News AMD's Q2 2022, yet another quarter of revenue growth

- Thread starter Hans de Vries

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Impressive numbers. Each segment grew significantly. Even client and gaming. Reiterated guidance.

It's not "the market" why Intel's ER was bad.

It's not "the market" why Intel's ER was bad.

Markfw

Moderator Emeritus, Elite Member

- May 16, 2002

- 27,374

- 16,217

- 136

I would say those that are saying Intel loss is due to the current environment (not sure the exact phrase) is why they are loosing money is all excuses. 70% growth y/y ? Thats insane.

shady28

Platinum Member

- Apr 11, 2004

- 2,520

- 397

- 126

You're new to AMD's stock, aren't you? Normal no matter if they beat the sh*t out of their guidance by 50% or it's a miss.There's a reason this is happening right now.

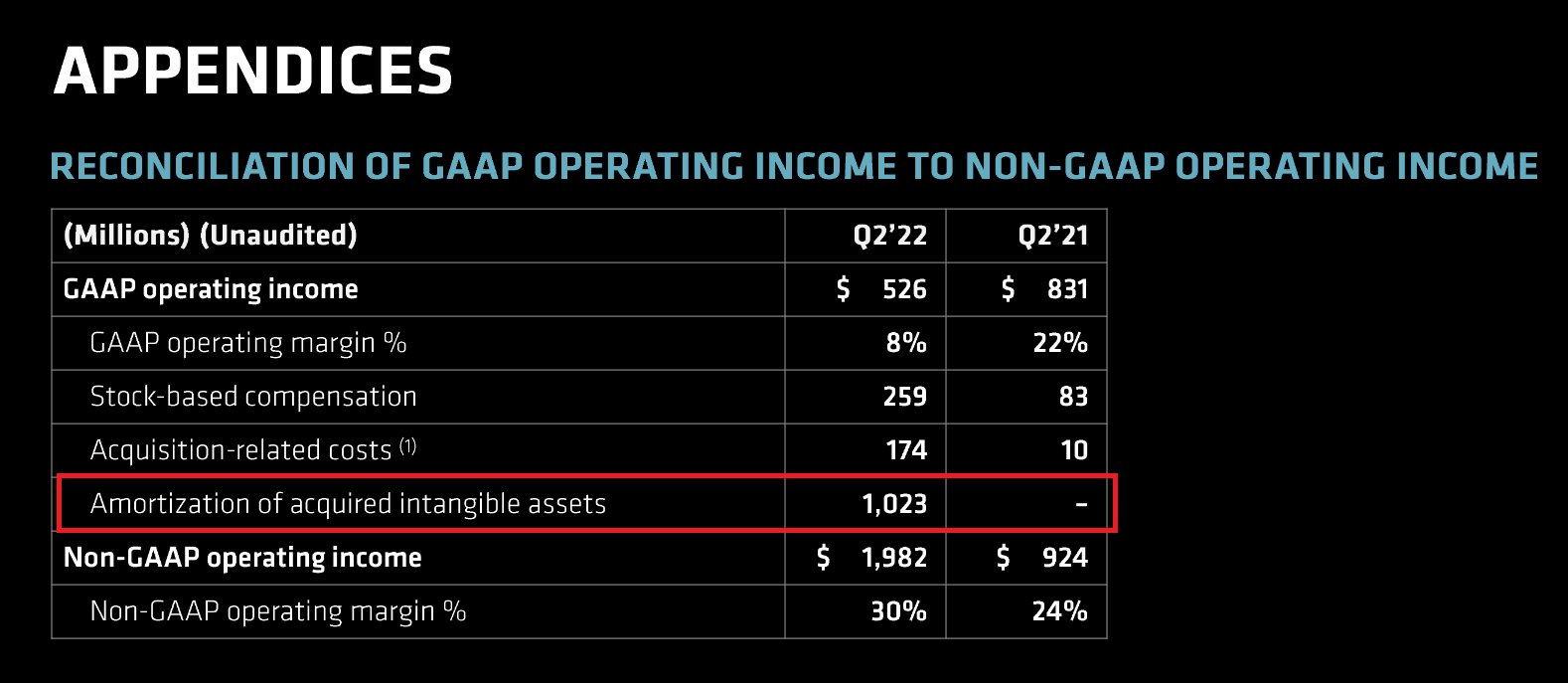

Besides that the latter of your post is true. Try looking more closely. Just a hint regarding GAAP: Amortization of Xilinx intangible assets.

