What we have is explosive growth and volume of the high end market due to mining, which over inflated the value of cards and kept pricing and demand high.

High end cards have the highest margins and it overlapped the mining market. What happened is graphic cards became undervalued overall but overvalued in gaming market.

For miners and potential investor, the prospect of being able to make money back in two or 3 months while keeping largely the value of the purchased good(they didn't assume the crash would come so hard), while anytime after that would be profit became too interesting and appetizing attracting even the attention of the general public.

What this created is a huge new demand which constrained the supply keeping price up. Gamers don't like seeing the price to performance of cards to remain static for two years. But to miners and also to miners/gamers, the thought of being able to pay for there investment in two to three months and afterwards, turning anything else afterwards into pure profit meant all of a sudden videocards were all of a sudden undervalued. This type of profit is unheard of any business for a piece of equipment which if all goes well, appreciates over time. This turned videocards literally into money making machines. Along with small time miners, this attracted venture capital money, illegal blackmarket money(drug/illicit) to be invested into videocards which blew up the market.

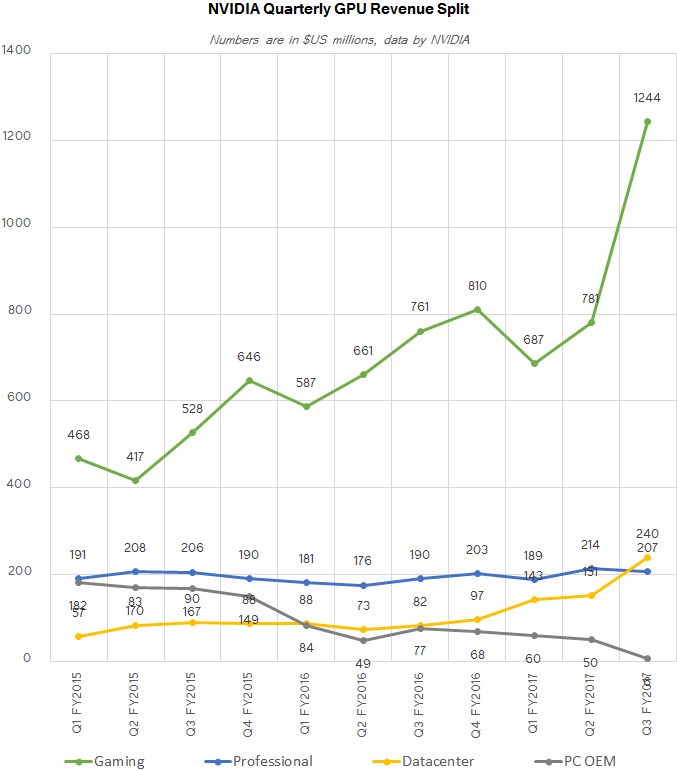

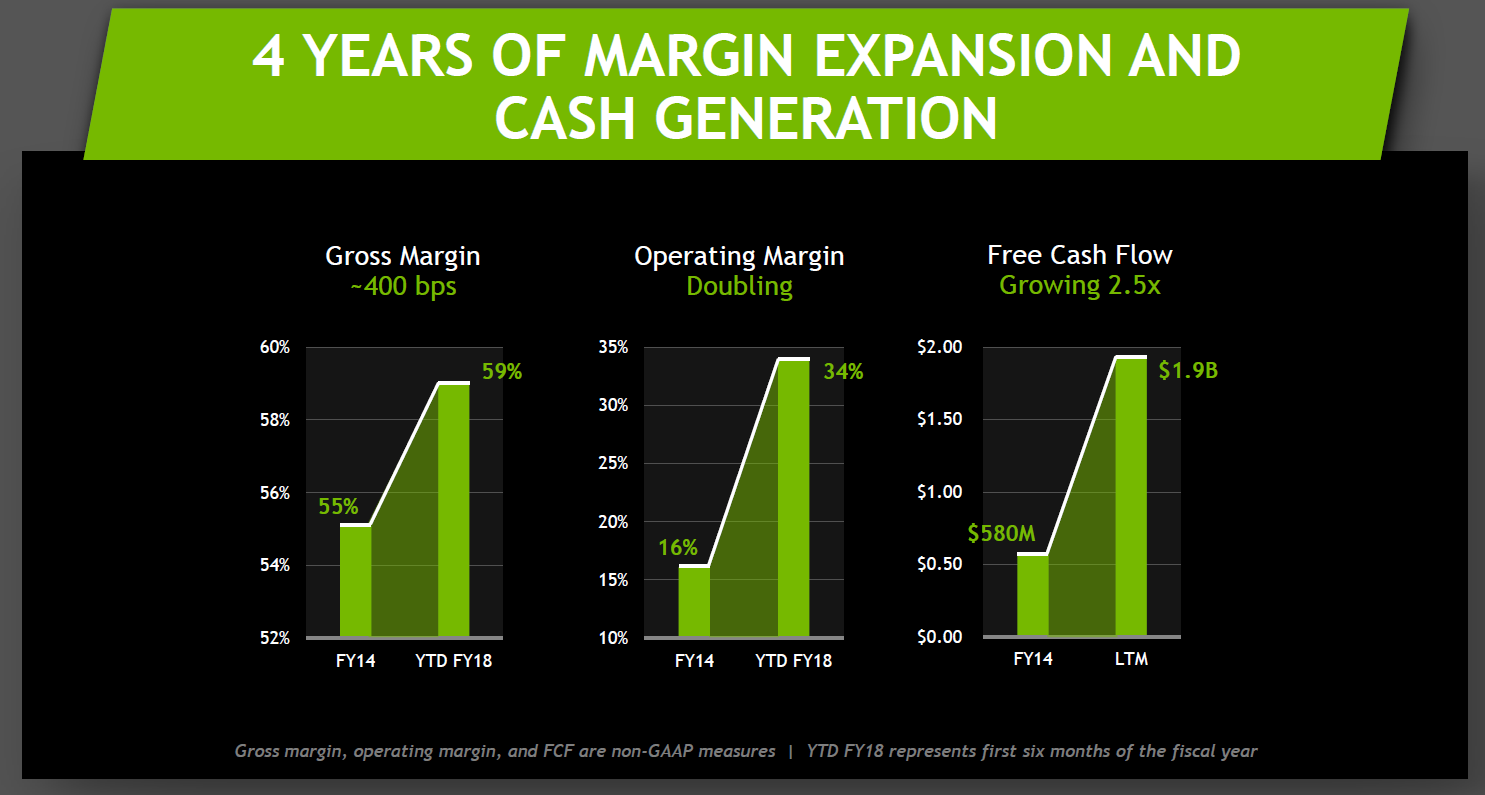

