Creating this thread in preparation of Intel announcing 1Q23 results.

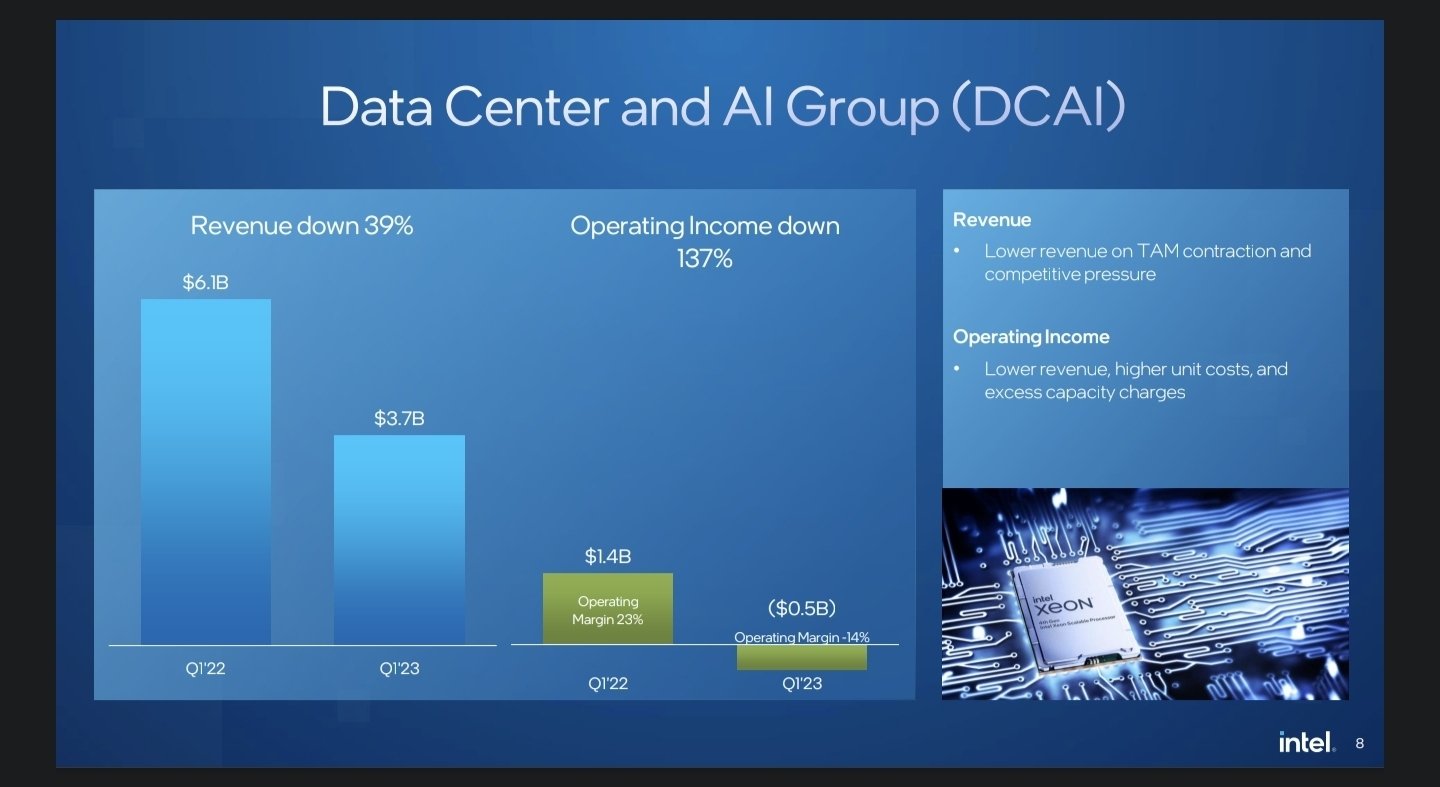

While we wait, here is a report/rumor (no idea of the credibility) that Sapphire Rapids demand is way below expectations and that the, "supply chain" is cutting SPR orders by up to 50%. Specifically, MS is called out as cutting SPR orders for 2H23 by 50%-70% and that MS plans on a large Ampere (ARM based) CPU purchase early next year. Intel had indicated that they expect a recovery in business in 2H23 so it will be interesting to see if their commentary on this has changed at all.

