The client group is actually profitable, their most profitable segment by far. I’m not sure how much of Dell’s revenue is laptops, but the company overall is significantly larger than HP or Lenovo.Lol, Dell is half Lenovo or HP in the laptop segment, so the "better pricing" is nothing else that chips sold at a loss and subsided by the profits Intel make with the formers, that s why Intel make no profit out of a huge 12.7bn quarterly sales.

News Intel 1Q24 Earnings Report

Page 6 - Seeking answers? Join the AnandTech community: where nearly half-a-million members share solutions and discuss the latest tech.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mahboi

Golden Member

- Apr 4, 2024

- 1,058

- 1,969

- 96

Out of everything I hear about Intel, this is easily what scares me the most.Pat seems to think Intel is already back to process leadership:

They sound like they're all patting each other on the back saying that "they're already back on top" every year. I don't know if it is catastrophic internal mood forcing the Narrative or managerial arrogance. Whichever, it's a crimson flag.

The client group is actually profitable, their most profitable segment by far. I’m not sure how much of Dell’s revenue is laptops, but the company overall is significantly larger than HP or Lenovo.

It s not profitable, they just played with the numbers by stating that their foundries are selling the chips at a loss to their CPU divison, that s really a joke of an accounting report, they are telling you that their foundry business is a different firm that their CPU division all while arbitrarly deciding of the ressources allocations to make you believe that their chips are sold at a profit, are you that gullible to buy such a scam ..?.

As for Dell they own about 10% of the PC market while Lenovo and HP are both at about 20%, that is, together they hold 40% of the market, so it s obvious that you are relying on urban legends for about everything if you thought that Dell was bigger than those two firms, and significantly, lol of a lol.

I can’t prove a negative.It s not profitable, they just played with the numbers by stating that their foundries are selling the chips at a loss to their CPU divison, that s really a joke of an accounting report, they are telling you that their foundry business is a different firm that their CPU division all while arbitrarly deciding of the ressources allocations to make you believe that their chips are sold at a profit, are you that gullible to buy such a scam ..?.

I’m going by their earnings. Dell 88bn revenue for 2023, HP 53bn revenue & Lenovo is 53Bn revenue. Dell is nearly as big as Lenovo & HP combined.As for Dell they own about 10% of the PC market while Lenovo and HP are both at about 20%, that is, together they hold 40% of the market, so it s obvious that you are relying on urban legends for about everything if you thought that Dell was bigger than those two firms, and significantly, lol of a lol.

Mahboi

Golden Member

- Apr 4, 2024

- 1,058

- 1,969

- 96

I'm sorry but I just don't see anything to defend here.This has to be the most negative thread I’ve ever seen here. I’ve read through the entire thing and basically the only info I’ve gotten is that a bunch of people really hate Intel.

Actual cliff notes of new info from listening to earnings call.

Overall not a great earnings report, not because Q1 numbers were necessarily bad but rather forward looking prospects for Q2 became more grim than expected.

- Intel is packaging limited at the moment for client and it is eating into Q2/Q3 revenue.

- SRF is hitting PRQ.

- Gaudi 3 has $500M in orders for H2.

- 18A PDK 1.0 is going to be available this quarter.

- Additional 18A customer from defense industry (meh).

- X86 Datacenter sales up by a tiny amount with Intel proclaiming they’ve stopped market share loss and gained a tiny amount back (dubious claim).

Intel is a screeching pile of molten iron that used to be a war machine.

I've yet to see the shock of their situation actually penetrate the skulls over there. IBMisation is underway.

I can’t prove a negative.

I’m going by their earnings. Dell 88bn revenue for 2023, HP 53bn revenue & Lenovo is 53Bn revenue. Dell is nearly as big as Lenovo & HP combined.

As far as we re talking PC market Dell is quite below Lenovo and HP, and i dont think that boycotting AMD will get them a bigger marketshare.

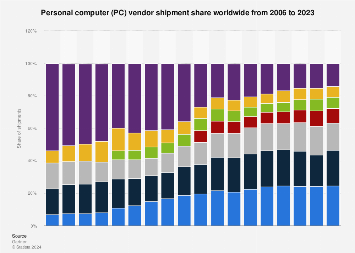

PC vendor market share worldwide 2024| Statista

The overall market leader in the global personal computer market in 2023 was Lenovo with a market share of 25.5 percent with HP Inc.

