Capt Caveman

Lifer

Tesla has already dropped 17% from its peak.

Yeah, and only up 460% over the last year. :biggrin: And after Q3 earnings released, we'll see another high.

Again, high school or college?

Last edited:

Tesla has already dropped 17% from its peak.

So what will people like me (zero debt -no CC, no car or house note, and have some money in the banks with excellent credit score) to do?

Go out and buy a house (30 years mortgage) and a new car (with 5-6 years car note) because of low interest rate? What else is there to do to financially protect myself?

So, if I understand. You don't think QE will end? Ever? If it does not end will it grow in your opinion?

I have read on other sites that say it won't end and still others say it will be cut no later than 2nd quarter 2014.

.

So what will people like me (zero debt -no CC, no car or house note, and have some money in the banks with excellent credit score) to do?

Go out and buy a house (30 years mortgage) and a new car (with 5-6 years car note) because of low interest rate? What else is there to do to financially protect myself?

Invest in a basket of consumer non-discretionary goods manufacturers??

The direction this thread is heading illustrates the problem with the economic 'winter'.

If you were in indexed stocks in 2000, you are up about 20% in 14 years. But, in terms of buying power, you lost. If you were in cash only, you lost even more. Commodities did very well, but per my previous post - commodities are the last domino to fall, and it appears to be falling now.

If that's correct and the last domino is falling, there will be no reliable place to make positive value return. People in the past tend to chase markets back and forth, losing all the way. The most you can hope for is to preserve value. The smart move is likely to be highly diversified in type of investment, ie stocks, bonds, cash, and hard assets like land.

In other words, it becomes a game of finding the asset that loses the least value.

So what will people like me (zero debt -no CC, no car or house note, and have some money in the banks with excellent credit score) to do?

Go out and buy a house (30 years mortgage) and a new car (with 5-6 years car note) because of low interest rate? What else is there to do to financially protect myself?

And why would it go up? Forward PE ratio is 95, which is horrible. Price to sales is 14.7. To put that in context, Toyota's price to sales is 0.71, Ford's price to sales is 0.46. The stock is so incredibly overpriced that down is virtually the only direction it can go from here.Yeah, and only up 460% over the last year. And after Q3 earnings released, we'll see another high.

Bernanke Mode: You should get a HELOC and use that money to invest in the stock market. Now is the perfect time to buy because it's currently at an all time high. Have you considered buying stock in Tesla or GM? Alternative, you could use that borrowed money to buy products from China. Employing Chinese workers somehow helps America.

And why would it go up? Forward PE ratio is 95, which is horrible. Price to sales is 14.7. To put that in context, Toyota's price to sales is 0.71, Ford's price to sales is 0.46. The stock is so incredibly overpriced that down is virtually the only direction it can go from here.

The direction this thread is heading illustrates the problem with the economic 'winter'.

If you were in indexed stocks in 2000, you are up about 20% in 14 years. But, in terms of buying power, you lost. If you were in cash only, you lost even more. Commodities did very well, but per my previous post - commodities are the last domino to fall, and it appears to be falling now.

If that's correct and the last domino is falling, there will be no reliable place to make positive value return. People in the past tend to chase markets back and forth, losing all the way. The most you can hope for is to preserve value. The smart move is likely to be highly diversified in type of investment, ie stocks, bonds, cash, and hard assets like land.

In other words, it becomes a game of finding the asset that loses the least value.

Your entire post relies on an arbitrary selection of dates. If you bought a couple years before 2000 or a couple years after that destroys your whole point.[/QUOTE20%.]

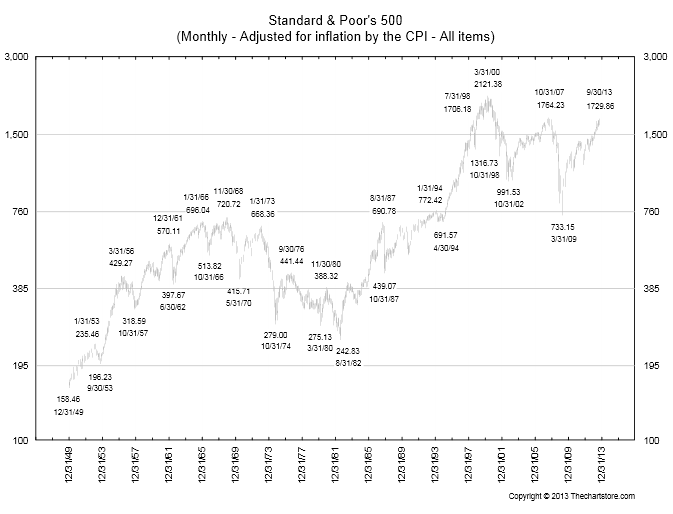

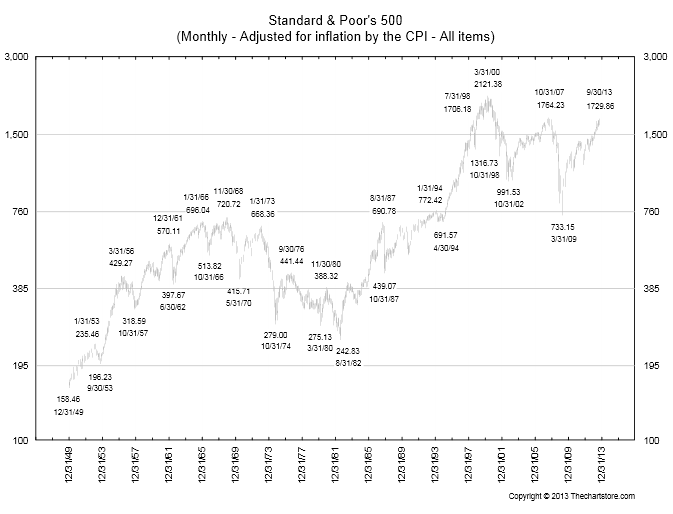

Not really. Look at a similar block of time from the peak before the 1987 crash in stocks to 2000. You would have done much better than in the last 14 years since 2000. ie about 350% vs 20%

Not really. Look at a similar block of time from the peak before the 1987 crash in stocks to 2000. You would have done much better than in the last 14 years since 2000. ie about 350% vs 20%

So once again you're relying on arbitrary dates that include buying a the peak of a market run-up. As soon as you pick an example that doesn't involve buying at a peak, your point falls apart.