AMD was in a very bad shape about 7-8 years ago - from that perspective is somehow shocking to see their revenue at circa 43 percent of Intel in Q2!

DisEnchantment

Golden Member

- Mar 3, 2017

- 1,779

- 6,798

- 136

There is a reason AMD omitted Q/Q results for Q2. Basically Q1 had half of Xilinx revenue. Q2 had full Xilinx revenue of 1.2Billion. Below is Q1 result

Overall Q/Q gains are flattish (+100M) for the core business if leaving out Xilinx. But not bad given the economic and geopolitical environment.

Overall Q/Q gains are flattish (+100M) for the core business if leaving out Xilinx. But not bad given the economic and geopolitical environment.

Last edited:

Markfw

Moderator Emeritus, Elite Member

- May 16, 2002

- 27,374

- 16,217

- 136

Would you try and phrase that in english ? What are you trying to say ? Those are great numbers, and a lot of growth up there. Data center is almost doubled and client like 50% or so more.There's a reason this is happening right now. Try looking more closely at those numbers.

View attachment 65261

@Henry swagger could you leave some positive comment?

There is a reason AMD omitted Q/Q results for Q2. Basically Q1 had half of Xilinx revenue. Q2 had full Xilinx revenue of 1.2Billion. Below is Q1 result

View attachment 65262

Overall gains are flattish (+100M) for the core business if leaving out Xilinx. But not bad given the economic and geopolitical environment.

Your first sentence sounds somehow strange: Xilinx is right now part of AMD, why they should keep results separated?

Btw, Intel do not count Altera results?

Last edited:

Well Y/Y is the only relevant metric just because of all the seasonal shenanigans. Like holidays, back to school, Q3 ramp for consoles etc. Doing Q/Q comparisons is pretty pointless due to that because it just doesn't work on an "accurate" basis.There is a reason AMD omitted Q/Q results for Q2. Basically Q1 had half of Xilinx revenue. Q2 had full Xilinx revenue of 1.2Billion. Below is Q1 result

View attachment 65262

Overall gains are flattish (+100M) for the core business if leaving out Xilinx. But not bad given the economic and geopolitical environment.

DisEnchantment

Golden Member

- Mar 3, 2017

- 1,779

- 6,798

- 136

That's the point, AMD came out unscathed in this environment. Not sure why people don't like real data (or at least talk it down).Excluding Xilinx revenue increased within their traditional segments, if anything Intel s numbers are a prove that the market contracted significantly and that AMD managed to sort out some growth despite this downturn.

Besides, it was nobody else other than AMD adding it there in the first place when it was rosy.

nicalandia

Diamond Member

- Jan 10, 2019

- 3,331

- 5,282

- 136

Impressive. Some were speculating that AMD would have seen negative results????????

Markfw

Moderator Emeritus, Elite Member

- May 16, 2002

- 27,374

- 16,217

- 136

I am not talking it down, but in the Intel Q2 thread, TheElf wants to know hy they has 70% revenue growth and net income was down 37%. I have no idea about all this, maybe you can explain it to him ?That's the point, AMD came out unscathed in this environment. Not sure why people don't like real data (or at least talk it down).

Besides, it was nobody else other than AMD adding it there in the first place when it was rosy.

Also, I would says those who support Intel are the ones talking it down.

I am not talking it down, but in the Intel Q2 thread, TheElf wants to know hy they has 70% revenue growth and net income was down 37%. I have no idea about all this, maybe you can explain it to him ?

Also, I would says those who support Intel are the ones talking it down.

They marked a big operating loss that eat most of the operating income, dunno what it is exactly, either it s an accountatility trick to reduce taxes, or eventually payements that were sent to TSMC for future waffers since this firm asked for payements in advance.

shady28

Platinum Member

- Apr 11, 2004

- 2,520

- 397

- 126

HoleInTheEarth

Member

- Jun 18, 2022

- 38

- 38

- 51

I'm more curious in the actual breakdown. The whole "70%" is across the board Y/Y, but when you seem to look into the numbers, I found this slide interesting.

