Guidance for Q1 is also bad.

Yeah that's basically exactly what they expected from q4.Most of it is educational and cheap ones (e.g. chromebooks)

Expectations for 2021:

View attachment 38146

Depends on why the margins dropped, if it's because of higher cost of 10nm compared to 14nm sure but it might as well be additional cost due to transporting or just buying things during covid and if that is the case then AMD is going to have a really bad time.I didn't have time to look at it today, but I will try to dig in more and listen to the conference call tomorrow. Their margins continue to slide pretty quickly and their projected operating margins for next quarter are pretty bad compared to what they used to be. If things continue at this rate, AMD will catch up to their OM within a year.

AMD is not gonna have a bad time in their Q4 earnings - least of all with margins (considering the selling price of new products they introduced that quarter).then AMD is going to have a really bad time.

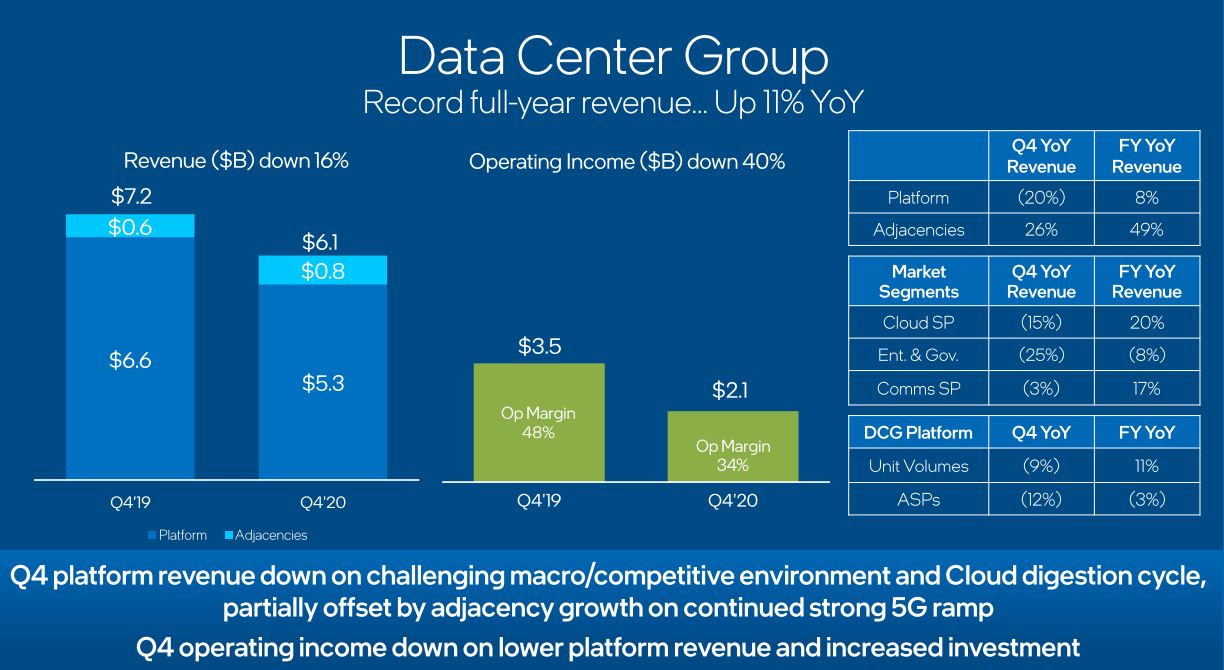

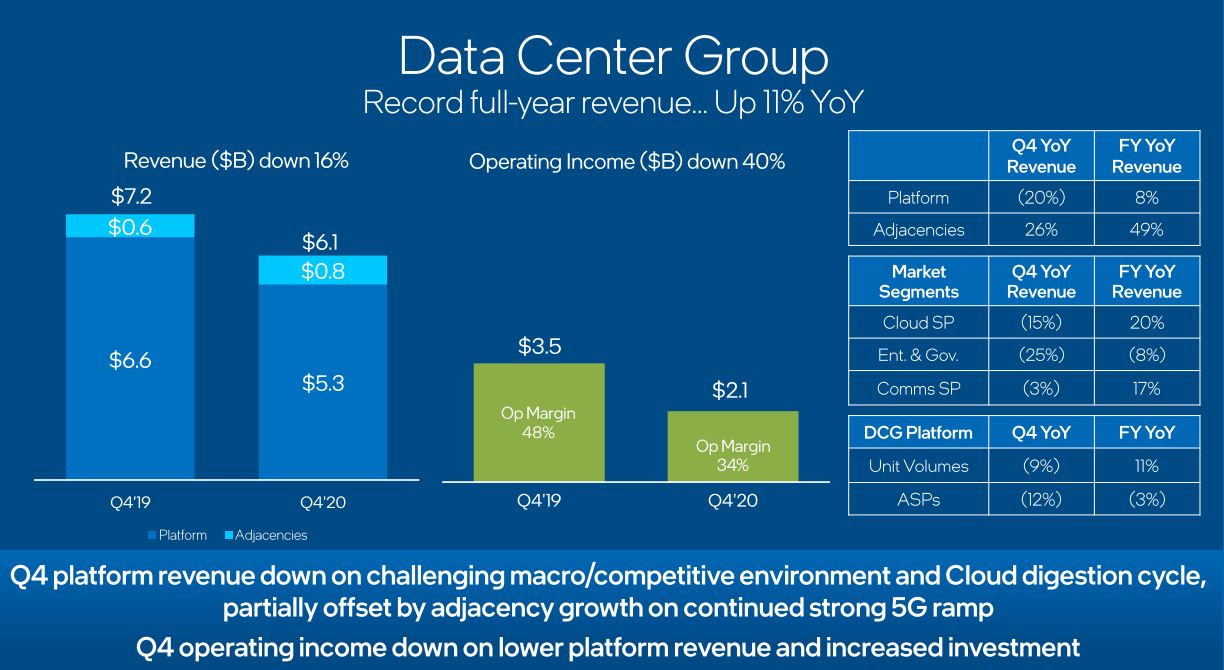

The "Cloud digestion cycle" part is quite fun.Patrick's notes on the Q4 earnings makes for a good read with a couple of extra bits of related info:

Server Industry Takeaways from Intel Q4 2020 Earnings

Earnings presentations are carefully crafted which is why the Intel Q4 2020 earnings summary was fascinating for the server marketwww.servethehome.com

The cloud providers buy a bunch of chips then they “digest” them. In other words once they get the chips they have to finish putting them into whatever they are being used for, and so stop buying more until that is done.