Market cycles will generally start at a trough, run to a peak, then a new cycle starts at a peak and runs to a trough.

What you are talking about is trying to make money on short-term trades within one of those cycles. That isn't what happens to the majority though.

Look at this chart again. There are 15-20 year cycles where its good to buy stocks and easy to make money in stocks, and 15-20 year cycles where it isn't so good. 1949-1968 good. 1968-1982, not good. 1982 - 2000 good. 2000 - 201? not good.

Sure within those cycles, there are buying opportunities. But from a long term perspective, losing money on average for 15 years is something few people can afford.

The thing is, these cycles make up a larger cycle that represent spring, summer, autumn, and winter. The cycle we're in now, 2000-201x, is winter.

Everything we see that we think is some new economic problem has happened before. The market blowoff and bubble of 2000 was predicted and explained by someone who died 65 years before it happened.

The current winter should be debt repudiation, but that hasn't been allowed to happen. They've merely extended the winter cycle by preventing elimination of bad debt; that still has to happen.

We will see a new low on the markets in constant-value dollar terms before this is over.

The current winter should be debt repudiation, but that hasn't been allowed to happen. They've merely extended the winter cycle by preventing elimination of bad debt; that still has to happen.

Market cycles will generally start at a trough, run to a peak, then a new cycle starts at a peak and runs to a trough.

What you are talking about is trying to make money on short-term trades within one of those cycles. That isn't what happens to the majority though.

Look at this chart again. There are 15-20 year cycles where its good to buy stocks and easy to make money in stocks, and 15-20 year cycles where it isn't so good. 1949-1968 good. 1968-1982, not good. 1982 - 2000 good. 2000 - 201? not good.

Sure within those cycles, there are buying opportunities. But from a long term perspective, losing money on average for 15 years is something few people can afford.

The thing is, these cycles make up a larger cycle that represent spring, summer, autumn, and winter. The cycle we're in now, 2000-201x, is winter.

Everything we see that we think is some new economic problem has happened before. The market blowoff and bubble of 2000 was predicted and explained by someone who died 65 years before it happened.

The current winter should be debt repudiation, but that hasn't been allowed to happen. They've merely extended the winter cycle by preventing elimination of bad debt; that still has to happen.

We will see a new low on the markets in constant-value dollar terms before this is over.

Few people can't afford a 15 year decline? I started putting money away at 24, I was 2 years later since I went to grad school right after undergrad. If I retire at 55 I can last 2 down cycles without a problem, then move into bonds.

Who cares if your stocks go up or down every 15 years as long as the 30+ year cycle is in your favor, and it is. Your picking arbitrary points every 15 years is silly. Pick a 30 year period and let me know how you do.

Unfortunately, few people begin investing when young, for a variety of reasons. Today's situation is that all too many younger workers live hand to mouth between bouts of unemployment & low wages, regardless of education.

It's part & parcel of explosive inequality.

Unfortunately, few people begin investing when young, for a variety of reasons. Today's situation is that all too many younger workers live hand to mouth between bouts of unemployment & low wages, regardless of education.

It's part & parcel of explosive inequality.

the people in europe reduce the income inequality on their own (rather than their govts), quite fucking contrary to popular belief. and taxes would have to get much, much more regressive here for full blown socialism to happen... the Neo-Republicans[1], [2] have already taxed the people enough, and quite regressively at that.Interestingly, even the richer folk in democracies with more equalized income distribution than the US are happier than rich Americans.

the people in europe reduce the income inequality on their own (rather than their govts), quite fucking contrary to popular belief. and taxes would have to get much, much more regressive here for full blown socialism to happen... the Neo-Republicans[1], [2] have already taxed the people enough, and quite regressively at that.

you want govt run health care? then you're going to have to start paying a VAT to the u.s. govt. then your payroll taxes will go up. then you'll have to pay more income tax. all for something that most people dont even know that they'll even use what they're forced to pay for. and then when there are drug shortages due to price fixing it will not be pretty. and then more inequality than ever before happens when the wealthy get better health care from the private sector while the poor people who lose 90% of their income to taxation will be waiting 6 months to get treatment that they have little to no say in.

[1]members of the Party of Lincoln, not the Jeffersonian Old Republican '98ers

[2]yes i know that neo does not mean new

so everyone is taxed to pay for everyone's expenses.You have no fucking clue what you are talking about. Europeans are taxed, massively, through many ways. Furthermore, their governments, such as Germany, promote the middle class in a variety of ways, including the Mittlestand, Landesbanken, and massive union presence. Furthermore, they take a very level headed approach to allocation of educational resources by testing their kids half way through, sending some to university and the rest to practical schools. This is a huge governmental bureaucracy.

Few people can't afford a 15 year decline? I started putting money away at 24, I was 2 years later since I went to grad school right after undergrad. If I retire at 55 I can last 2 down cycles without a problem, then move into bonds.

Who cares if your stocks go up or down every 15 years as long as the 30+ year cycle is in your favor, and it is. Your picking arbitrary points every 15 years is silly. Pick a 30 year period and let me know how you do.

anyway, attempting to destroy all individuality is a revolt against the laws of Nature and of Nature's God.