No, I'm saying that there is a large actual difference in the effects of debt held in a currency you print vs. debt not held in a currency you print. Those who print their own currency are not nearly so vulnerable to runs on their debt, they have a lender of last resort, etc.

See: Greece vs. Japan.

And yet Japan is in a horrible position and Abenomics has done "wonders" to turn things around. The refrain will be, "It wasn't enacted with enough time and enough spending" instead of a more sensible, "Never should have gotten to this point to begin with."

No, I'm saying that ever increasing US debts can absolutely be sustainable so long as they average out to be equal to or less than GDP growth over a given time period. US actions over the last few years have been good in that we ramped up our debt in a time of economic depression. Our biggest failure was not ramping up debt ENOUGH, not that we did too much.

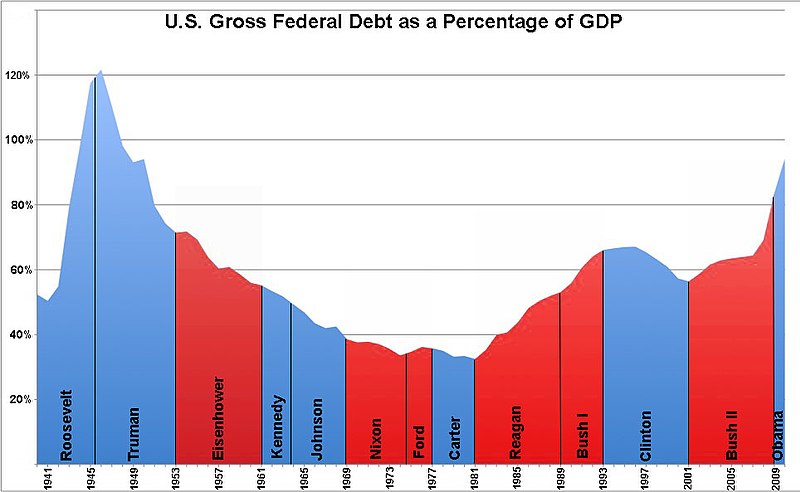

In 1980 when Reagan took office it was sitting at about 32% and now stands over 100%. Too wide of a sample? Since 2000 when Bush took office it has risen from 55% to over 100%.

You stated,

"increasing US debts can absolutely be sustainable so long as they average out to be equal to or less than GDP growth over a given time period."

In both data sets the ratio is increasing.

Of course I can read between the lines and our economic concerns and approach are quite different. Unfortunately, aggressive economists who disregard unbalanced spending and increasing debt burden won't be footing the bill. Of course there is always a politician to blame, right?

Sorry, I am not trying to be snarky and will let bygones be bygones after this post, but IMO the popular paths encouraged by some quarters of economists is

very high risk (impact vital services and benefits) as they are

highly dependent upon political control. I don't want to leave something as important as SS's success or failure dependent upon whether both parties can get along (they cannot). Yes, that means not leveraging every ounce of economic muscle and relying on a pedestrian, more conservative approach that is lower risk. This isn't pointing a finger at any one party as the chart I posted shows both parties have had an equal hand in the jar. But a lot of this comes down to philosophical issues: Should budgets be balanced? Should there be spending caps? To what extent should the government be involved in services (more or less?) and how should these be assessed to the citizenry (taxes, service fees, or other?)

Personally, as an observation of human nature, my strong preference is balanced budgets that force humans to see a correlation between the benefits and services garnered and the costs incurred. I think it is fundamentally flawed and unfair to burden future generations. Of course this is great politics as everyone "paid" for their service or benefit and the threat of change is a direct affront to these people (as it should be) but is based on the misunderstanding that they invested anything. It is a vicious cycle that moves more and more of the private life and wealth into the public domain where a slight margin of a popularity contest puts unqualified people in control.

RE: Ryan. Putting aside the plan specifics,

what are the many bullet point negatives to moving to a balanced budget where outflow must match inflow?

Let's say you could even adjust inflow/outflow where outflow = (inflow + debt/%GDP) to allow spending at a fixed rate of newly accrued debt in relation to GFP.

I would be very interested to see the list of concerns of such a model.