shady28

Platinum Member

- Apr 11, 2004

- 2,520

- 397

- 126

China has no ability to do that. That's not how treasury bonds work.

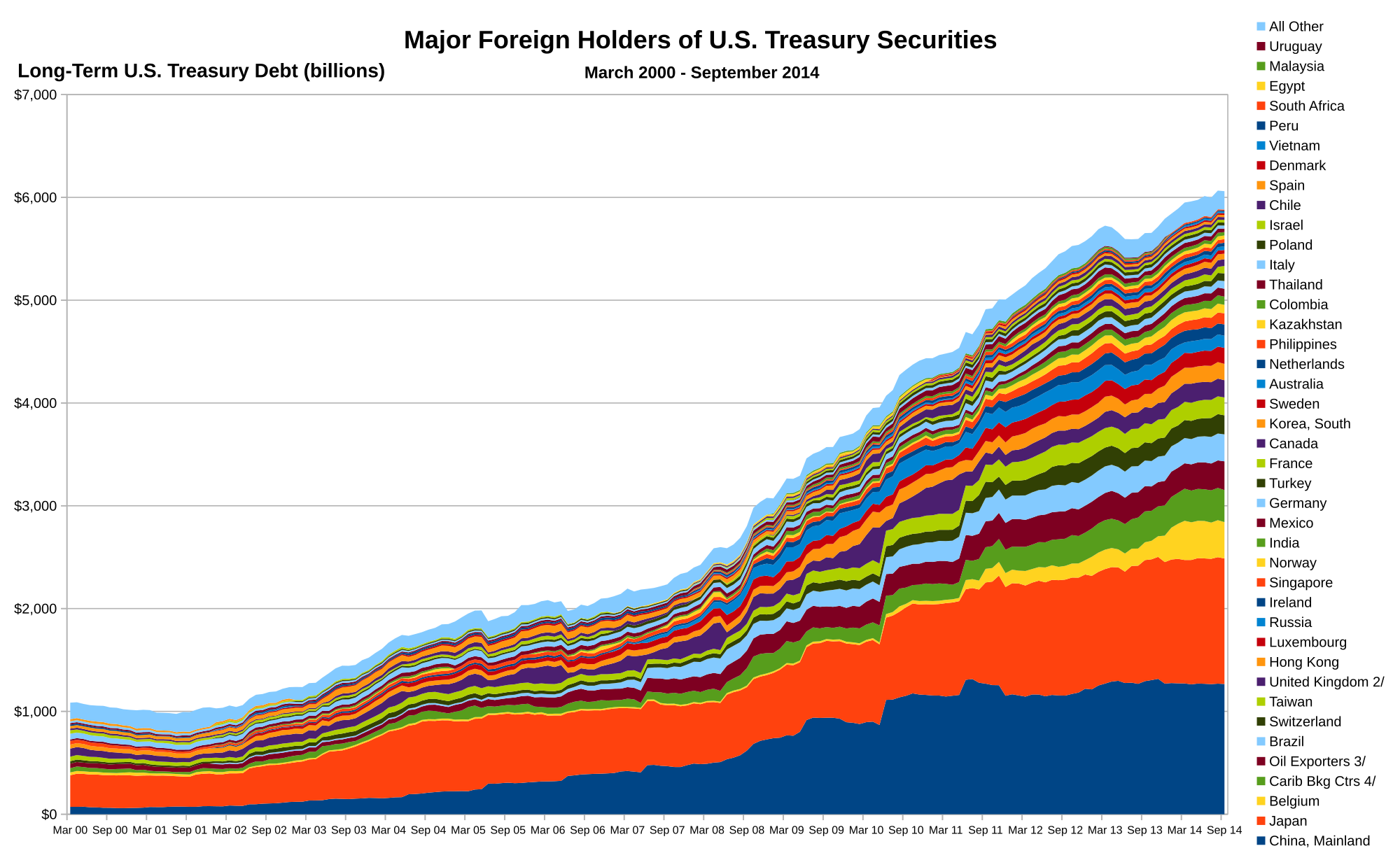

Second, we have no need for China to buy our bonds. Did you know that China has actually been selling US treasuries, not buying them, for quite awhile now?

Exactly, you didn't even notice.

Just like you to focus in on something not so important.

China in particular liquidated considerable dollars attempting to avoid devaluing the Yuan. They are already taking steps to avoid the use of the USD for purchases of oil.

The United States must have foreign countries to buy our debt. Whether that is China or some other country is immaterial. Without buyers of our debt, we cannot run the massive trade deficits and continue the deficit spending needed to support both the welfare state and our massive military-industrial complex.

No one is saying that the USD is not the reserve currency of the world - it absolutely is.

The US economy is totally dependent on selling debt at this point. This is why it frankly does not matter much who the POTUS is. One of their main jobs as Commander in Chief will be to protect this critical US interest. This means the US will be involved in the middle east. Obama talked a lot of shit about military adventurism before he was elected. I'm sure someone from the Federal Reserve gave him a facts of life talk from which he decided to go the proxy route.

If the POTUS doesn't honor Nixon's deal, we'll get to see what happens when the USD loses its reserve status.

http://energyfuse.org/chinas-currency-on-track-to-challenge-the-u-s-dollar-in-oil-markets/

The U.S. dollar has been the de-facto international reserve currency for seven decades, but its supremacy is being challenged rapidly. Chinas forthcoming launch of a crude futures contract to be traded with the yuan is another major step to cement itself as a global economic powerhouse and challenge the U.S. currencys dominance in oil markets. While China has a long road to travel if it wishes to unseat the dollar, the Asian juggernaut has taken a number of steps to boost its currencys standing in the global marketplace, but the move to establish a crude futures exchange is among the most significant.

...

There has already been movement in displacing the dollar in oil deals, a trend that has not received much attention in mainstream U.S. outlets. China overtook the U.S. this year as the top importer of crude oil, and as major producers compete for market share from Chinese buyers, they have been willing to do deals in yuan. Both Russia and Iran are accepting the yuan, as are Angola, Venezuela and Sudan. Others are likely to follow.