https://seekingalpha.com/pr/16978522-amd-reports-third-quarter-2017-financial-results

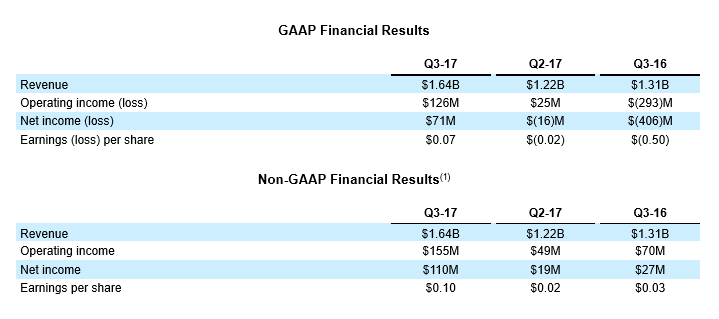

SUNNYVALE, Calif., Oct. 24, 2017 (GLOBE NEWSWIRE) -- AMD(NASDAQ:AMD) today announced revenue for the third quarter of 2017 of $1.64 billion, operating income of $126 million and net income of $71 million, and diluted earnings per share of $0.07. On a non-GAAP(1) basis, operating income was $155 million, net income was $110 million, and diluted earnings per share was $0.10.

Q3 2017 Results

Current Outlook

AMD’s outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under “Cautionary Statement” below.

For the fourth quarter of 2017, AMD expects revenue to decrease approximately 15 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in fourth quarter 2017 revenue increasing approximately 26 percent year-over-year. AMD now expects annual 2017 revenue to increase by greater than 20 percent, compared to prior guidance of mid-to-high teens percentage.

imo 2017 is just the beginning. 2018 is when the real revenue growth will come as Raven Ridge, Pinnacle Ridge and EPYC ramp should be in full flow.

SUNNYVALE, Calif., Oct. 24, 2017 (GLOBE NEWSWIRE) -- AMD(NASDAQ:AMD) today announced revenue for the third quarter of 2017 of $1.64 billion, operating income of $126 million and net income of $71 million, and diluted earnings per share of $0.07. On a non-GAAP(1) basis, operating income was $155 million, net income was $110 million, and diluted earnings per share was $0.10.

Q3 2017 Results

- Revenue was $1.64 billion, up 26 percent year-over-year, primarily driven by higher revenue in the Computing and Graphics segment (CG). Revenue was up 34 percent sequentially, driven by the Enterprise Embedded and Semi-Custom segment (EESC) revenue seasonality and higher revenue in CG. In the quarter, AMD closed a patent licensing transaction which positively impacted revenue in the segments.

- Computing and Graphics segment revenue was $819 million, up 74 percent year-over-year primarily driven by strong sales of RadeonTM graphics and RyzenTM desktop processors.

- Client average selling price (ASP) increased significantly year-over-year, due to higher desktop processor ASP driven by RyzenTM processor sales.

- GPU ASP increased significantly year-over-year.

- Operating income was $70 million, compared to an operating loss of $66 million a year ago. The year-over-year improvement was primarily driven by higher revenue.

- Enterprise, Embedded and Semi-Custom segment revenue was $824 million, approximately flat year-over-year primarily driven by lower semi-custom SoC sales, mostly offset by IP related and EPYCTM processor revenue.

- Operating income was $84 million, compared to $136 million a year ago. The year-over-year decrease was primarily due to higher costs partially offset by the net benefit of IP related items.

- All Other operating loss was $28 million compared with an operating loss of $363 million a year ago. The year-over-year difference in operating loss was primarily related to the WSA charge in the year ago period.

Current Outlook

AMD’s outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under “Cautionary Statement” below.

For the fourth quarter of 2017, AMD expects revenue to decrease approximately 15 percent sequentially, plus or minus 3 percent. The midpoint of guidance would result in fourth quarter 2017 revenue increasing approximately 26 percent year-over-year. AMD now expects annual 2017 revenue to increase by greater than 20 percent, compared to prior guidance of mid-to-high teens percentage.

imo 2017 is just the beginning. 2018 is when the real revenue growth will come as Raven Ridge, Pinnacle Ridge and EPYC ramp should be in full flow.