Imagine you are building a giant barn and Lowe’s is delivering the lumber. You might buy a bunch of lumber, Lowe’s books the revenue and starts delivering it into a big pile. Now you have a pile of lumber and start drawing from the pile it as you build the barn. You tell Lowe’s to stop delivering more once the pile gets pretty big and their sales stop, until you use up a lot of the lumber in the building process (digesting it); once your supply starts running low you start ordering more and they start adding more lumber to the pile.

My personal opinion is that it is also a bit of a smokescreen for market share losses. You might want to keep a good relationship with Lowe’s and could tell them you are “digesting” and to hold off on supplying more lumber while simultaneously telling Home Depot to start delivering to a new different pile on the other side of the barn from which you could draw.

AT posted a transcript of the QA

AnandTech Forums: Technology, Hardware, Software, and Deals

Seeking answers? Join the AnandTech community: where nearly half-a-million members share solutions and discuss the latest tech.www.anandtech.com

The "Cloud digestion cycle" part is quite fun.

Good analogy from Reddit:

Depends on why the margins dropped, if it's because of higher cost of 10nm compared to 14nm sure but it might as well be additional cost due to transporting or just buying things during covid and if that is the case then AMD is going to have a really bad time.

I think this is the 3rd quarter in a row now that Intel has given the 'digestions cycle' reason. I'm sure there's some truth to it, but I'm also sure that they are using it to cover market share loss to both AMD and expanding ARM cloud solutions (e.g. AWS).