What this allowed because cost stayed high is for both Nvidia and AMD to absorb any additional income due to better yields over time as profit while additionally the ramp up of high end discrete cards translated into pure profits which made the gaming market vastly more profitable than it was before.

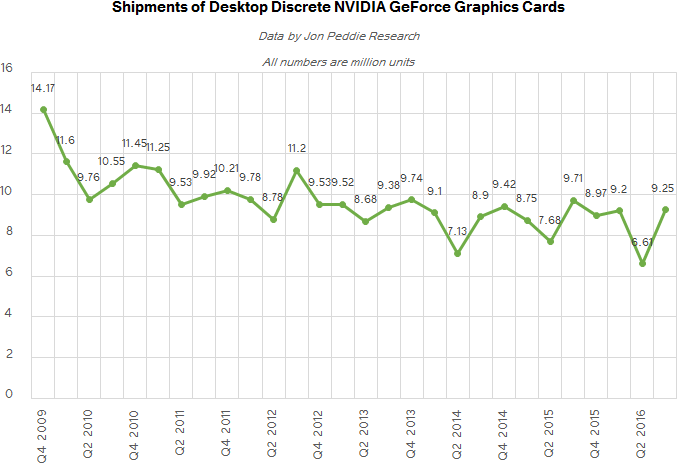

As a result, we didn't see the normal discrete market drops of earlier years, we saw increases in pricing and sales. And more importantly they all happened at the mainstream to high end where margins are the best. Combine all these factors and you have the potential for explosive revenue growth.

On top of this, for the benefit of Nvidia and AMD, games like Fortnite and PUBG just happened to coincide with this mining market which created new demand in the gaming market ensuring the videocard supply market would remain constrained for gamers would remain constrained as well.

This is what lead to the graphs you posted along with crazy growth of the AI/Pro market. Professional products have really high margins and particularly the data center market, had extreme growth over the years. I noticed your graphs(perhaps strategically on your own part) are missing for the most recent periods where this is clearest.

View attachment 2884

What we will see next quarter is a big market correction which shows the true size and worth of the gaming market. Margin will stay high but this is the result of the professional market and how much revenue they represent for the company. But we will see a huge drop in net profit and net profit margin back to more regular level when the correction occurs.

The temporary increase in sales due to the mining market cannot be seen as typical.