Other semicon and electronics companies have started reporting results indicating significant weakness. Texas Instruments had a luke warm report and actually indicated that they see some difficult market conditions in 2H23 (link). Samsung reporting demand continues to be soft and their profits were demolished for the quarter, but inventory is starting to clear for finished products and they do expect an uptick in demand in 2H23 due to cleared out inventory and new models being introduced (link). TI and Samsung play in a different area than Intel, but it is still interesting to see what they are experiencing to get a more macro view of things.

EETimes is also reporting that Nvidia is at an historically high inventory level (~225 days of inventory vs historical industry average of 92 days). AMD is reportedly at ~125 days.

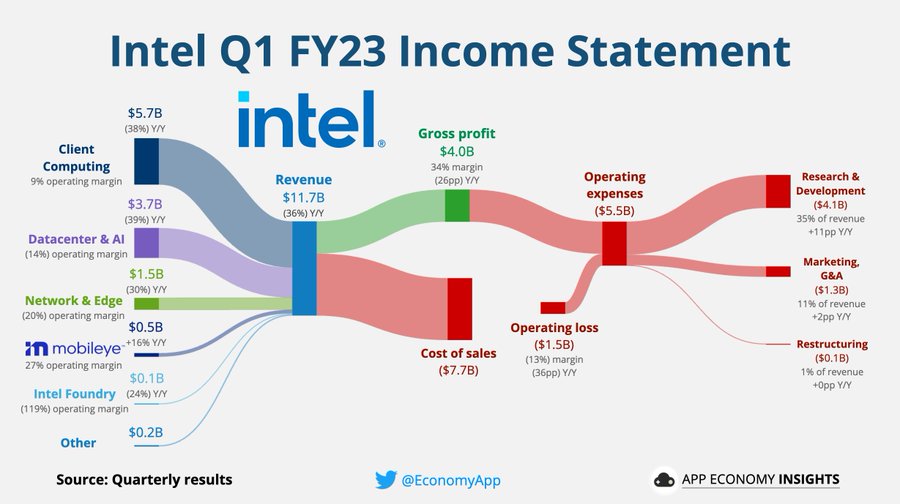

Lastly, as a refresher, during their 4Q22 earnings, Intel gave a 1Q23 forecast revenue of $10.5 billion to $11.5 billion and first-quarter EPS of $(0.80) (non-GAAP EPS of $(0.15)).

Overall, things are tough as expected and not just for Intel. At the same time, Intel is in about as vulnerable position as they've been in decades. Hopefully Gelsinger brought a bailing bucket and a strong steering hand as these are some very rough waters they are navigating.

Edit:

Results not as bad as expected:

While we wait, here is a report/rumor (no idea of the credibility) that Sapphire Rapids demand is way below expectations and that the, "supply chain" is cutting SPR orders by up to 50%. Specifically, MS is called out as cutting SPR orders for 2H23 by 50%-70% and that MS plans on a large Ampere (ARM based) CPU purchase early next year. Intel had indicated that they expect a recovery in business in 2H23 so it will be interesting to see if their commentary on this has changed at all.

Other semicon and electronics companies have started reporting results indicating significant weakness. Texas Instruments had a luke warm report and actually indicated that they see some difficult market conditions in 2H23 (link). Samsung reporting demand continues to be soft and their profits were demolished for the quarter, but inventory is starting to clear for finished products and they do expect an uptick in demand in 2H23 due to cleared out inventory and new models being introduced (link). TI and Samsung play in a different area than Intel, but it is still interesting to see what they are experiencing to get a more macro view of things.

EETimes is also reporting that Nvidia is at an historically high inventory level (~225 days of inventory vs historical industry average of 92 days). AMD is reportedly at ~125 days.

Lastly, as a refresher, during their 4Q22 earnings, Intel gave a 1Q23 forecast revenue of $10.5 billion to $11.5 billion and first-quarter EPS of $(0.80) (non-GAAP EPS of $(0.15)).

Overall, things are tough as expected and not just for Intel. At the same time, Intel is in about as vulnerable position as they've been in decades. Hopefully Gelsinger brought a bailing bucket and a strong steering hand as these are some very rough waters they are navigating.

Edit:

Results not as bad as expected:

Last edited: