Luckily subprime loans are a small percentage of the car market. Any crisis caused by a bond bubble will be contained, and I don’t buy the premise, Maria, that cars depreciate. I also don’t buy the premise that debt pulls demand from the future. If that were true, living on debt would have severe long term consequences because future demand would shrink as the debt grows. We all know that living on debt has no consequences, so the premise must be false.

I’m not directing this at anyone in particular. I just need to rant. I read so much stupid crap written by Austrian “economists” and Ron Paul supporters. This seems like a good thread to vent my frustrations.

GM's loan books

This is fantastic news. Without the Bernanke put, now the Yellen put, that number would be much lower. If we imposed tighter lending standards like those silly democrats talk about (but never do), GM would only be allowed to lend money to people who are capable of paying it back. Bill Clinton and George Bush were right – less regulation is better. We need to unshackle GM so they can make bad loans and thereby increase aggregate demand for cars. Anyone looking at the US economy would conclude the real problem is not enough cars. Americans would be much more productive if they simply owned more cars. Even that doesn’t matter since modern economies don’t rely on production.

Supply side economics was debunked decades ago. Prosperity comes from demand; not supply. No sane person would say they are doing well simply because they

have nice things and they can sell their surplus things to other people. True prosperity comes from

wanting nice things that other people produce. This is why it’s important to fund aggregate demand through credit bubbles rather than funding demand through production; living on credit cards is more sustainable than getting a job. The added benefit of credit bubbles is that they allocate capital away from productive uses and into nonproductive uses. Back in 2005, every woman with nice legs was a realtor, and that’s why the economy was doing great. The federal reserve’s credit bubble had successfully diverted capital away from things like engineering and into things like building condos that nobody lives in.

Our economy would have contracted much sooner if we had too many people on the supply side, doing silly things like trying to design a more efficient car. Increasing efficiency is bad for the economy because it leads to deflation. Back in 1960, engineering was ridiculously expensive because people had to draw the plans with a pencil and paper. Sharing the plans with another office meant getting in a car and driving to the other office. All of this made engineering expensive, and that’s why the economy was doing great. Now we’re in the age of computers and it’s a complete disaster. The entire Taj Mahal can be drawn by 1 person using 1 computer, and it can be shared with multiple offices just by sending an email. This drives the cost of engineering through the floor. This is called deflation, and it’s very bad because the lower prices lower aggregate demand. Ask any

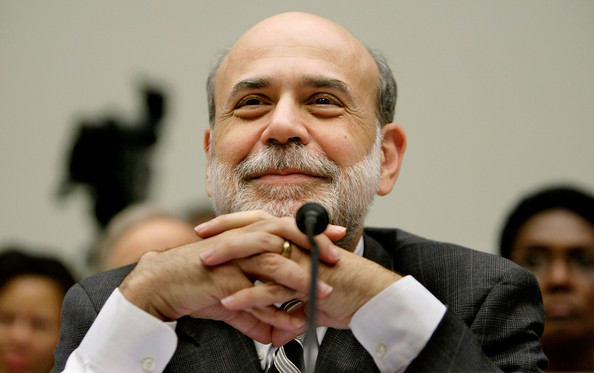

real economist who understands Keynesian economics, such as Paul Krugman, and they’ll tell you that higher prices lead to higher demand. This is why cell phones were more popular in the 1980s than they are today. When that movie Wall Street came out, a phone like Gordon’s would easily cost more than $1000, and the air time was just as expensive. Today, they give away phones in cereal boxes. The price is so incredibly low that demand no longer exists. I don’t know a single person who owns a cell phone. Deflation has destroyed the cell phone industry. Thank god people like Bernanke are working overtime to prevent that from happening to houses. If housing ever became cheap, we would all be homeless. Nobody would want a house.

/end rant

Not only is the economy doing great right now, but people are thrilled to put high risk loans in their retirement funds. Sure, one could argue that luring the pension funds of old people into a building then welding the doors shut and setting the building on fire is cruel, but as the old saying goes, old people are not people.

Securization of worthless auto loans.

That sounds like a pretty awesome deal. I lend out a bunch of money at maybe 5% interest, and only 7.6% of the loans go into default. The idiot Austrians have been wrong about junk bonds being dangerous for the past 5 years. They’ll never admit they were wrong about this even though it’s clear as day that junk bonds are a safe investment as long as the credit supply grows exponentially and new loans are taken out to pay the interest on the old loans.

You’re welcome, America

Thumbs up to GM for thinking of this scam. It's elegance comes from its simplicity.

1) Issue loans to drug addicts so they can buy your product.

2) Package up the worthless bonds and sell them to old people.

3) Go to step 1.