I really don't know what the status is of Sierra Forrest. They made it sound like it is shipping, but then, in answer to first question (some transcripts have an error in them) Pat said that Sierra Forrest went to production this week)There was also some interesting comments on Sierra Forest and PRQ schedule. Gelsinger announced at the beginning of the call that SRF has PRQ'd but then later on Zinsner said that Intel will now be shipping after PRQ versus the previous practice of building inventory to have product ready to ship at PRQ. So, I'm not sure if SRF is actually shipping now or not, it seems not quite yet? Someone correct me if I'm misreading it.

I’m not really defending it. I have a bad habit of pushing back against group think and dog piling.I'm sorry but I just don't see anything to defend here.

Intel is a screeching pile of molten iron that used to be a war machine.

I've yet to see the shock of their situation actually penetrate the skulls over there. IBMisation is underway.

On another forum I appear to be a Qualcomm white knight (in light of their recent benchmark snafu), simply because there’s a large majority of people there that are really critical of anything that could be perceived as challenging x86.

I have a bad habit of pushing back against group think and dog piling.

Go buy some Intel stock then before it recovers, if it recovers.

It s not profitable, they just played with the numbers by stating that their foundries are selling the chips at a loss to their CPU divison

But they aren't. What they are doing is showing how expensive it is to fund new nodes. The Foundry could cancel the future nodes and be profitable.

But they aren't. What they are doing is showing how expensive it is to fund new nodes. The Foundry could cancel the future nodes and be profitable.

That funding should be shown in the product COGS and clearly it is not otherwise foundry margin would be higher and product margin would be lower. The foundries external customers will show it in their COGS because Intel are going to be including R&D and other overheads in their price per wafer to those customers.

Ultimately Intel are fighting on multiple fronts, the foundry side needs its own margin to stay competitive with Samsung / TSMC and t he product side needs its own margin to stay competitive with ARM based products / NV / AMD etc.

Mahboi

Golden Member

- Apr 4, 2024

- 1,058

- 1,969

- 96

I getcha, but even if we're looking at this in a no money, only product way:I’m not really defending it. I have a bad habit of pushing back against group think and dog piling.

On another forum I appear to be a Qualcomm white knight (in light of their recent benchmark snafu), simply because there’s a large majority of people there that are really critical of anything that could be perceived as challenging x86.

- MTL came out 9 months later than PHX, is far more expensive and offers the same broad perf, except Intel GPU drivers still suck at gaming

- RPL-R is not changing a thing to RPL except the wattage

- SPR being replaced by EMR is easily one of the best products that has come out in awhile, yes I think EMR is actually worth a damn even if it's not EPYC competitive

- ARL has yet to be confirmed perf wise and I doubt it'll compete with Zen 5

- All the advanced nodes, Intel 4 or 3 etc are not ramped up yet so prod is just meh

- Word is getting out that the govt may just buy Intel and that's a death sentence to me, govts are universally bad at producing things

I don't see a positive outside of EMR here. I don't have any expectations except a big sad stumble with SRF, because spamming e-cores feels like a commercial/license per CPU type of thing, not an actual good product.

Nothing about ARL sounds much better. At worst Skymont looks like it'll be a nice thing. And considering how they took Gracemont and somehow boosted the watts to twice what it should've been to get 10% extra perf, I'm doubtful that they'll do good with it.

It just really is that bad.

I don't see a positive outside of EMR here. I don't have any expectations except a big sad stumble with SRF, because spamming e-cores feels like a commercial/license per CPU type of thing, not an actual good product.

There's definately a market for Core Spam products - namely Linux and virtualization. But something like SF needs to be either much faster or way more efficient in extreme MT situations to be worth it compared to the regular server products.

Some more bad news for Intel. They have now lowered their 2Q24 revenue projection after the U.S. revoked their (and QC's) export license for selling CPUs (and other chips) to Huawei. Previously, Intel had projected $13B, plus or minus $0.5B, in revenue for 2Q24. They are now projecting to be under $13B, but no new number was given. Full year revenue is still projected to grow compared to 2023, though obviously not as much as before.