Versus Q1 2022. It looks like Embedded is what really had a boost. Gaming was actually down. Client was a wash. Data Center was $1,486 vs $1293, so not a huge jump or market share gain. So, there was no huge jump in Data Center or Client this quarter?

As a whole, AMD actual revenue was only a $0.663. Q1 was $5,887 vs $6,550.

Versus Q1 2022. It looks like Embedded is what really had a boost. Gaming was actually down. Client was a wash. Data Center was $1,486 vs $1293, so not a huge jump or market share gain. So, there was no huge jump in Data Center or Client this quarter?

As a whole, AMD actual revenue was only a $0.663. Q1 was $5,887 vs $6,550.

Here.

There's your answer for the GAAP numbers.

DisEnchantment

Golden Member

- Mar 3, 2017

- 1,779

- 6,798

- 136

Yep, this is the one. Like mentioned, traditional DC and Client are flattish but not bad in this environment.I'm more curious in the actual breakdown. The whole "70%" is across the board, but when you seem to look into the numbers, I found this slide interesting.

View attachment 65263

Versus Q1 2022. It looks like Embedded is what really had a boost. Gaming was actually down. Client was a wash. Data Center was $1,486 vs $1293, so not a huge jump or market share gain. So, there was no huge jump in Data Center or Client this quarter?

As a whole, AMD actual revenue was only a $0.663. Q1 was $5,887 vs $6,550.

Hopefully the upcoming refresh cycle changes things a bit. "Digestion" anyone?

DC + AECG operates in B2B mainly so they won't get affected by seasonality.

AMD SP is always wild so won't bother commenting on that.

Lots of the cost of the Xilinx acquisition is also being absorbed which is affecting profits.

Embedded is Xilinx for now. (AECG - Adaptive + Ryzen Embedded)

Like I said: If you actually want to compare numbers from any earnings report do it with those from the same quarter a year ago. Anything else doesn't give you a good comparison because of all the seasonal stuff which impacts numbers.Versus Q1 2022. It looks like Embedded is what really had a boost. Gaming was actually down. Client was a wash. Data Center was $1,486 vs $1293, so not a huge jump or market share gain. So, there was no huge jump in Data Center or Client this quarter?

As a whole, AMD actual revenue was only a $0.663. Q1 was $5,887 vs $6,550.

That's why all companies are doing it mainly Y/Y.

HoleInTheEarth

Member

- Jun 18, 2022

- 38

- 38

- 51

I know, but exactly what season stuff happened between Jan-Mar and Apr-Jun? I mean, for the sake of just seeing actual progression, comparing it to last quarter is interesting. You are also not factoring in that last year was a ramp up year due to overall consumer purchasing during a pandemic and you're taking where they were at the same point last year vs. right now, not considering all of that. It's just an observation and doesn't look like they had much of a boost this year. So, has the market settled or is AMD still on an upward trend? Looking at the short-term data, it would appear things sort of leveled off. It'll probably increase as the year goes on and we do get into the real holiday season.Like I said: If you actually want to compare numbers from any earnings report do it with those from the same quarter a year ago. Anything else doesn't give you a good comparison because of all the seasonal stuff which impacts numbers.

That's why all companies are doing it mainly Y/Y.

HurleyBird

Platinum Member

- Apr 22, 2003

- 2,817

- 1,552

- 136

Like I said: If you actually want to compare numbers from any earnings report do it with those from the same quarter a year ago. Anything else doesn't give you a good comparison because of all the seasonal stuff which impacts numbers.

That's why all companies are doing it mainly Y/Y.

Typically, but in the case of a company that is growing as rapidly as AMD, Q/Q is arguably more important. If Q2 growth was, say, 25% Y/Y, that would be disastrous in this context.

TRENDING THREADS

-

Discussion Zen 5 Speculation (EPYC Turin and Strix Point/Granite Ridge - Ryzen 9000)

- Started by DisEnchantment

- Replies: 25K

-

Discussion Intel Meteor, Arrow, Lunar & Panther Lakes + WCL Discussion Threads

- Started by Tigerick

- Replies: 23K

-

Discussion Intel current and future Lakes & Rapids thread

- Started by TheF34RChannel

- Replies: 23K

-

-

AnandTech is part of Future plc, an international media group and leading digital publisher. Visit our corporate site.

© Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.