TL;dr

{

Non-GAAP EPS of $0.08, matches expectations.

Revenue of $1.42B, $1.44B was expected. Revenue from semi-custom business and consumer GPU sales down, causing lower revenue. Strong Ryzen and Epyc sales offset much of the missing revenue as well as some data center GPU growth.

Projected high single digit revenue growth for 2019.

}

More details. . .

https://seekingalpha.com/pr/17395264-amd-reports-fourth-quarter-annual-2018-financial-results

Developing. . .

{

Non-GAAP EPS of $0.08, matches expectations.

Revenue of $1.42B, $1.44B was expected. Revenue from semi-custom business and consumer GPU sales down, causing lower revenue. Strong Ryzen and Epyc sales offset much of the missing revenue as well as some data center GPU growth.

Projected high single digit revenue growth for 2019.

}

More details. . .

https://seekingalpha.com/pr/17395264-amd-reports-fourth-quarter-annual-2018-financial-results

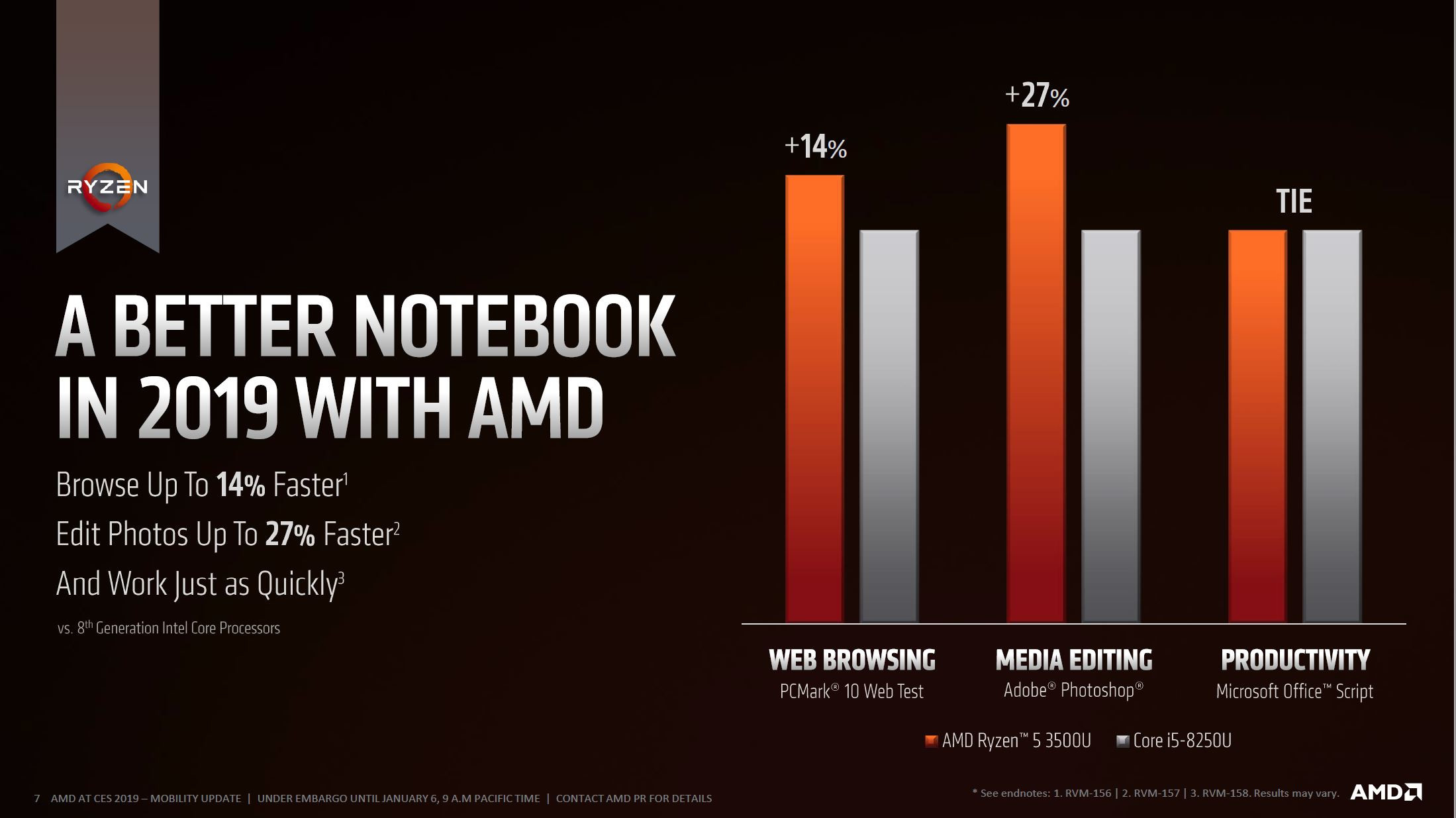

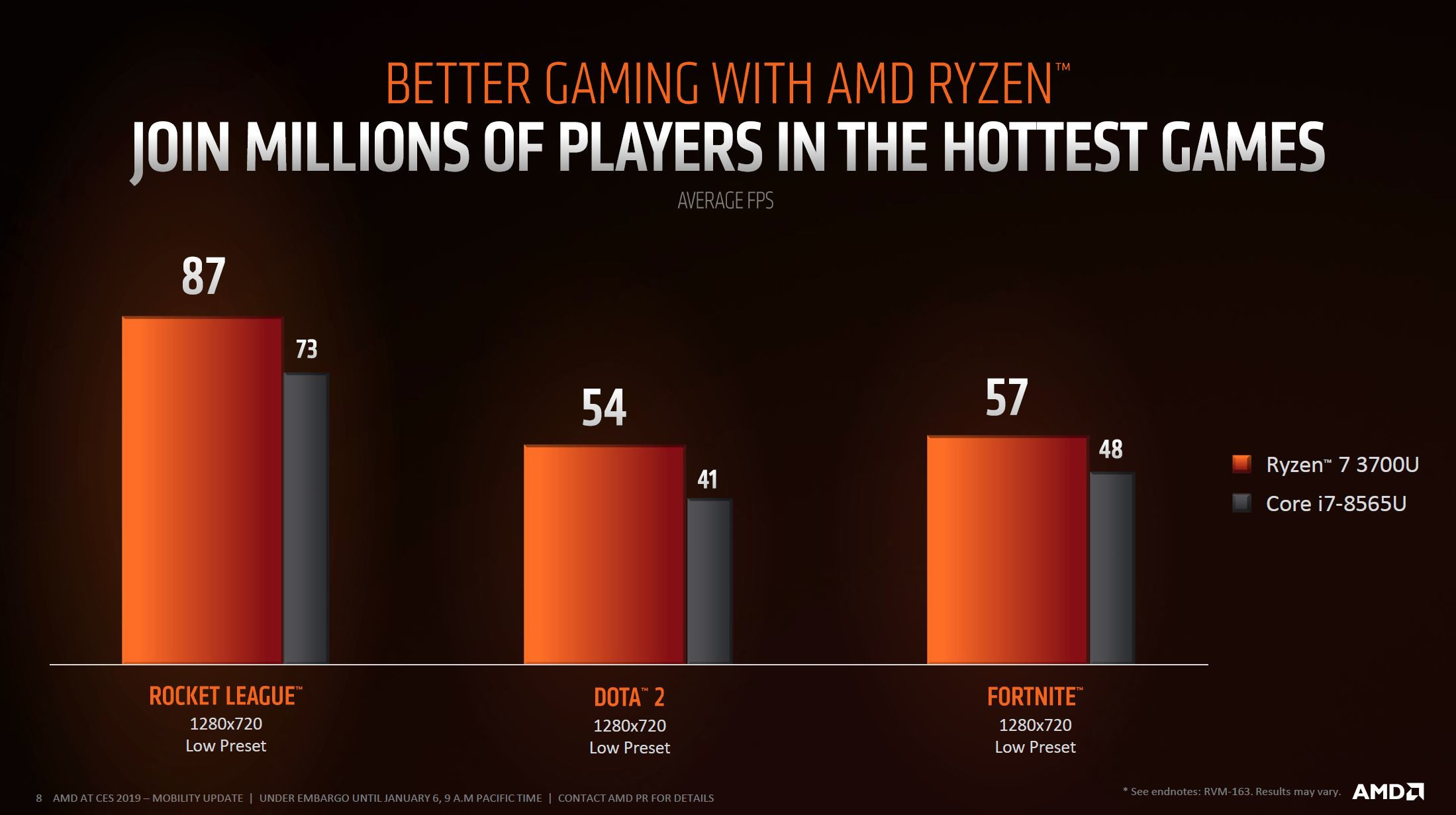

For full year 2019, AMD expects high single digit percentage revenue growth driven by Ryzen, EPYC and Radeon datacenter GPU product sales

Developing. . .

Last edited: