Gallup polling shows significant improvement in U.S. Employment in October

Page 2 - Seeking answers? Join the AnandTech community: where nearly half-a-million members share solutions and discuss the latest tech.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

No one denies he inherited a bad situation. What you lefties fail to realize is that he made it worse, not better. That is what the right condemns him on, not the fact that we are in a bad situation to start with.

Can you post evidence on how we are worse off?

Last edited:

Doppel

Lifer

- Feb 5, 2011

- 13,306

- 3

- 0

Unemployment worse, national debt worse, incomes worse, etc. worse in basically every way. The question is how responsible he is for it and I won't get into that here but definitely the country is worse off.Can you post evidence on how we are worse off?

Unemployment worse, national debt worse, incomes worse, etc. worse in basically every way. The question is how responsible he is for it and I won't get into that here but definitely the country is worse off.

Unemployment peaked at 10% and it is lower now but not good.

Of course the National Debt is worse look at how many people are unemployed and we are still forking out craploads of cash in the Sandpit from hell approximately 4 TRILLION dollars since the first American boots hit the ground in Afghanistan.

The income being worse happened over the last 30 years.

Last edited:

First

Lifer

- Jun 3, 2002

- 10,518

- 271

- 136

Unemployment worse, national debt worse, incomes worse, etc. worse in basically every way. The question is how responsible he is for it and I won't get into that here but definitely the country is worse off.

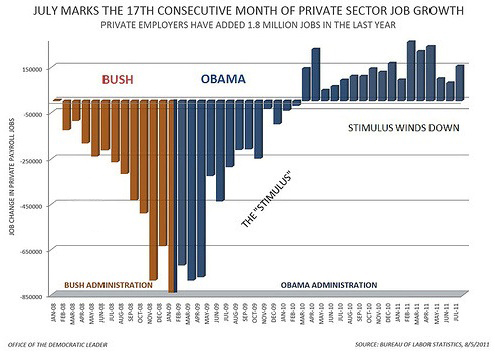

Worse off compared to when? We're immeasurably better off since January 2009, and that's just a statistical fact.

Doppel

Lifer

- Feb 5, 2011

- 13,306

- 3

- 0

Compared to January 2009 of course we're off worse and that's just a statistical fact, e.g. unemployment. That jobs growth graphic above still doesn't bring us back to 7.6% unemployment. Apparently the too big to fail banks are even bigger now, which means more moral hazard.

Look, this isn't Obama's fault. He's a useless tit, but he's simply helming a ship that was already headed to disaster. I'm just saying things are worse. Craig posted a great graphic in another thread that republicans can use. They're all great measures of how much worse off we are. They insinuate that it's Obama's fault even if most of it isn't.

Yeah but it keeps happening.The income being worse happened over the last 30 years.

Look, this isn't Obama's fault. He's a useless tit, but he's simply helming a ship that was already headed to disaster. I'm just saying things are worse. Craig posted a great graphic in another thread that republicans can use. They're all great measures of how much worse off we are. They insinuate that it's Obama's fault even if most of it isn't.

Compared to January 2009 of course we're off worse and that's just a statistical fact, e.g. unemployment. That jobs growth graphic above still doesn't bring us back to 7.6% unemployment. Apparently the too big to fail banks are even bigger now, which means more moral hazard.Yeah but it keeps happening.

Look, this isn't Obama's fault. He's a useless tit, but he's simply helming a ship that was already headed to disaster. I'm just saying things are worse. Craig posted a great graphic in another thread that republicans can use. They're all great measures of how much worse off we are. They insinuate that it's Obama's fault even if most of it isn't.

Republican's are notorious for staying in lockstep and acting like they truly believe the shit they are shoveling so their weak minded sheep will lap it up.

The Democrats on the other hand are frustrating because the Bludog Democrats are a joke and should switch the "D" to an "R" .

The Democrats also have to work on their messaging which needs to be lazer focused like the Republicans hence the same talking points from every Republican talking head that can find a camera.

Last edited:

Home prices lower, etc.

Do you realize how long it is going to take to wind down all the Toxic assets those irresponsible bankers were peddling? House prices will not bottom out until the Toxic debt gets out of the WORLDS financial system.

Last edited:

Interesting comment by Liesman on CNBC: he said extending unemployment benefits may be artificially elevating unemployment rate by 0.8% because there are lots of people 58 and 59 years old who would have otherwise retired, but haven't so they can continue collecting unemployment.

Goldman Sachs Asset Management Chairman on set I think mumbled that he thought that was consistent with economic data from companies, I think.

edit: (start at 1:20 point of this video) http://video.cnbc.com/gallery/?video=3000052301

Goldman Sachs Asset Management Chairman on set I think mumbled that he thought that was consistent with economic data from companies, I think.

edit: (start at 1:20 point of this video) http://video.cnbc.com/gallery/?video=3000052301

Last edited:

MooseNSquirrel

Platinum Member

- Feb 26, 2009

- 2,587

- 318

- 126

If unemployment numbers drop the GOP is sunk in 2012 and I am sure that the GOP in Congress will be applying the full court press of obstructionism right up to the next election cycle..hopefully their asshole maneuvers come back to bite them in the ass.