For example Ampere Altra.

AnandTech Forums: Technology, Hardware, Software, and Deals

Seeking answers? Join the AnandTech community: where nearly half-a-million members share solutions and discuss the latest tech.www.anandtech.com

Yes for 3 years now intel is making twice the money then before, this q4 seals it for year three, have I been saying anything different?For years you have been saying things aren't bad for Intel yet you are never correct still you keep at it while things just keep getting worse. While you say AMD will come back to earth yet they continue to gain ground. It has been going on this way for 4 years.

Yes I'm sure Intel didn't take any major hits in the datacentre at allYes for 3 years now intel is making twice the money then before, this q4 seals it for year three, have I been saying anything different?

You have to be crazy to believe that intel is doing badly while making all the money.

Everybody always says that intel is losing the tech advantage and that this is going to cost them but it has been three full years now and there is zero loss for intel. I guess the market is still digesting on the ZEN because intel just won't make any loss.

The individual divisions will always have up and downs and all the AMD buzzards are cycling above each quarter's numbers to find something were intel's numbers for the quarter are down to make believe that something is wrong, all the while losing the overview on why intel is always making money.

Intel has a very diverse product line so that one product can compensate for the other, they always have something that sells very well, this time it was notebooks although data centric group was also up 11% compared to 2019.

Indeed.I think this is the 3rd quarter in a row now that Intel has given the 'digestions cycle' reason. I'm sure there's some truth to it, but I'm also sure that they are using it to cover market share loss to both AMD and expanding ARM cloud solutions (e.g. AWS).

If i remeber right, Oracle cloud is deployong them. Not one of the big ones for sure though.Have we seen any large cloud deployments of Ampere? As far as I know, the only public ARM instances are running on Graviton/Graviton 2.

I just don't know why any hyperscalar would pay Ampere for an ARM chip when they could build their own, cut out the middle man, and get precisely the chip they need. I think the merchant ARM market is a really tough place to be- see also Nuvia selling up to Qualcomm.

Cloud providers had enough of the appetizers (Intel) and are now moving onto the main course (AMD).AMD reported record server revenue driven by increases in both cloud and enterprise server sales, so Intel seems to be on an island in terms of their reported 'digestion cycle'.

When you think about it Intel has lost leadership in both cpu design and fabrication. I know I am captain obvious here but they have two mountains to climb. The odds are really stacked against them. Plus they have given no reason for anyone to have any confidence they will be able to get back into any kind of leadership position.

How does that change the amount of money that they make?!Yes I'm sure Intel didn't take any major hits in the datacentre at allplease don't look at operating margins or ASPs, they're fine, just trust me bro.

Come on. Stop digging your heads in the sand. Lets get some things straight here - it's costing them. Intel are having to play the price/perf game now and that continues with Ice Lake-SP. Did you listen to the investor call? Because if you did you'll notice Intel did not talk about leadership performance but rather they focused on price. They focused on the advantage of having their own fabs vs AMD not having the supply to keep up with demand. Intel know perfectly well where they stand in the server market (and I'm highlighting this here) and it's not one they want to be in. It's not a leadership position. And they're expecting the situation to degrade further in Q1.

AMD joins Enterprise, Embedded and Semi-Custom together meaning that console sales and cloud enterprise and data center are all together in the same pot, we do know for sure that console CPUs got a huge boost...AMD reported record server revenue driven by increases in both cloud and enterprise server sales, so Intel seems to be on an island in terms of their reported 'digestion cycle'.

I dunno man, you tell me. How would average sale prices dropping off a cliff change the amount of money they make?How does that change the amount of money that they make?!

Making all the money without even having to provide the best tech?! Best deal ever!

Intel's data center group increased 11% compared to last year, how is that costing intel?

Well call me as soon as this happens and maybe we'll be able to figure it out.I dunno man, you tell me. How would average sale prices dropping off a cliff change the amount of money they make?