https://newsroom.intel.com/news-releases/intel-reports-second-quarter-2018-financial-results/

https://finance.yahoo.com/news/intels-data-center-business-misses-202025519.html?guccounter=1

July 26 (Reuters) - Intel Corp's fast-growing data center business missed Wall Street targets on Thursday as the world's second-largest chipmaker faced stiff rivalry from Advanced Micro Devices Inc, and again delayed the release of its next-generation chips until the end of 2019.

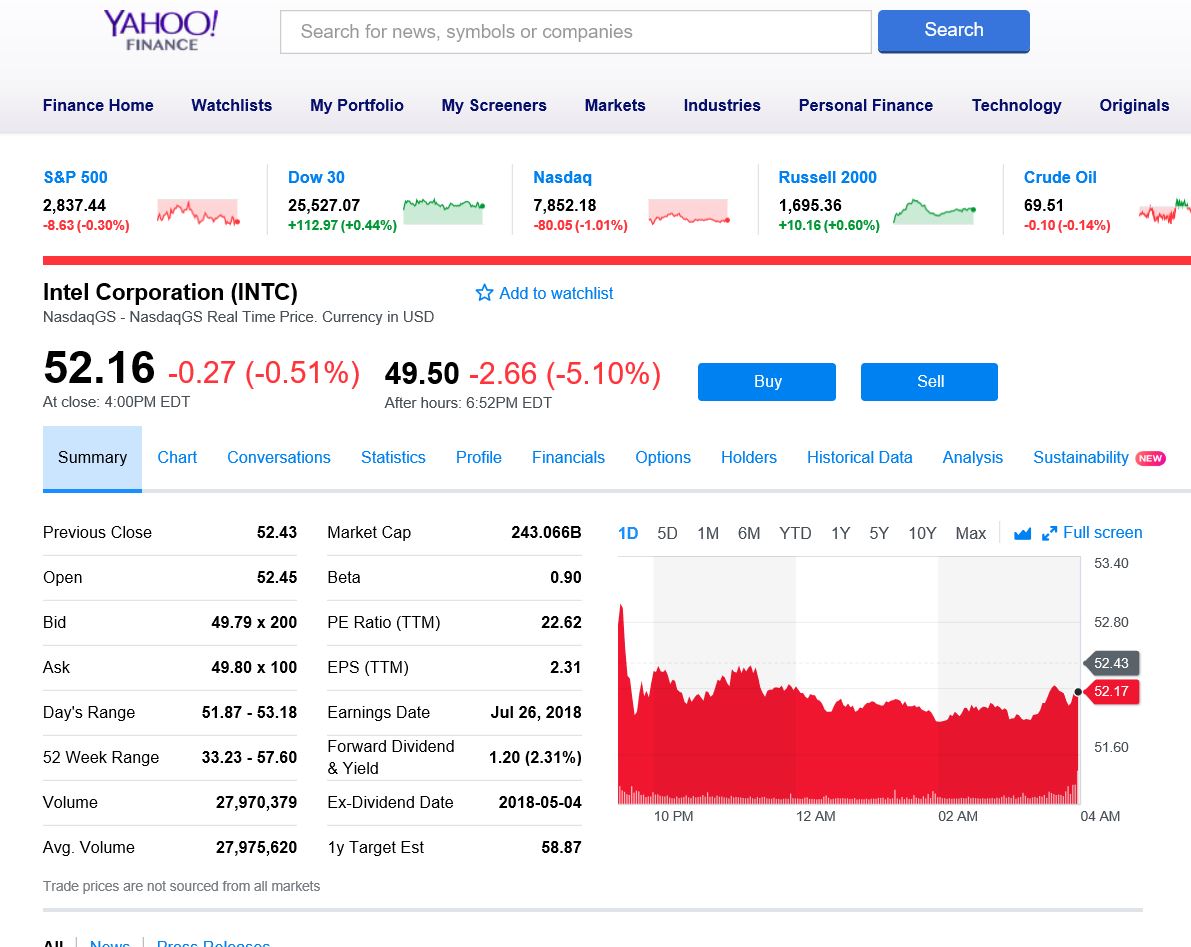

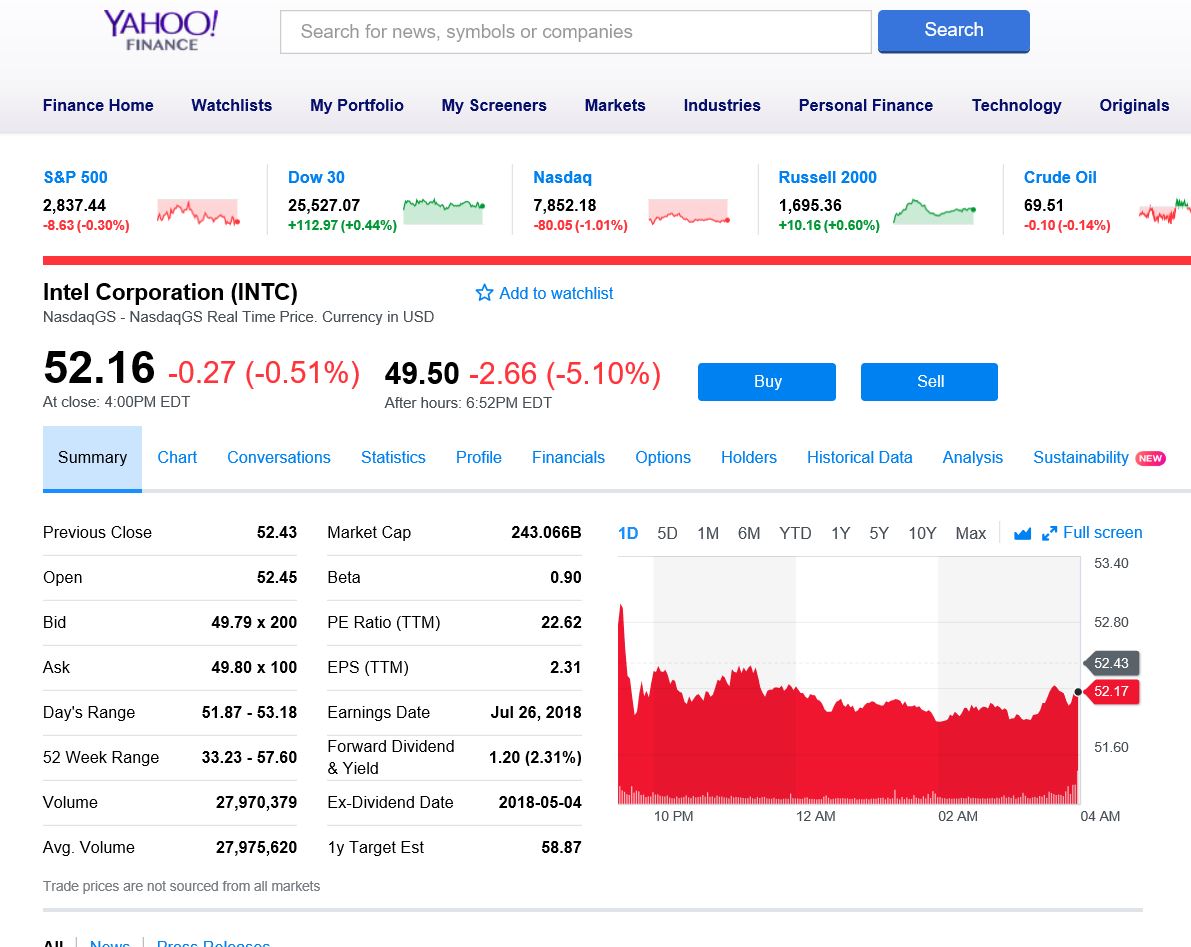

The company's shares fell almost 6 percent in extended trading.

Sales to data centers that power mobile and web apps, which bring more profit than chips for personal computers, rose 26.9 percent to $5.55 billion in the second quarter ended June 30. Analysts had expected revenue of $5.63 billion, according to financial and data analytics firm FactSet.

Intel has been increasingly catering to data centers as revenue from PCs has flattened since shipments peaked in 2011.

AMD, which has been gaining ground with its new server chips, beat estimates for quarterly profit and revenue on Wednesday, powered by its EPYC server processors.

Intel expects that PCs with its next-generation 10nm chips will be for sale during the holiday season of 2019, company spokeswoman Cara Walker said by email. On a conference call with investors, Murthy Renduchintala, Intel's chip architecture chief, said 10nm data center chips will be released "shortly after" the consumer PC chips.

