dasherHampton

Platinum Member

- Jan 19, 2018

- 2,543

- 488

- 96

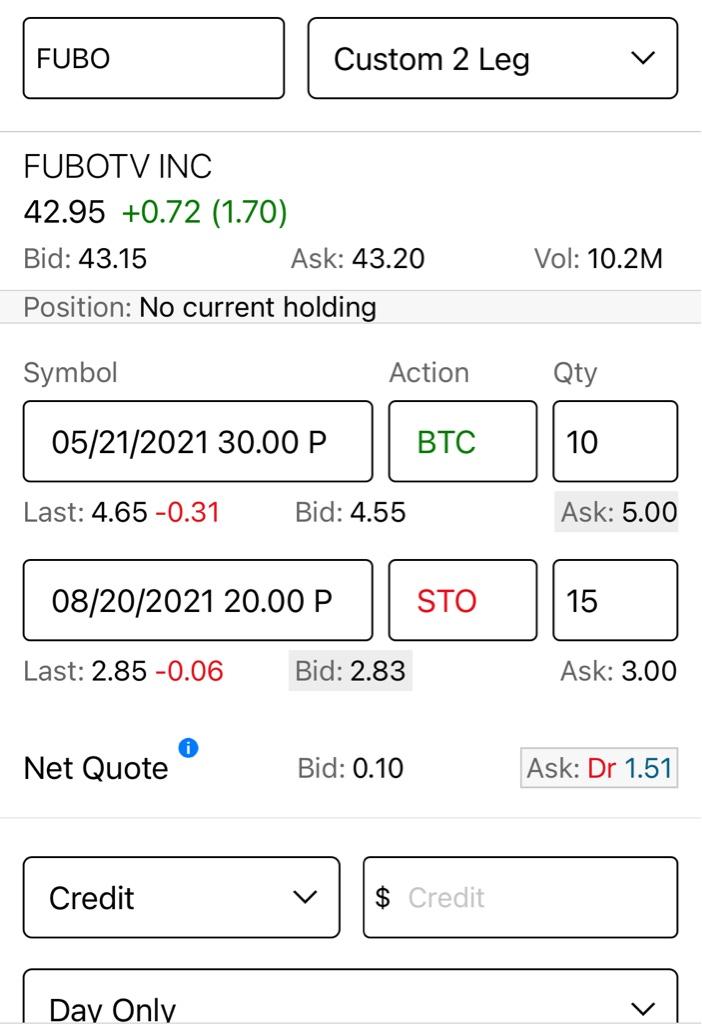

You can do a multi-leg transaction, often used for buying or selling spreads, strangles, and other more complicated trades.

On one leg, you would BTC (buy to close) the current puts May you are short, and you would STO (sell to open) the August puts. When it asks for a price, you’d say $0 or something close to it (though you should definitely take the net price your broker suggests as a starting point). Make sure you choose credit so you are a net seller (IE: receiving money) vs the other way around (debit / paying money)

I am not an expert, this is not advice, etc., etc., so please do your own due diligence etc.but I regularly use this strategy to roll calls and puts I sell.

Thanks for that very clear explanation. I've never done that.

I think if I make the switch I'll probably go with Aug 20 $25 puts. They're at 4.95. The 20s seem to have gone down in value.