Intel stock pops on earnings beat and return to growth

Intel beat expectations and grew revenue slightly and gave better-than-expected guidance, sending shares up.

More coming soon, will update as I have time to add info and comments.

Server volume down but revenue still up. ASP are up across the board. Will be interesting to see what happens to ASP with Zen 2 as a competitor now.

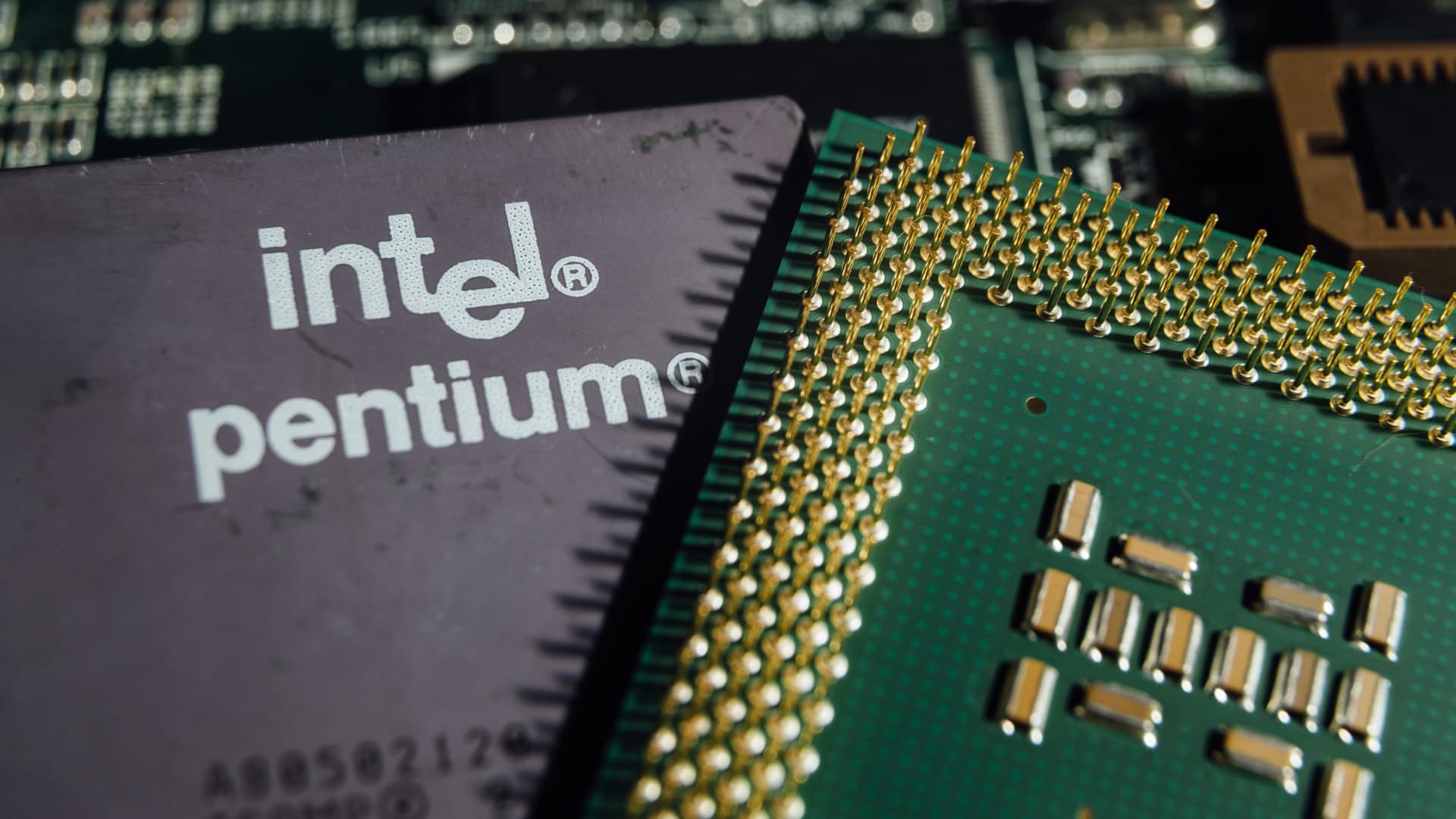

View attachment 12368

So they are saying that they gained some marketshare volume wise in the server department since IDC state that total servers sales are down 9.3%.....

Worldwide Server Market Revenue Declined 11.6% Year Over Year in the Second Quarter of 2019, According to IDC

IDC examines consumer markets by devices, applications, networks, and services to provide complete solutions for succeeding in these expanding markets.www.idc.com

You can't find this in any of their slides, or mentioned in the call, but raw earnings (Non-GAAP) were down $700 million as well. EPS is higher because of lower tax rate and less shares outstanding.

That looks more like reality.