Dewd, take a look at the GOP candidates.

Yeah exactly.

I think its just deserts that the Christianists in disguise oops I meant the Tea Party will probably be the reason the GOP has no chances of winning in '12

xBiffx

Diamond Member

- Aug 22, 2011

- 8,232

- 2

- 0

Dewd, take a look at the GOP candidates.

Yeah exactly.

I think its just deserts that the Christianists in disguise oops I meant the Tea Party will probably be the reason the GOP has no chances of winning in '12

Time to put down the bottle.

MooseNSquirrel

Platinum Member

- Feb 26, 2009

- 2,587

- 318

- 126

Unemployment worse, national debt worse, incomes worse, etc. worse in basically every way. The question is how responsible he is for it and I won't get into that here but definitely the country is worse off.

Most of the job losses have been in State and Local governments, not something a President has a direct hand in controlling.

Fern

Elite Member

- Sep 30, 2003

- 26,907

- 173

- 106

Most of the job losses have been in State and Local governments, not something a President has a direct hand in controlling.

I've been hearing differently. E.g.:

The private sector has lost 6.3 million jobs, a 5.4 percent drop, since December 2007, while the public sector has only lost 1.8 percent, or 392,000 jobs, in that same time, according to the U.S. Bureau of Labor Statistics. The public sector had 22.3 million jobs in December 2007 and dropped to 21.2 million in September 2011. The private sector had 115.6 million jobs in December 2007 and it dropped to 109.3 million as of September 2011.

And I agree with these remarks in that article:

Hohman said the American Recovery & Reinvestment Act of 2009 protected many government jobs.

“The private sector is still way down and they should not be asked to support government jobs that have been protected from a recession,” Hohman said.

Fern

Last edited:

woolfe9999

Diamond Member

- Mar 28, 2005

- 7,164

- 0

- 0

I've been hearing differently. E.g.:

And I agree with these remarks in that article:

Fern

Quoting Rush Limbaugh without attribution? Bad form Fern.

The BLS numbers show 535,000 public sector job losses since September, 2008. Between September, 2008 and now we have seen net private sector job gains. How many I don't know without accessing every monthly BLS report since then, but I think it's over a million.

The game being played here is focus on what happened from late 1997 to mid 2009. However, in economic terms, what is important is the recent trending. For two full years now, we've been experiencing losses in the public sector (minor in 2010 but growing this year) while month over month the private sector shows modest gain (with few exceptions). The salient question, when talking about government policy, is what is happening right now in the economy, not what was happening 2-4 years ago.

- wolf

Last edited:

Fern

Elite Member

- Sep 30, 2003

- 26,907

- 173

- 106

Quoting Rush Limbaugh without attribution? Bad form Fern.

No.

And I was unaware Rush Limbaugh actually wrote anything?

Anyhoo, I had heard this info on one of the cable news shows earlier today. I googled and came upon this site:

http://www.michigancapitolconfidential.com/15897

Just forgot to include the link in my post.

The BLS numbers show 535,000 public sector job losses since September, 2008. Between September, 2008 and now we have seen net private sector job gains. How many I don't know without accessing every monthly BLS report since then, but I think it's over a million.

The game being played here is focus on what happened from late 1997 to mid 2009. However, in economic terms, what is important is the recent trending. For two full years now, we've been experiencing losses in the public sector (minor in 2010 but growing this year) while month over month the private sector shows modest gain (with few exceptions). The salient question, when talking about government policy, is what is happening right now in the economy, not what was happening 2-4 years ago.

- wolf

You're cherry picking dates.

The numbers I quote are current and include data up thru Sept 2011.

If you're talking about Obama's performance, yes use a start date of 2009 when he took office. (Why pick 2008? To cherry pick?) But that's not the issue. The issue is how are private v public jobs faring under the recession. Clearly the private sector is still far behind in terms of a recovery.

Fern

woolfe9999

Diamond Member

- Mar 28, 2005

- 7,164

- 0

- 0

No.

And I was unaware Rush Limbaugh actually wrote anything?

Anyhoo, I had heard this info on one of the cable news shows earlier today. I googled and came upon this site:

http://www.michigancapitolconfidential.com/15897

Just forgot to include the link in my post.

You're cherry picking dates.

The numbers I quote are current and include data up thru Sept 2011.

If you're talking about Obama's performance, yes use a start date of 2009 when he took office. (Why pick 2008? To cherry pick?) But that's not the issue. The issue is how are private v public jobs faring under the recession. Clearly the private sector is still far behind in terms of a recovery.

Fern

First of all, if the issue is Obama's performance, it's kind of absurd to saddle him with the first 6 months in office. There was an avalanche of job loss starting in late 2008 and it wasn't going to be stemmed *that* quickly no matter what he did. So no, I'm not cherry picking dates.

But that wasn't really my point either. My point is the recent trending of private sector gain, public sector losses. If we're talking about government policy, it seems to me you want to stop the current bleeding first, particularly since it is in the public sector and that is the sector in which the government obviously has the most control. The bleeding has already been stopped in the private sector. The market is supposed to bring that back. Which is not to say that we don't want to nudge that along as well. But the simplest thing to do here is to provide the states with some relief so they can stop the layoffs.

