lotus503

Diamond Member

- Feb 12, 2005

- 6,502

- 1

- 76

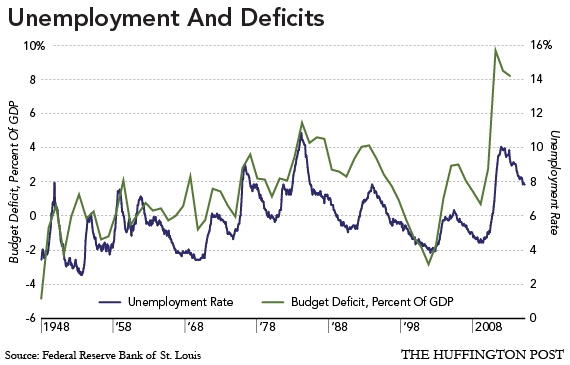

Stimulus does NOT work, austerity hasn't even been properly tried. Let go of the ideology and think rationally

Don't tell me show me with Data.

and you need to properly understand my position

Austerity doesn't work

Stimulus only delays

My position is none of it works, were fucked, it ain't getting, better before it gets very bad first. Being one of the people doing very well in this shitty world (house of cards) economy. Forgive me for wanting my little kids to be a little older before they are forced to understand the gravity of where we are. I'd much rather be fending for myself when my kids are teenagers or adults.

Thats why I prefer spending vs austerity because other than timing it doesn't matter.