The U.S. had only granted Intel and QC this license and rejected AMD's request for an export license for selling to Huawei, so this will not effect AMD's projections.

seekingalpha.com

seekingalpha.com

The U.S. had only granted Intel and QC this license and rejected AMD's request for an export license for selling to Huawei, so this will not effect AMD's projections.

Intel, Qualcomm in focus as companies confirm losing export licenses

Intel (INTC) was in focus on Wednesday after the company lowered its forecast for the coming second-quarter after the Biden administration revoked export licens

But it wasn't revoked, it was only temporary to begin with and it wasn't extended thus was running out. Did Intel really plan to succeed at getting an extension in the current climate?

All the articles I've seen are saying that it was revoked, but you are correct in that it was given as a temporary license to begin with. No one outside of Intel and the U.S. officials know when it was set to expire, so it's possible that it just expired naturally and the U.S. is refusing to renew it. Reportedly, when QC gave their recent guidance for Q2, they did so assuming zero revenue from Huawei, so at least QC was anticipating that the license would not continue beyond Q1 of this year.

moinmoin

Diamond Member

- Jun 1, 2017

- 5,248

- 8,463

- 136

Wasn't it known before? I remember reading before that the Biden gov last year was thinking of revoking it prematurely but then opted to simply let it run out this year or something. AMD was said to want an export license as well for equal treatment. Didn't find the article where I read both of that, but the former is covered in this:All the articles I've seen are saying that it was revoked, but you are correct in that it was given as a temporary license to begin with. No one outside of Intel and the U.S. officials know when it was set to expire, so it's possible that it just expired naturally and the U.S. is refusing to renew it. Reportedly, when QC gave their recent guidance for Q2, they did so assuming zero revenue from Huawei, so at least QC was anticipating that the license would not continue beyond Q1 of this year.

US lawmakers rage over Intel Meteor Lake-powered Huawei PC

Special export license granted to Intel by President Trump unlikely to be renewed

Wasn't it known before? I remember reading before that the Biden gov last year was thinking of revoking it prematurely but then opted to simply let it run out this year or something. AMD was said to want an export license as well for equal treatment. Didn't find the article where I read both of that, but the former is covered in this:

US lawmakers rage over Intel Meteor Lake-powered Huawei PC

Special export license granted to Intel by President Trump unlikely to be renewedwww.theregister.com

No, the date of expiration wasn't known. There were "sources" that said it was to end later in 2024 but no one knew for sure what the actual term length was. The U.S. almost revoked Intel's license late last year but decided against it. Maybe this is why Intel felt confident in including the Huawei revenue in their projections and was blindsided by this recent news. Alternatively, maybe they didn't revoke it late last year simply because it was going to expire early this year anyway so they figured to let it just run its course and Intel foolishly thought it would get renewed before it expired. It's anyone's guess as far as that goes.

AMD petitioned for a license back in 2021 but reportedly didn't even receive a response. A big part of the push for revoking Intel's license last year was because of the seemingly unfair situation of allowing Intel to sale hundreds of millions of dollars worth of chips to Huawei while barring their main competitor from selling any.

AMD applied for a license to sell similar chips in early 2021 after President Joe Biden took office but never received a response to its application, a source said.

Reuters could not determine why Intel was granted its license and AMD was not. But the impact on CPU chip sales to Huawei was immediate, with the share of sales of Huawei laptops containing AMD chips plunging from 47.1% in 2020 to 9.3% in the first half of 2023, an internal AMD presentation with data sourced to NPD and GfK showed. Intel's share of sales of Huawei laptops containing its chips soared during the period from 52.9% to 90.7%, according to the presentation. That left the two companies with upwards of a $512 million dollar "estimated revenue discrepancy" by early 2023, according to the presentation.

Last edited:

TRENDING THREADS

-

Discussion Zen 5 Speculation (EPYC Turin and Strix Point/Granite Ridge - Ryzen 9000)

- Started by DisEnchantment

- Replies: 25K

-

Discussion Intel Meteor, Arrow, Lunar & Panther Lakes + WCL Discussion Threads

- Started by Tigerick

- Replies: 24K

-

Discussion Intel current and future Lakes & Rapids thread

- Started by TheF34RChannel

- Replies: 23K

-

-

AnandTech is part of Future plc, an international media group and leading digital publisher. Visit our corporate site.

© Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.