So I was wrong in my initial estimate that this was "Good for the industry", rather, it's a smoke-and-mirrors (of sorts, it's legal) of Intel, to raise their stock prices, by use stock buy-backs, and therefore, less stock outstanding, so what earnings they have, their EPS is up over initial guidance...?I also find it interesting that intel is projecting flat revenue for Q4 when historically Q4 is typically their strongest quarter. I'll have to read through the earnings call to see if this was addressed at all. It will get really interesting for investors if they do have flat or even slightly higher Q/Q revenue but margins continue to fall.

OK, even if it was BAD for Intel (which I think it is), there is no way they are going under or anything, they are just going to give up market share and struggle. and lower prices until they become competitive again. Which could come as early as 2021. I don't think next year will be anything but a struggle.So I was wrong in my initial estimate that this was "Good for the industry", rather, it's a smoke-and-mirrors (of sorts, it's legal) of Intel, to raise their stock prices, by use stock buy-backs, and therefore, less stock outstanding, so what earnings they have, their EPS is up over initial guidance...?

So I was wrong in my initial estimate that this was "Good for the industry", rather, it's a smoke-and-mirrors (of sorts, it's legal) of Intel, to raise their stock prices, by use stock buy-backs, and therefore, less stock outstanding, so what earnings they have, their EPS is up over initial guidance...?

funny how some in this thread are unhappy with intel doing well.

Honestly, I think that this is GOOD news. I'm not the biggest fan of Intel, but I'm not their worst enemy either, and honestly, with the "barbarians at the gate" for consumer computing (The ARM-y), I think Intel beating estimates is GOOD news for the ENTIRE PC (x86/x64/AMD64) industry.

uh no. Companies get aggressive buying back their stock when they think they are undervalued. Not when they are scared lol. I dont think you know anything when it comes to investing or corporate actions.

Intel spent 10bln ytd buying back their own stock. They are about to spend another 20bln in the next 15-18months buying back their stock.

In addition to that they are increasing their wafer capacity 25% next year (on top of the 25%) this year.

The company is THE ONLY large semi company that has increased its guidance this year.

Wall st. estimated ASPS down 6% for PC and 3% for DCG, ASPS were up in both segments.

Wall st. estimated DCG revenues were going to be down 9%, they were up 4%

AMD has been "competitive" since 2017. While they have taken share, Intel has hit record numbers, asps, earnings. .

The amount of hate in here on the company makes no sense. Intel certainly has been doing well and has crushed bearish expectations.

Personally I want to see both Intel and AMD succeed. Punch each other back and forth, and work hard to top the other. Enough bean counters dribbling a bit here and there, just to milk the market.Not really. In general, those outside of the investor class want to see profitability tied to quality of products/services. Higher revenues in the face of declining product quality is bad for consumers.

By now you've noticed some smoke and mirrors.

If I read that right, its exactly what I posted above.+Personally I want to see both Intel and AMD succeed. Punch each other back and forth, and work hard to top the other. Enough bean counters dribbling a bit here and there, just to milk the market.

Personally I want to see both Intel and AMD succeed.

Their R&D is up over a bln dollars over the past few years. They spend 2x in R&D what AMD generates in annual revenue. What are you going on about?

Interesting point. Note that the 200 mil is what Intel stated. The article quotes two analysts critical of that number, both who have Intel on an underperform rating.And it seems like another 200 million was spent early by customerst to avoid upcoming tarrifs:

Intel earnings arent as good as they looked analysts say - MarketWatch

Intel Corp. reported a surprise increase in data-center revenue Thursday en route to a big earnings beat, but some are questioning the sustainability of the company’s momentum.www.marketwatch.com

“In particular, enterprise server grew 50% quarter over quarter — management noted they believed $200 million of 3Q revenue was China related pull-ins, but our math suggests the impact could have been much higher, since it doesn’t make sense to us that enterprise would have accelerated in the current environment,”

Of course Intel is worried. They are getting hammered on every front and are losing ground to various competitors. Inertia like someone said in an earlier post. It takes a long time for these types of weaknesses to become apparent. If they don't turn things around their marketshare will erode on all fronts. Their margins will shrink further. Then things won't be so rosy.funny how some in this thread are unhappy with intel doing well. Company desktop cpu unit sales were up 17% sequential DESPITE Ryzen 3.

Consensus expected DGG revs down 9% yoy, they were up 4%.

ASPs up across the board. And the forward guidance was increased.

In addition, the company bought back 4.5bln dollars of equity in the quarter and added an additional 20bln of repurchase authority which they plan to use over the next 15-18months.

Does this sound like a company that is -redacted- their pants?

Profanity in the tech forums is prohibited.

Daveybrat

AT Moderator

Yup, optane DIMMS for one and 10nm for nervana artificial intelligence AI training.What I struggle to understand then is what they have spent all that money on?! They have spent all that cash and ended up designing them self into a corner architecture wise and completely made a hash of their 10nm introduction. I suppose it must have gone on all their little side hussles like their optane stuff and other bits and pieces.

Stock buyback are such a con. I hope the next president reinstates the policy of prohibiting them. Companies should be valued on fundamentals, not market manipulations. /rant

Why is it a con?

I think your post is funnier than the rest, since you think this thread is funny,You guys in here are incredible. Thank you all for the entertainment