zinfamous

No Lifer

- Jul 12, 2006

- 110,592

- 29,221

- 146

If I'm understanding correctly:

-Unemployed in July. Subsequently picked up a Kaiser plan (via ACA marketplace?) since you likely lost your employer plan

-Will become employed in October - and presumably drop your current Kaiser plan and get a new one from the employer.

You sure they even have an HSA to offer? While a high-deductible plan is required in order to be eligible for an HSA, an employer (or health care provider) is under no obligation to actually provide an HSA (to my knowledge at least). Hence why you can freely open an HSA with any provider at anytime as long as you have a qualified high deductible plan.

But yes, if you have a qualified high-deductible plan - you should have no problem opening one and contributing to it on a basis of how long you have had the high-deductible plan. That is, if you sign-up for a high-deductible plan mid-year instead of at the beginning of the year, then I believe you are supposed to limit your contributions based on how many months you have had the qualifying plan. (e.g. If you obtain a high-deductible plan in April and keep it through the year, you had a HD plan for 9 out of 12 months. Make sure that you don't contribute more than (9/12) = 75% * Maximum HSA contribution.

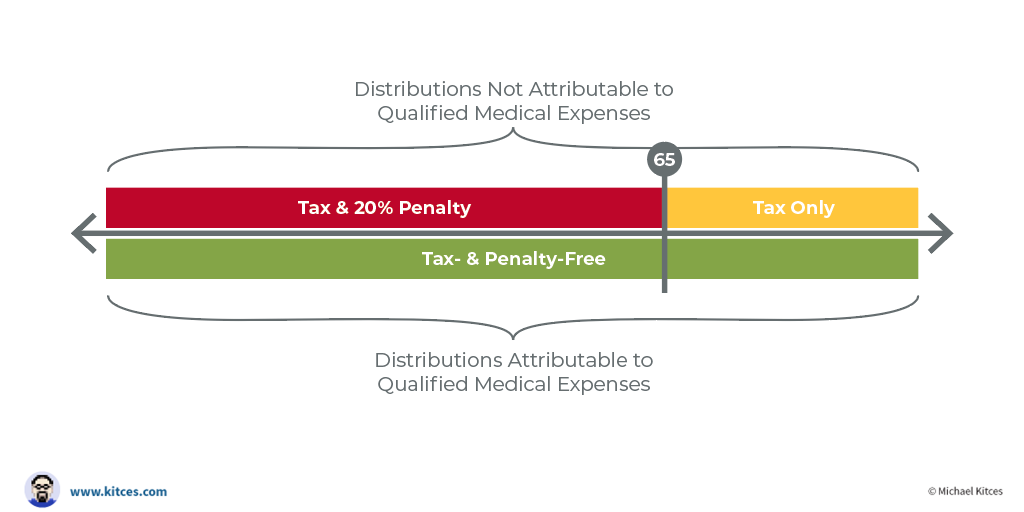

While you are able to withdraw your money for healthcare expenses at ANYTIME after the account is created - you are only eligible to make contributions when you have a qualified high-deductible plan. Hope that makes sense.

But when you say "I will have actual healthcare starting in October" - what do you mean by that? As in, you will get new health insurance through your new employer? In all likelihood, your employer should have a high-deductible plan as well if you want to continue with HSA contributions. Personally, I find with how much cheaper high-deductible plans are, I'm better off with high-deductible plans.

ah OK. SO I can't contribute to it if I have (yes, what I call) actual health care: meaning, zero deductible, low premium, balls to the wall awesome. ...I mean, that's my only experience with healthcare.

So, while I can open it and keep it for life now, I actually won't be able to contribute to it during the months/years when I have a real healthcare plan. I mean, that makes sense and certainly seems honest. It's why I kept asking the CSRs because it wouldn't make sense to be able to, but you know...

Yes, Kaiser has one. I had Kaiser with my previous employer, and saw that they offered a shitty plan with HSA, so I thought I would go with that for these couple of months because if anything, it's cheaper than COBRA and does give HSA access, and I can keep my current medical records/history in one place with less hassle (I have now found a separate site that sets up the HSA account separately--surprise surprise, you will never find it through Kaiser, by talking to anyone at Kaiser...you just have to use Google to find it from Kaiser. fucking hell).

Granted, my options could be different in October b/c it is the first time I will be out of Academia (Federal contractor, technically, and after 4 or 5 months, I still haven't received any information regarding the benefits), and maybe not as great as Academia options (typically ~$60 premium for full health/eyes, $0 deductible, $10 copay, etc. Dental the typical at $10/month).

....hmm, so maybe I should cancel this and get on Medicaid for the next 2 months? Apparently, a colleague, also leaving at the same time, says she is paying $0 during the gap. That sounds better than the absurd $260 that I am paying....and now for an HSA that really seems to just be a dream? le sigh...