Last quarter, the company said the 10nm chips were being pushed from 2018 to 2019 but did not specify when. Intel originally predicted the chips could be ready by 2015.

The compares to rival Taiwan Semiconductor Manufacturing Co Ltd expecting 7nm chips to contribute more than 20 percent to its revenue next year.

Intel's net income rose to $5.01 billion, or $1.05 per share, from $2.81 billion, or 58 cents per share, in the year-ago quarter. https://bit.ly/2mLLApb

Excluding items, the company earned $1.04 per share, beating expectations of 96 cents per share, according to Thomson Reuters I/B/E/S.

The company benefited from a stabilizing PC market, in which worldwide shipments grew for the first time in six years, according to research firm Gartner.

Revenue in Intel's client computing business, which caters to PC makers and is still the biggest contributor to sales, rose 6.3 percent to $8.73 billion, beating FactSet estimates of $8.48 billion.

Intel forecast current-quarter revenue of $18.1 billion, plus or minus $500 million, and adjusted earnings of $1.15 per share, plus or minus 5 cents. Analysts on average had expected revenue of $17.60 billion on a profit of $1.08 per share, according to Thomson Reuters I/B/E/S.

Net revenue rose 14.9 percent to $16.96 billion, above estimates of $16.77 billion.

The company is searching for a new chief executive after Brian Krzanich was ousted last month following an investigation that found he had a consensual relationship with an employee in breach of company policy.

Chief Financial Officer Robert Swan is acting as interim CEO.

Shares of the Santa Clara, California-based chipmaker which have gained 13 percent so far this year, fell 5.6 percent to $49.28 after the bell.

https://finance.yahoo.com/news/intels-data-center-business-misses-202025519.html?guccounter=1

July 26 (Reuters) - Intel Corp's fast-growing data center business missed Wall Street targets on Thursday as the world's second-largest chipmaker faced stiff rivalry from Advanced Micro Devices Inc, and again delayed the release of its next-generation chips until the end of 2019.

The company's shares fell almost 6 percent in extended trading.

Sales to data centers that power mobile and web apps, which bring more profit than chips for personal computers, rose 26.9 percent to $5.55 billion in the second quarter ended June 30. Analysts had expected revenue of $5.63 billion, according to financial and data analytics firm FactSet.

Intel has been increasingly catering to data centers as revenue from PCs has flattened since shipments peaked in 2011.

AMD, which has been gaining ground with its new server chips, beat estimates for quarterly profit and revenue on Wednesday, powered by its EPYC server processors.

Intel expects that PCs with its next-generation 10nm chips will be for sale during the holiday season of 2019, company spokeswoman Cara Walker said by email. On a conference call with investors, Murthy Renduchintala, Intel's chip architecture chief, said 10nm data center chips will be released "shortly after" the consumer PC chips.

Last quarter, the company said the 10nm chips were being pushed from 2018 to 2019 but did not specify when. Intel originally predicted the chips could be ready by 2015.

The compares to rival Taiwan Semiconductor Manufacturing Co Ltd expecting 7nm chips to contribute more than 20 percent to its revenue next year.

Intel's net income rose to $5.01 billion, or $1.05 per share, from $2.81 billion, or 58 cents per share, in the year-ago quarter. https://bit.ly/2mLLApb

Excluding items, the company earned $1.04 per share, beating expectations of 96 cents per share, according to Thomson Reuters I/B/E/S.

The company benefited from a stabilizing PC market, in which worldwide shipments grew for the first time in six years, according to research firm Gartner.

Revenue in Intel's client computing business, which caters to PC makers and is still the biggest contributor to sales, rose 6.3 percent to $8.73 billion, beating FactSet estimates of $8.48 billion.

Intel forecast current-quarter revenue of $18.1 billion, plus or minus $500 million, and adjusted earnings of $1.15 per share, plus or minus 5 cents. Analysts on average had expected revenue of $17.60 billion on a profit of $1.08 per share, according to Thomson Reuters I/B/E/S.

Net revenue rose 14.9 percent to $16.96 billion, above estimates of $16.77 billion.

The company is searching for a new chief executive after Brian Krzanich was ousted last month following an investigation that found he had a consensual relationship with an employee in breach of company policy.

Chief Financial Officer Robert Swan is acting as interim CEO.

Shares of the Santa Clara, California-based chipmaker which have gained 13 percent so far this year, fell 5.6 percent to $49.28 after the bell.