Atreus21

Lifer

- Aug 21, 2007

- 12,007

- 572

- 126

In a household your income and spending are all basically independent while in a larger economy this is not true. In a national economy my spending is your income and vice versa. In a house if dad cuts back his spending mom's income doesn't go down. In a country this isn't true.

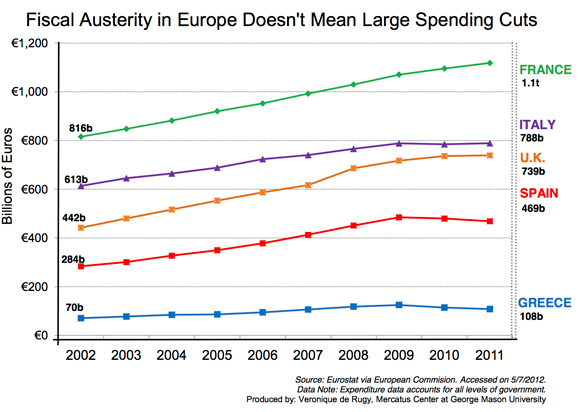

This is one of the reasons that the negative feedback effects from budget cuts in a depressed economy have been self defeating. Countries that all cut their budgets are actually ending up worse off debt wise than ones who didn't.

I still don't quite understand, so I'll just say what I think in layman's terms.

It seems to me when you're deep in debt you have two options to get money to pay it off: Reducing your expenditures below your income or increasing your income above your expenditures. If it's true on a small scale, I don't understand how it's not true on the larger scale. If this statement is true, then it follows that if increasing income isn't an option, your only recourse is to cut your spending.

Is that not the case?