Sorry about the Limbaugh thing. I can see that Limbaugh was using the same statistics 2 hours ago as your article from a day ago, so you and he are using the same source.

- wolf

I am very suspicious of making any valid conclusions about jobs Obama has created (or not) based on that study because it's "baseline" for comparison is conveniently September 2007.

IIRC, talk about subprime was showing up on tv in August, but talking heads like Kudlow were smugly dismissing the subprime issue because it only represented 15% of GDP and could only produce a mild recession, at worst. (I believe the global financial credit freeze was due to leveraged speculation using borrowed money with subprime essentially as principal, so he probably would have been right if it indeed were only the subprime mortgages themselves going bad, and not the 40 - 50 to 1 leveraged losses using borrowed money with subprime as collateral and that might need to be reborrowed overnight each and every day markets are open). I think a lot of these players were using overnight funding to finance their gambling, and when subprime started to tumble these same players became hesitant to lend to anyone else because they suspected they owned the same toxic assets they themselves owned and thought they wouldn't get paid back if they lent them money.

Real meltdown took place in October and that is when businesses started saying they have absolutely no clarity on future earnings and started laying off people en masse.

So, that study is probably like concluding that index investing no longer works by taking one particular 10 year snapshot where the starting point was absolute peak of the stock market in 2001 (prior to that, you always made money if you bought and held the SP500 (70% of total U. S. stock market capitalization) over any 10 year rolling period; it will also probably true for almost all rolling periods going forward, save another financial panic like we saw in 2007.

I believe I read that private sector has been adding 125k jobs per month for over a year, but monthly employment statistics and unemployment rate are being held down by forced layoffs in local and state government at same time.

Plus how many of those 'lost" jobs were construction workers building houses no one would need a have to live in, only flip, for many years? (someone on these forums previously posted housing statistics and I think he said we were building over 2 million homes during peak bubble, when norm was about 1.2 million, and right now we are only at 600K)

IIRC, talk about subprime was showing up on tv in August, but talking heads like Kudlow were smugly dismissing the subprime issue because it only represented 15% of GDP and could only produce a mild recession, at worst. (I believe the global financial credit freeze was due to leveraged speculation using borrowed money with subprime essentially as principal, so he probably would have been right if it indeed were only the subprime mortgages themselves going bad, and not the 40 - 50 to 1 leveraged losses using borrowed money with subprime as collateral and that might need to be reborrowed overnight each and every day markets are open). I think a lot of these players were using overnight funding to finance their gambling, and when subprime started to tumble these same players became hesitant to lend to anyone else because they suspected they owned the same toxic assets they themselves owned and thought they wouldn't get paid back if they lent them money.

Stock market dipped in July 2007, but completely recovered to new highs in early October, when the crash took place. So September labor statistics are probably based upon corporate CEOs with rosy outlooks based upon looking at economy and surging stock market in August or September, and like Kudlow scoffed that subprime is "contained" and of no real consequence and adjusted their businesses and hiring accordingly.Or, as Gordon Gekko said:

"Hedge fund managers came home with 50 to 100 million bucks a year.

So Mr. Banker, he looks around and says.

My life looks pretty boring.

So he starts leveraging his interest up to 40%, 50% to 100%. With your money not his. (I think this is supposed to be 40 - 50 : 1 leverage)

Yours. Because he could.

You are supposed to be borrowing not them.

And the beauty of the deal is no one is responsible.

Because everyone is drinking the same cool-aid.

http://political-economy.com/wall-street-money-never-sleeps/

Real meltdown took place in October and that is when businesses started saying they have absolutely no clarity on future earnings and started laying off people en masse.

So, that study is probably like concluding that index investing no longer works by taking one particular 10 year snapshot where the starting point was absolute peak of the stock market in 2001 (prior to that, you always made money if you bought and held the SP500 (70% of total U. S. stock market capitalization) over any 10 year rolling period; it will also probably true for almost all rolling periods going forward, save another financial panic like we saw in 2007.

I believe I read that private sector has been adding 125k jobs per month for over a year, but monthly employment statistics and unemployment rate are being held down by forced layoffs in local and state government at same time.

Plus how many of those 'lost" jobs were construction workers building houses no one would need a have to live in, only flip, for many years? (someone on these forums previously posted housing statistics and I think he said we were building over 2 million homes during peak bubble, when norm was about 1.2 million, and right now we are only at 600K)

Last edited:

TRENDING THREADS

-

Discussion Intel current and future Lakes & Rapids thread

- Started by TheF34RChannel

- Replies: 23K

-

Discussion Zen 5 Speculation (EPYC Turin and Strix Point/Granite Ridge - Ryzen 9000)

- Started by DisEnchantment

- Replies: 9K

-

-

Discussion Intel Meteor, Arrow, Lunar & Panther Lakes Discussion Threads

- Started by Tigerick

- Replies: 7K

-

AnandTech is part of Future plc, an international media group and leading digital publisher. Visit our corporate site.

© Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.